Delving into Using trailing stops in Forex trading, this introduction immerses readers in a unique and compelling narrative, with a focus on understanding what trailing stops are and how they can be utilized effectively in the Forex market. From setting up trailing stops to exploring various strategies for their optimal use, this guide aims to provide invaluable insights for traders looking to enhance their trading approach.

Introduction to Trailing Stops: Using Trailing Stops In Forex Trading

Trailing stops are a popular risk management tool used in Forex trading to protect profits and limit losses. Unlike traditional stop-loss orders that are set at a specific price level, trailing stops automatically adjust as the market price moves in a favorable direction.

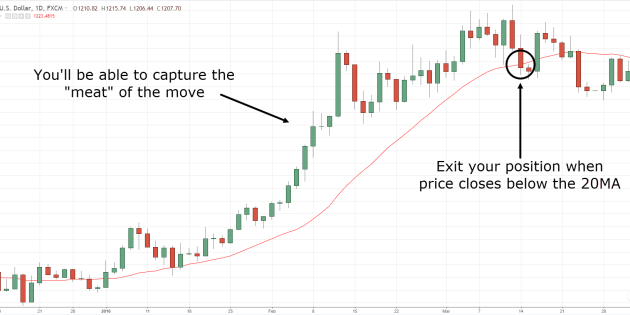

Trailing stops work by following the market price at a set distance, allowing traders to lock in profits as the price moves in their favor. If the market price reverses and hits the trailing stop level, the trade is automatically closed, helping traders minimize potential losses.

Examples of Trailing Stops in Different Market Scenarios

Trailing stops can be particularly useful in volatile markets where prices can fluctuate rapidly. For example, if a trader enters a long position on a currency pair and sets a trailing stop of 20 pips, the stop-loss level will adjust upwards by 20 pips for every 20-pip increase in the market price. This allows the trader to secure profits without having to constantly monitor the trade.

Benefits of Using Trailing Stops in Trading

- Protecting profits: Trailing stops help traders lock in profits by automatically adjusting the stop-loss level as the market price moves in their favor.

- Limiting losses: By trailing the stop-loss level, traders can minimize potential losses if the market price reverses unexpectedly.

- Emotional control: Trailing stops remove the emotional aspect of trading decisions, as they are based on a predetermined strategy rather than impulsive reactions to market movements.

Setting Up Trailing Stops

Setting up trailing stops in forex trading is a crucial step to protect profits and minimize losses. Trailing stops are designed to follow the price movement of an asset, allowing traders to lock in profits as the price moves in their favor. Here, we will discuss the process of setting up trailing stops on trading platforms, compare different methods based on market conditions, and provide tips on choosing the right trailing stop distance for trades.

Process of Setting Up Trailing Stops

When setting up trailing stops on a trading platform, traders typically have the option to choose between a fixed distance or a percentage-based trailing stop. A fixed distance trailing stop sets a specific number of pips away from the current market price, while a percentage-based trailing stop moves with the price based on a percentage set by the trader.

- For a fixed distance trailing stop, traders can simply input the desired number of pips away from the entry price to set the stop loss level.

- On the other hand, a percentage-based trailing stop allows traders to set the stop loss level as a percentage of the current market price. This ensures that the stop loss moves in line with the price movement, providing flexibility in volatile market conditions.

Choosing the Right Trailing Stop Distance

Selecting the appropriate trailing stop distance is essential for successful trading. Factors to consider when determining the right distance include market volatility, trading strategy, and risk tolerance.

- Highly volatile markets may require a wider trailing stop distance to account for price fluctuations, while stable markets may benefit from a tighter stop loss level.

- Traders employing a long-term trading strategy may opt for a wider trailing stop distance to allow for larger price movements, while short-term traders may prefer a tighter stop loss to capture quick profits.

- It is important for traders to assess their risk tolerance and adjust the trailing stop distance accordingly. Conservative traders may choose a smaller distance to protect profits, while aggressive traders may opt for a wider stop loss level to ride out price swings.

Pros and Cons of Using Trailing Stops

When it comes to incorporating trailing stops in Forex trading strategies, there are various advantages and disadvantages to consider. Let’s explore the pros and cons of using trailing stops to manage trades effectively.

Advantages of Using Trailing Stops, Using trailing stops in Forex trading

- Minimize Risk: Trailing stops help traders protect their profits by automatically adjusting the stop-loss level as the trade moves in their favor.

- Lock in Gains: By trailing the stop-loss level, traders can secure profits and prevent giving back gains in case of a reversal.

- Reduce Emotional Bias: Trailing stops eliminate the need for traders to make manual decisions, reducing the impact of emotions on trading outcomes.

Disadvantages of Using Trailing Stops

- Whipsaw Effect: In volatile markets, trailing stops can trigger prematurely, resulting in losses if the price quickly reverses after hitting the stop-loss level.

- Missed Opportunities: Trailing stops may cause traders to exit positions too early, missing out on potential profits if the trade continues to move in their favor.

- Increased Costs: Constantly adjusting trailing stops can lead to higher trading costs, especially for frequent traders.

Impact of Trailing Stops on Trade Outcomes

Trailing stops can have a significant impact on trade outcomes, both positively and negatively. For example, if a trader uses a trailing stop to secure profits on a winning trade, they can lock in gains and protect their capital. On the other hand, if the trailing stop is set too close to the entry point, it may result in premature exits and missed opportunities for additional profits. It is essential for traders to carefully consider their risk tolerance and market conditions when deciding whether to use trailing stops in their trading strategies.

Strategies for Effective Use of Trailing Stops

Trailing stops can be a powerful tool in a trader’s arsenal when used effectively. By implementing the right strategies, traders can maximize their profits while minimizing potential losses. Let’s explore some key strategies for using trailing stops in Forex trading.

Adjusting Trailing Stop Levels Based on Market Volatility

One important strategy for effective use of trailing stops is adjusting the stop levels based on market volatility. In highly volatile markets, wider stop levels may be needed to prevent premature triggering of the stop loss. Conversely, in calmer market conditions, tighter stop levels can be used to lock in profits more efficiently.

- Traders can use Average True Range (ATR) indicator to determine the optimal distance for trailing stops based on market volatility.

- Regularly assess market conditions and adjust stop levels accordingly to adapt to changing volatility.

- Consider using a percentage-based approach to setting trailing stop levels to account for varying market conditions.

Combining Trailing Stops with Other Risk Management Techniques

In addition to adjusting stop levels based on market volatility, traders can enhance the effectiveness of trailing stops by combining them with other risk management techniques.

- Utilize position sizing to determine the appropriate trade size relative to the risk level and account size.

- Implement a well-defined trading plan with clear entry and exit rules to complement the use of trailing stops.

- Consider using multiple time frame analysis to confirm trading signals and improve decision-making when setting trailing stops.

Final Thoughts

In conclusion, mastering the art of using trailing stops in Forex trading can significantly improve trading outcomes by minimizing risks and maximizing profits. By understanding the pros and cons, setting up trailing stops effectively, and implementing the right strategies, traders can navigate the volatile market with confidence and precision. Stay informed, stay strategic, and stay ahead in your Forex trading journey.

When it comes to trading the AUD/USD pair, it’s crucial to understand the factors that influence the exchange rate between the Australian dollar and the US dollar. Traders need to keep an eye on economic indicators, geopolitical events, and market sentiment to make informed decisions.

By analyzing historical data and staying updated on news, traders can develop effective strategies to capitalize on the fluctuations of the AUD/USD pair. To learn more about trading this currency pair, check out this informative article on Trading AUD/USD pair.

When it comes to trading the AUD/USD pair, it is essential to understand the factors that influence the exchange rate between the Australian dollar and the US dollar. Traders need to stay updated on economic indicators, geopolitical events, and central bank decisions that can impact the currency pair.

By analyzing charts and using technical analysis tools, traders can make informed decisions about when to buy or sell the AUD/USD pair. For more insights on trading the AUD/USD pair, check out this article on Trading AUD/USD pair.