Types of stocks to invest in: At the core of every successful investment journey lies the crucial decision of which stocks to invest in. Dive into this guide to explore the diverse world of stocks and uncover the key factors to consider before making your next investment move.

From common stocks to blue-chip stocks, growth stocks to value stocks, and domestic to international stocks, this guide will equip you with the knowledge needed to navigate the complex landscape of stock investments.

Overview of Stocks

Stocks represent ownership in a company and are typically bought and sold on stock exchanges. When you purchase a stock, you are essentially buying a small piece of that company. Investors can make money through stock price appreciation, dividends, or both.

Concept of Investing in Stocks

Investing in stocks involves buying shares of publicly traded companies with the expectation of earning a return on your investment. This can be done through capital gains, where the value of the stock increases, or through dividends, which are payments made by some companies to shareholders.

Potential Benefits and Risks of Investing in Stocks

- Benefits:

- Potential for high returns: Stocks have historically provided higher returns compared to other investment options over the long term.

- Diversification: Investing in a variety of stocks can help spread risk and reduce the impact of market fluctuations.

- Liquidity: Stocks can be easily bought and sold on the stock market, providing investors with flexibility.

- Risks:

- Market volatility: Stock prices can be highly volatile, leading to fluctuations in the value of your investments.

- Company-specific risks: Factors such as poor management, competition, or industry trends can impact the performance of individual stocks.

- Loss of principal: There is a risk of losing some or all of your initial investment if stock prices decline significantly.

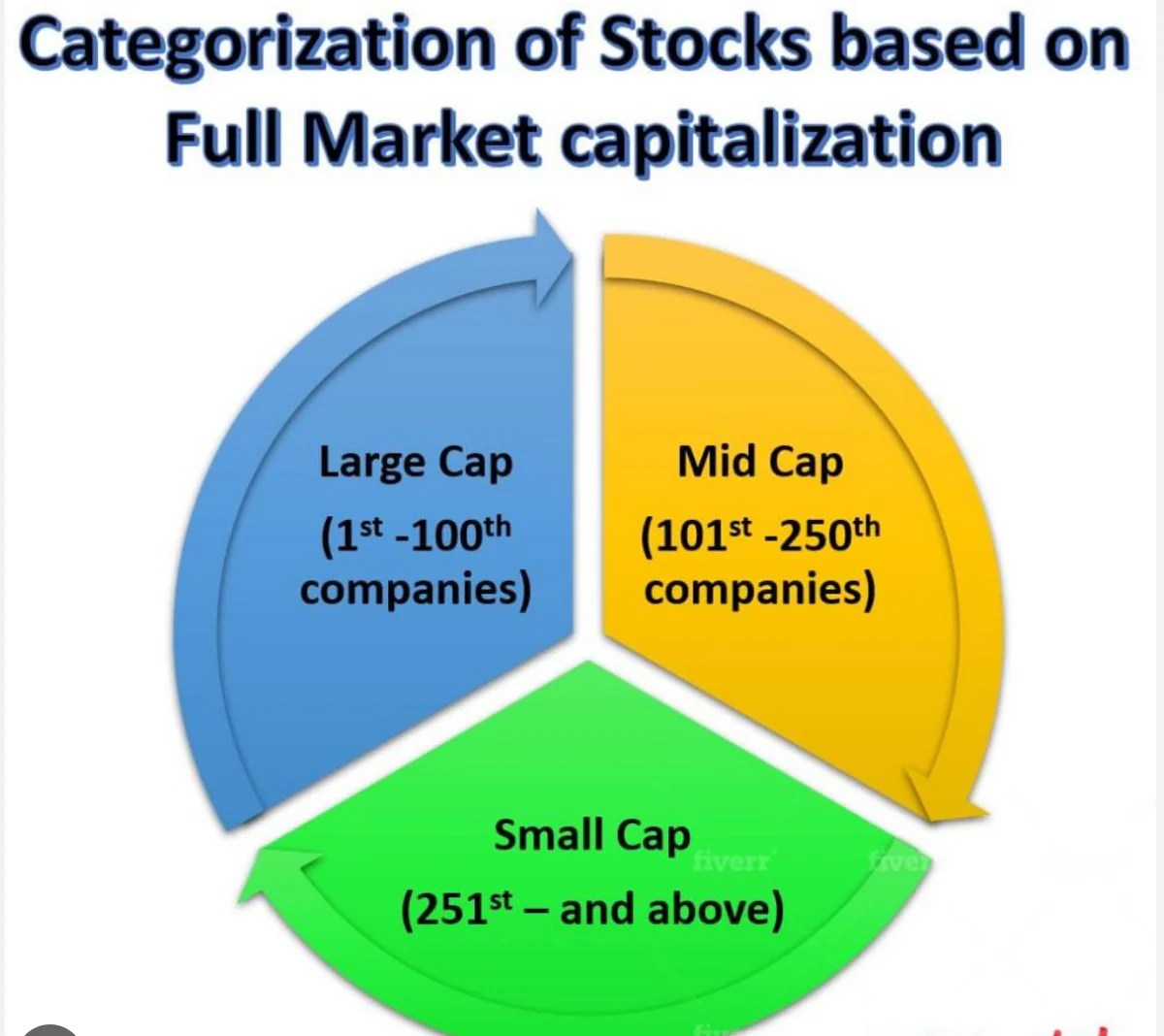

Types of Stocks: Types Of Stocks To Invest In

When it comes to investing in stocks, it is essential to understand the different types available in the market. This knowledge can help investors make informed decisions based on their financial goals and risk tolerance.

Common Stocks, Types of stocks to invest in

Common stocks are the most basic type of stock that companies issue. They represent ownership in a company and typically come with voting rights at shareholder meetings. Common stockholders may also receive dividends if the company distributes profits.

Preferred Stocks

Preferred stocks, on the other hand, do not usually come with voting rights but have a higher claim on assets and earnings compared to common stocks. They offer a fixed dividend that must be paid before dividends can be distributed to common stockholders.

Blue-Chip Stocks

Blue-chip stocks are shares of well-established, financially stable companies with a history of reliable performance. These stocks are considered safe investments and often pay dividends regularly. Examples of blue-chip stocks include companies like Coca-Cola, Apple, and Johnson & Johnson.

Growth Stocks vs. Value Stocks

Growth stocks are shares of companies that are expected to grow at a faster rate than the average market. These stocks typically reinvest earnings into the company to fuel expansion and do not typically pay dividends. On the other hand, value stocks are shares of companies that are considered undervalued by the market. These stocks are often overlooked but have the potential for long-term growth.

Domestic Stocks vs. International Stocks

Domestic stocks are shares of companies based in the investor’s home country, while international stocks are shares of companies based in foreign countries. Investing in international stocks can provide diversification benefits and exposure to different economies and industries. However, it also comes with additional risks such as currency fluctuations and political instability.

Factors to Consider Before Investing

When it comes to investing in stocks, there are several key factors that investors should carefully consider before making any decisions. These factors play a crucial role in determining the success and profitability of your investment portfolio.

Financial Goals

- Before investing in stocks, it is important to clearly define your financial goals. Whether you are looking to save for retirement, purchase a home, or grow your wealth, your financial goals will influence your investment strategy.

- Consider your risk tolerance and investment timeframe when setting your financial goals to ensure they are realistic and achievable.

Economic Conditions and Stock Selection

- Economic conditions, such as interest rates, inflation, and unemployment, can have a significant impact on stock prices and overall market performance.

- It is essential to stay informed about current economic trends and events to make informed decisions when selecting stocks for your portfolio.

- Consider how different sectors of the economy may be affected by economic conditions and adjust your stock selection accordingly.

The Importance of Diversification

- Diversification is a crucial strategy for reducing risk in your investment portfolio. By spreading your investments across different asset classes, industries, and geographies, you can minimize the impact of market fluctuations on your overall portfolio.

- Ensure your portfolio is well-diversified to protect against the risk of individual stock underperformance or sector-specific downturns.

- Rebalance your portfolio regularly to maintain diversification and adjust your holdings based on changing market conditions and your investment goals.

Strategies for Investing in Stocks

Investing in stocks requires careful consideration and a solid strategy to maximize returns and minimize risks. There are several investment strategies that investors can employ when it comes to buying and selling stocks. Let’s explore some of the most common strategies below.

Buy and Hold Strategy

The buy and hold strategy involves purchasing stocks and holding onto them for an extended period, regardless of short-term market fluctuations. This strategy is based on the belief that over the long term, the stock market tends to increase in value. Investors following this strategy typically focus on fundamentally strong companies with growth potential.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy where investors regularly invest a fixed amount of money in a particular stock or a diversified portfolio. By investing a consistent amount at regular intervals, investors can take advantage of market fluctuations and potentially lower the average cost per share over time.

Value Investing

Value investing involves identifying undervalued stocks that are trading below their intrinsic value. Investors following this strategy look for companies with strong fundamentals, a competitive advantage, and a margin of safety. The goal is to buy these stocks at a discount and hold them until the market recognizes their true value.

Research and Analysis

Before investing in stocks, it’s essential to conduct thorough research and analysis. This includes analyzing financial statements, studying industry trends, evaluating competitive positioning, and assessing management quality. Investors can use various tools and resources, such as financial websites, stock screeners, and analyst reports, to make informed investment decisions.

Market Timing

Market timing refers to the practice of trying to predict the direction of stock prices in the short term. While some investors may attempt to time the market to buy low and sell high, it’s important to note that market timing is notoriously difficult and often leads to poor investment outcomes. Instead, long-term investors are advised to focus on their investment goals, risk tolerance, and asset allocation strategy rather than trying to time the market.

Wrap-Up

In conclusion, understanding the types of stocks available for investment is essential for building a robust investment portfolio. By considering various factors and strategies, you can make informed decisions and optimize your investment potential in the stock market.