Using stop-loss orders for stock investments opens up a world of risk management strategies to safeguard your investments. Dive into the realm of stop-loss orders and discover how they can shield your portfolio from unexpected downturns.

Learn about the importance of setting stop-loss order parameters, the different types of stop-loss orders available, and how to effectively implement them to enhance your trading experience.

Importance of Stop-Loss Orders

Stop-loss orders are a crucial risk management tool used by investors in the stock market. These orders are designed to automatically sell a stock when it reaches a predetermined price, helping investors limit potential losses and protect their investment capital.

Protection from Significant Losses

- For example, let’s say an investor purchases a stock at $50 per share. By setting a stop-loss order at $45, the investor ensures that if the stock price drops to that level, the stock will be automatically sold. This prevents the investor from experiencing further losses if the stock continues to decline.

- Stop-loss orders can help investors avoid emotional decision-making during periods of market volatility, as the order executes based on predefined criteria rather than impulse.

Risk Management Benefits

- One of the key benefits of using stop-loss orders is the ability to manage risk in a stock portfolio effectively. By setting stop-loss levels based on individual risk tolerance, investors can control the downside risk of their investments.

- Stop-loss orders also help investors maintain discipline and adhere to their investment strategy, ensuring that losses are limited and gains are protected.

Setting Stop-Loss Order Parameters

Setting stop-loss order parameters is crucial for investors to protect their investments and minimize potential losses. Determining the appropriate stop-loss percentage, considering market conditions, and individual risk tolerance are essential factors to consider.

Determining the Appropriate Stop-Loss Percentage

When deciding on the stop-loss percentage for an investment, investors should consider their risk tolerance and the volatility of the stock. A common approach is to set the stop-loss at a percentage below the purchase price, typically between 5% to 10%. However, more volatile stocks may require a wider percentage, while less volatile stocks may need a tighter percentage.

Strategies for Setting Stop-Loss Order Parameters

1. Market Conditions: In a volatile market, investors may opt for a larger stop-loss percentage to account for the fluctuations. In a stable market, a tighter stop-loss percentage may be sufficient.

2. Individual Risk Tolerance: Investors with a higher risk tolerance may set a wider stop-loss percentage to allow for more fluctuations, while conservative investors may prefer a tighter percentage.

3. Technical Analysis: Utilizing technical indicators such as support levels or moving averages can help determine appropriate stop-loss levels.

Considerations for Setting Stop-Loss Order Levels

– Avoid setting stop-loss levels too close to the current price, as this may trigger unnecessary selling due to market fluctuations.

– Consider the stock’s historical price movements and volatility to set an appropriate stop-loss percentage.

– Monitor the stock regularly and adjust the stop-loss order as needed based on changing market conditions and individual risk tolerance.

Types of Stop-Loss Orders

When it comes to stock investments, utilizing different types of stop-loss orders can help manage risk and protect gains. Let’s compare and contrast market orders, limit orders, and trailing stop-loss orders to understand their impact on trading outcomes.

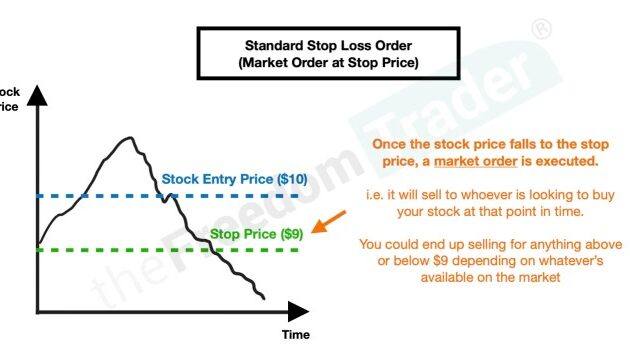

Market Orders

Market orders are executed at the current market price, ensuring immediate execution but potentially at a different price than expected. This type of stop-loss order is most effective in volatile markets or when quick execution is crucial.

Limit Orders

Limit orders allow investors to set a specific price at which the stop-loss order should be triggered. This provides more control over the execution price but may not guarantee immediate execution. Limit orders are beneficial in more stable market conditions or when investors have a target exit price in mind.

Trailing Stop-Loss Orders

Trailing stop-loss orders dynamically adjust the stop price as the stock price moves in a favorable direction. This type of stop-loss order is effective in capturing profits while also protecting against potential losses. Trailing stop-loss orders are particularly useful when investors want to ride the upward momentum of a stock while ensuring they lock in gains if the stock price reverses.

It’s essential for investors to understand the differences between these types of stop-loss orders and choose the most suitable one based on their risk tolerance, investment goals, and market conditions.

Implementing Stop-Loss Orders

When it comes to implementing stop-loss orders in stock trading, it’s essential to follow a strategic approach to protect your investments. Let’s delve into a step-by-step guide on how to effectively place stop-loss orders with a brokerage platform, common mistakes to avoid, and tips on monitoring and adjusting these orders as market conditions fluctuate.

Placing Stop-Loss Orders with a Brokerage Platform

To place a stop-loss order with a brokerage platform, follow these steps:

- Log in to your brokerage account and select the stock you want to set a stop-loss order for.

- Locate the option to place a stop-loss order, usually found under the order type dropdown menu.

- Enter the stop price at which you want the order to trigger.

- Set the quantity of shares you want the stop-loss order to apply to.

- Choose the duration of the stop-loss order (day order or good-till-canceled).

- Review and confirm the details of the stop-loss order before submitting it.

Common Mistakes to Avoid

When implementing stop-loss orders, it’s crucial to steer clear of the following common mistakes:

- Setting stop-loss orders too close to the current price, leading to premature triggering and potential losses.

- Not adjusting stop-loss orders as the stock price fluctuates, missing out on opportunities to protect profits or minimize losses.

- Relying solely on stop-loss orders without considering other risk management strategies.

Monitoring and Adjusting Stop-Loss Orders, Using stop-loss orders for stock investments

To effectively monitor and adjust stop-loss orders as market conditions change, consider the following tips:

- Regularly review the performance of your investments and assess whether adjustments to stop-loss orders are necessary based on new information.

- Stay informed about market trends, news, and events that could impact the price of your stocks and adjust your stop-loss orders accordingly.

- Consider trailing stop-loss orders that automatically adjust as the stock price moves in your favor, locking in profits while still protecting against losses.

Final Review: Using Stop-loss Orders For Stock Investments

In conclusion, mastering the art of using stop-loss orders can be a game-changer in your stock investment journey. By understanding the intricacies of setting parameters and selecting the right type of stop-loss order, you can navigate the volatile stock market with confidence and protect your hard-earned gains.

Timing the stock market for maximum returns is a crucial aspect of successful investing. Investors often try to predict the best time to buy or sell stocks to maximize profits. However, timing the market perfectly is nearly impossible due to its volatile nature.

It requires a deep understanding of market trends, economic indicators, and a bit of luck. To learn more about timing the stock market effectively, check out this insightful article on Timing the stock market for maximum returns.

When it comes to investing in the stock market, timing is everything. Understanding the right time to buy or sell stocks can make a huge difference in your overall returns. To learn more about timing the stock market for maximum returns, check out this informative article Timing the stock market for maximum returns.