Kicking off with Understanding Forex chart patterns, this comprehensive guide delves into the intricacies of recognizing and utilizing these patterns for successful trading strategies. From common patterns to advanced strategies, this article covers it all.

Introduction to Forex Chart Patterns

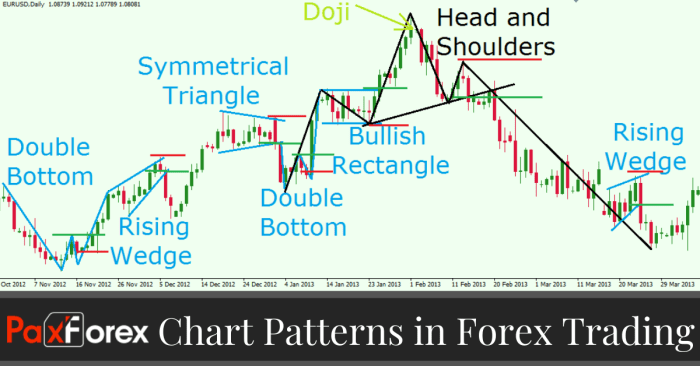

Forex chart patterns are visual representations of price movements in the foreign exchange market. These patterns can help traders identify potential market trends and make informed decisions about when to buy or sell currencies.

When it comes to trading, knowing the most volatile currency pairs can make a huge difference in your strategy. Some of the most volatile currency pairs to trade include Most volatile currency pairs to trade. Understanding the dynamics of these pairs can help you anticipate market movements and maximize your profits.

Whether you’re a beginner or an experienced trader, keeping an eye on these pairs can give you an edge in the forex market.

Importance of Recognizing Forex Chart Patterns, Understanding Forex chart patterns

- Understanding chart patterns can provide valuable insights into market sentiment and potential price movements.

- Recognizing these patterns can help traders anticipate potential breakouts or reversals in the market.

- By identifying chart patterns, traders can develop trading strategies based on historical price data.

Common Forex Chart Patterns

| Pattern | Description |

|---|---|

| Head and Shoulders | A reversal pattern characterized by a peak (shoulder), followed by a higher peak (head), and then another lower peak (shoulder). |

| Double Top/Bottom | A reversal pattern where the price reaches a peak (double top) or trough (double bottom) twice before reversing its direction. |

| Triangles | Patterns formed by converging trendlines, indicating a period of consolidation before a breakout occurs. |

Types of Forex Chart Patterns: Understanding Forex Chart Patterns

Forex chart patterns can be categorized into two main types: continuation patterns and reversal patterns. Each type plays a crucial role in analyzing market trends and making informed trading decisions.

When it comes to trading, understanding the most volatile currency pairs is crucial for success. These pairs often offer greater opportunities for profit, but they also come with higher risks. Traders looking to capitalize on market fluctuations should keep a close eye on pairs like the most volatile currency pairs to trade.

By staying informed and making strategic decisions, traders can navigate the challenges and potentially reap substantial rewards in the forex market.

Continuation Patterns

- Continuation patterns indicate a temporary pause in the prevailing trend before resuming its original direction.

- These patterns suggest that the current trend is likely to continue after the consolidation phase.

- Common continuation patterns include flags, pennants, and triangles.

- Traders often use continuation patterns to confirm the strength of an existing trend and plan their entry and exit points accordingly.

- It is essential to wait for a breakout confirmation before initiating a trade based on a continuation pattern.

Reversal Patterns

- Reversal patterns signal a potential change in the current trend direction, indicating a reversal in market sentiment.

- These patterns are crucial for traders looking to identify possible trend reversals and adjust their trading strategies accordingly.

- Common reversal patterns include head and shoulders, double tops/bottoms, and triple tops/bottoms.

- Traders need to exercise caution when trading based on reversal patterns and wait for a confirmation of the trend reversal before taking action.

- Reversal patterns can offer lucrative trading opportunities if identified and executed correctly.

Major Forex Chart Patterns

When it comes to analyzing forex charts, traders often rely on major chart patterns to make informed decisions. These patterns provide valuable insights into potential market movements and help traders anticipate price changes. Let’s explore some of the key chart patterns that traders frequently encounter in the forex market.

Head and Shoulders Pattern

The Head and Shoulders pattern is a trend reversal pattern that signals a potential change in the direction of a currency pair. It consists of three peaks – a higher peak (head) flanked by two lower peaks (shoulders). The neckline, drawn by connecting the lows of the two shoulders, serves as a crucial level of support or resistance. Traders typically look for a break below the neckline to confirm a bearish trend reversal.

Double Tops and Double Bottoms

Double Tops and Double Bottoms are also reversal patterns that indicate a potential shift in market sentiment. A Double Top forms when the price reaches a peak twice at a similar level, signaling a resistance level that may lead to a downward trend. Conversely, a Double Bottom occurs when the price hits a low twice, suggesting a support level that could trigger an upward movement.

Triangles

Triangles are continuation patterns that represent a period of consolidation before the price breaks out in the direction of the prevailing trend. There are three main types of triangles – symmetrical, ascending, and descending. Symmetrical triangles show a period of indecision between buyers and sellers, while ascending triangles suggest bullish momentum and descending triangles indicate bearish sentiment.

Comparing the Reliability of Chart Patterns

While each chart pattern has its own unique characteristics and implications, traders often debate the reliability of these patterns in predicting future price movements. Some patterns, like the Head and Shoulders, are considered more reliable due to their clear and defined structure, while others may produce false signals or require additional confirmation from other indicators.

Trading Strategies using Chart Patterns

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-01-a6be7f7fd3124918a519946fead796b8.jpg?w=700)

When it comes to trading strategies using chart patterns, traders can utilize these visual patterns to make informed decisions in the forex market. By identifying these patterns, traders can anticipate potential price movements and plan their trades accordingly. Here are some guidelines on how traders can effectively use chart patterns in their trading strategies:

Setting Stop-Loss and Take-Profit Levels

- When using chart patterns, traders can set stop-loss levels below support levels for long positions and above resistance levels for short positions to manage risk.

- Take-profit levels can be set based on the height of the pattern, projecting a target price that reflects the potential price movement indicated by the pattern.

- Traders should consider the pattern’s reliability and the overall market conditions when setting stop-loss and take-profit levels to ensure a balanced risk-reward ratio.

Combining Chart Patterns with Other Technical Analysis Tools

- Traders can enhance the effectiveness of chart patterns by combining them with other technical analysis tools such as moving averages, RSI, MACD, and Fibonacci retracement levels.

- Using multiple indicators can provide confirmation signals and strengthen the validity of the trading decision based on the chart pattern.

- It is important to avoid relying solely on chart patterns and consider the broader technical analysis context to make well-informed trading decisions.

Final Summary

In conclusion, mastering Forex chart patterns is essential for any trader looking to navigate the volatile market with confidence. By understanding the nuances of these patterns and implementing effective strategies, traders can enhance their chances of success in the competitive world of Forex trading.