Yield farming with Compound tokens sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve into the world of decentralized finance (DeFi) and explore the potential of Compound tokens, a journey of maximizing profits and navigating risks unfolds before us.

Overview of Yield Farming with Compound Tokens

Yield farming in the context of decentralized finance (DeFi) refers to the practice of earning rewards by providing liquidity to DeFi protocols. Users can earn interest, fees, or other rewards by lending or staking their cryptocurrencies.

What are Compound Tokens?

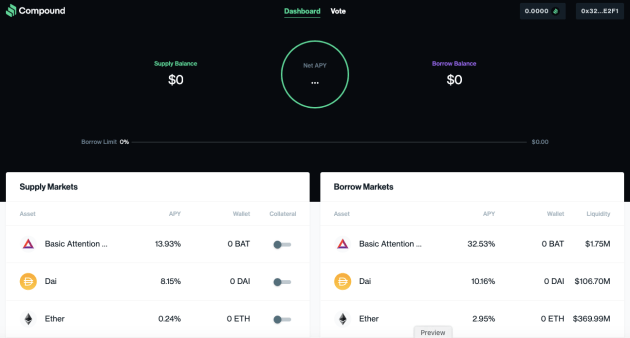

Compound is a decentralized protocol that allows users to lend and borrow cryptocurrencies. Compound tokens are ERC-20 tokens that represent a user’s share of the funds supplied to the protocol. These tokens can be used for governance and to earn interest through yield farming.

Popular Compound Tokens for Yield Farming, Yield farming with Compound tokens

– COMP: The native governance token of the Compound protocol, used for voting on proposals and earning rewards.

– cUSDC: A token representing a user’s share of USDC supplied to the Compound protocol to earn interest.

– cETH: Similar to cUSDC, cETH represents a user’s share of ETH supplied to Compound for lending.

Benefits and Risks of Yield Farming with Compound Tokens

Benefits:

- Opportunity to earn passive income through interest and rewards.

- Ability to participate in governance decisions of the protocol.

- Diversification of crypto holdings by lending different assets.

Risks:

- Smart contract risks, such as vulnerabilities or exploits.

- Impermanent loss when providing liquidity to pools.

- Market volatility affecting the value of supplied assets.

How to Start Yield Farming with Compound Tokens

Starting yield farming with Compound tokens involves a few basic steps to get you on your way to earning yields. Here’s a guide on how to begin your journey in yield farming with Compound tokens.

Acquiring Compound Tokens

To start yield farming with Compound tokens, you first need to acquire Compound tokens. You can obtain Compound tokens by purchasing them from cryptocurrency exchanges that support the token. Make sure to choose a reputable exchange to ensure the security of your transactions.

Supplying Liquidity and Earning Yields

Once you have acquired Compound tokens, the next step is to supply liquidity to the Compound protocol. This involves depositing your tokens into the liquidity pool to earn yields. By supplying liquidity, you are contributing to the liquidity of the protocol and in return, you earn a portion of the fees generated by the platform.

Tips for Beginners

– Do thorough research: Before diving into yield farming with Compound tokens, make sure to research and understand how the process works.

– Start small: It’s advisable to start with a small amount of tokens until you become familiar with the process and the risks involved.

– Stay informed: Keep yourself updated on the latest trends and developments in the DeFi space to make informed decisions.

– Use reputable platforms: Choose well-established platforms for yield farming to minimize risks and ensure the security of your investments.

Strategies for Maximizing Yields with Compound Tokens

When it comes to maximizing yields with Compound tokens, there are several strategies that yield farmers can implement to optimize their returns. By exploring different approaches and understanding the various pools and protocols available, farmers can make informed decisions to mitigate risks and increase profits.

Comparing Different Pools and Protocols

- Compound offers a variety of pools with different assets and interest rates, allowing farmers to diversify their holdings and maximize returns.

- Other protocols like Aave or Yearn Finance also provide opportunities for yield farming, each with its unique features and benefits.

- By comparing the APY (Annual Percentage Yield) and risk factors of different pools and protocols, farmers can choose the most suitable options for their investment goals.

Understanding Impermanent Loss

- Impermanent loss occurs when the value of assets in a liquidity pool changes, leading to potential losses for liquidity providers.

- Yield farmers need to consider impermanent loss when participating in liquidity mining, as it can impact their overall returns and profitability.

- By monitoring the price movements of assets and adjusting their strategies accordingly, farmers can reduce the impact of impermanent loss on their yields.

Maximizing Profits and Mitigating Risks

- Diversifying across different pools and protocols can help farmers spread their risk and optimize their overall yield farming strategy.

- Using risk management tools like stop-loss orders or setting profit targets can help farmers protect their investments and lock in profits during volatile market conditions.

- Staying informed about market trends, protocol updates, and emerging opportunities is crucial for farmers looking to maximize their profits and navigate the dynamic DeFi landscape.

Future Trends and Innovations in Yield Farming with Compound Tokens

The world of yield farming with Compound tokens is constantly evolving, with new trends and innovations shaping the future of this space. Let’s explore some potential developments and advancements that could impact the way we approach yield farming with Compound tokens.

Impact of Upcoming Protocol Changes

As protocols like Compound undergo updates and changes, it is crucial for yield farmers to stay informed about how these modifications can affect their strategies. For example, changes in interest rates, collateral requirements, or governance structures can have a significant impact on the yields generated through yield farming with Compound tokens. It is important for farmers to adapt their strategies accordingly to maximize their returns and mitigate risks.

Emerging Trends and Projects

The DeFi space is known for its rapid innovation, and new projects are constantly emerging to revolutionize yield farming practices with Compound tokens. Projects focused on optimizing user experience, reducing gas fees, or introducing novel strategies for yield generation are gaining traction in the market. Keeping an eye on these emerging trends and projects can provide yield farmers with opportunities to explore new avenues for maximizing their yields.

Regulatory Challenges

Regulatory challenges continue to be a concern in the DeFi space, and yield farming with Compound tokens is not immune to these issues. As regulators around the world scrutinize DeFi platforms and tokens, it is essential for yield farmers to stay informed about any regulatory developments that could impact their activities. Adhering to compliance requirements and staying ahead of regulatory changes can help yield farmers navigate potential challenges and uncertainties in the future.

Last Point: Yield Farming With Compound Tokens

In conclusion, Yield farming with Compound tokens presents a lucrative opportunity for savvy investors to optimize their DeFi gains while being mindful of the associated risks. Dive into this evolving landscape with caution and strategic foresight to reap the rewards it offers.

When it comes to Ethereum 2.0, there are several top features that make it stand out in the world of cryptocurrency. One of the key features is the transition from proof of work to proof of stake, which aims to improve scalability and security.

Additionally, Ethereum 2.0 introduces shard chains, allowing for parallel processing and increasing transaction speed. If you want to learn more about the top features of Ethereum 2.0, check out this informative article: Top features of Ethereum 2.0.

When it comes to Ethereum 2.0, there are several top features that set it apart from its predecessor. One of the most prominent features is the shift to a proof-of-stake consensus mechanism, which aims to improve scalability and energy efficiency.

Additionally, Ethereum 2.0 introduces shard chains, allowing for parallel transaction processing to increase network capacity. Another key feature is the implementation of eWASM, a more efficient virtual machine for running smart contracts. Learn more about the top features of Ethereum 2.0 and how they are shaping the future of blockchain technology.