USDC adoption in global finance sets the stage for a transformative journey in the world of digital transactions, revolutionizing the way we perceive and engage with global financial systems.

As we delve deeper into the realm of USDC and its impact on the global financial landscape, a myriad of opportunities and challenges come to light, shaping the narrative of modern finance.

Overview of USDC in Global Finance

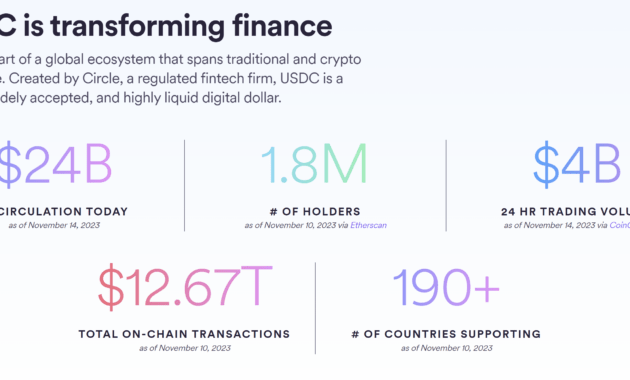

USDC, or USD Coin, is a stablecoin pegged to the US dollar, providing stability and predictability in the volatile cryptocurrency market. It plays a crucial role in global finance by enabling seamless cross-border transactions and serving as a reliable store of value.

Altcoins are alternative cryptocurrencies to Bitcoin, such as Ethereum, Ripple, and Litecoin. These digital currencies offer different features and use cases compared to Bitcoin. For example, Ethereum allows smart contracts to be executed on its blockchain, while Ripple focuses on facilitating cross-border payments.

To learn more about altcoins in cryptocurrency, check out this informative article on What are altcoins in cryptocurrency?.

USDC vs. Other Stablecoins

USDC stands out from other stablecoins due to its transparency and regulatory compliance. It is fully backed by US dollars held in reserve, ensuring a 1:1 ratio with the USD. This level of transparency instills trust among users and regulatory authorities, setting USDC apart from other stablecoins.

Altcoins are alternative cryptocurrencies to Bitcoin, such as Ethereum, Ripple, and Litecoin. These coins operate on their own blockchain technology and offer different features compared to Bitcoin. To learn more about altcoins in cryptocurrency, check out this informative article on What are altcoins in cryptocurrency?

.

Advantages of Using USDC in Global Finance

- Stability: USDC’s peg to the US dollar provides stability amidst the volatility of cryptocurrencies, making it a preferred choice for international transactions.

- Speed: Transactions using USDC are near-instantaneous, enabling swift cross-border payments without the delays associated with traditional banking systems.

- Cost-efficiency: USDC transactions incur lower fees compared to traditional banking systems, reducing the overall cost of international transfers.

- Accessibility: USDC can be easily traded, transferred, and stored using various cryptocurrency platforms, making it accessible to a global audience.

Current Use Cases of USDC in International Transactions

- Remittances: USDC is increasingly being used for cross-border remittances, allowing individuals to send money to family members abroad quickly and cost-effectively.

- Trade Finance: Businesses are utilizing USDC for international trade transactions, benefiting from the speed and efficiency of cryptocurrency payments.

- Financial Inclusion: USDC is promoting financial inclusion by providing individuals in underbanked regions with access to a stable digital currency for their financial needs.

Factors Driving USDC Adoption

The adoption of USDC in global finance is being driven by several key factors that highlight the benefits of using this digital currency over traditional methods. These factors include regulatory clarity, partnerships, and the advantages it offers compared to traditional currency exchange methods.

Regulatory Clarity Impact

Regulatory clarity plays a crucial role in the adoption of USDC as it provides a sense of security and legitimacy to users and businesses. With clear guidelines and regulations in place, individuals and institutions feel more confident in using USDC for their financial transactions, leading to increased adoption and trust in this digital currency.

Benefits Over Traditional Currency Exchange

The benefits of using USDC over traditional currency exchange methods are significant. USDC offers faster transaction speeds, lower fees, increased transparency, and enhanced security compared to traditional banking systems. These advantages make USDC an attractive option for individuals and businesses looking to streamline their financial transactions and reduce costs.

Role of Partnerships and Collaborations

Partnerships and collaborations play a vital role in promoting the adoption of USDC worldwide. By partnering with other financial institutions, payment processors, and technology companies, USDC can expand its reach and accessibility to a broader audience. These partnerships help facilitate the integration of USDC into various financial services and platforms, making it easier for users to transact with this digital currency.

Challenges and Barriers to USDC Adoption

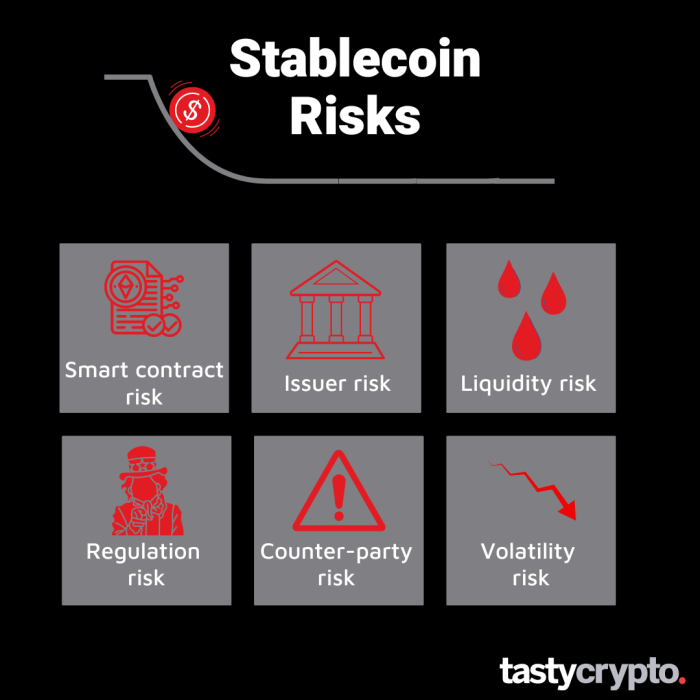

The widespread adoption of USDC in the global financial ecosystem faces several challenges that need to be addressed. These barriers could impact the growth and acceptance of USDC as a stablecoin in various markets.

Regulatory Hurdles

Navigating the regulatory landscape in different regions can be a significant challenge for USDC adoption. Regulations surrounding cryptocurrencies and stablecoins vary widely across countries, with some embracing them while others imposing strict restrictions. USDC may face hurdles in complying with these diverse regulatory frameworks, potentially limiting its adoption in certain regions.

Market Volatility Impact

The adoption of stablecoins like USDC can be influenced by market volatility. In times of extreme price fluctuations in the cryptocurrency market, investors may seek more stable assets, such as USDC, to hedge against risk. However, the overall market volatility can also impact the perceived stability of stablecoins, potentially hindering their adoption for certain use cases.

Security Concerns

Security is a paramount concern when it comes to using USDC for cross-border transactions. The decentralized nature of blockchain technology that underpins USDC can make it vulnerable to hacking attempts or security breaches. Ensuring the security of transactions and the protection of user funds will be crucial for gaining trust and wider adoption of USDC in global finance.

Future Outlook for USDC in Global Finance

The future of USDC in global finance looks promising as the adoption of stablecoins continues to gain traction worldwide. With advancements in blockchain technology and increasing acceptance of digital currencies, USDC is poised for significant growth in the coming years.

Potential Growth Trajectory of USDC Adoption, USDC adoption in global finance

- USDC adoption is expected to continue on an upward trend, driven by the growing demand for fast and low-cost cross-border transactions.

- As more financial institutions and businesses embrace digital currencies, the use of USDC as a stable medium of exchange is likely to expand globally.

- The regulatory clarity surrounding USDC and its compliance with existing financial laws could further fuel its adoption in mainstream finance.

Advancements in Blockchain Technology

- Blockchain technology innovations, such as layer 2 solutions and smart contracts, can enhance the efficiency and security of USDC transactions, making it more attractive for users.

- Integration with decentralized finance (DeFi) platforms and interoperability with other blockchain networks could broaden the utility of USDC in various financial applications.

- Improved scalability and reduced transaction costs through blockchain upgrades can make USDC a preferred choice for global financial transactions.

Potential Innovations Shaping the Future of USDC

- Development of central bank digital currencies (CBDCs) and their interoperability with USDC could create new opportunities for cross-border payments and trade settlements.

- Introduction of programmable features in USDC, such as conditional payments and automated compliance protocols, may revolutionize the way transactions are conducted in the global financial system.

- Collaborations with traditional financial institutions and payment processors can increase the accessibility of USDC to a broader audience, paving the way for its mainstream adoption.

Influence on International Trade and Finance

- The widespread adoption of USDC in global finance could streamline international trade by reducing transaction times and costs associated with traditional banking systems.

- Increased liquidity and stability offered by USDC can mitigate currency fluctuations and provide a secure medium for cross-border transactions, benefiting businesses and consumers alike.

- USDC adoption may encourage financial inclusion by providing access to digital financial services for underserved populations, fostering economic growth and innovation on a global scale.

Closure: USDC Adoption In Global Finance

In conclusion, the evolution of USDC adoption in global finance underscores the dynamic nature of digital currencies and their profound influence on international economic structures. As we anticipate the future developments and innovations in this space, one thing remains clear: USDC is poised to play a significant role in redefining the way we transact on a global scale.