Top stock investment strategies set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Fundamental analysis, technical analysis, growth investing, value investing, dividend investing, and sector rotation are just a few key components explored in this comprehensive guide.

Overview of Top Stock Investment Strategies

Stock investment strategies refer to the specific plans or approaches that investors use to make decisions about buying, selling, or holding stocks in order to achieve their financial goals. These strategies are crucial for guiding investors through the complexities of the stock market and helping them maximize their returns while managing risks effectively.

Types of Popular Stock Investment Strategies

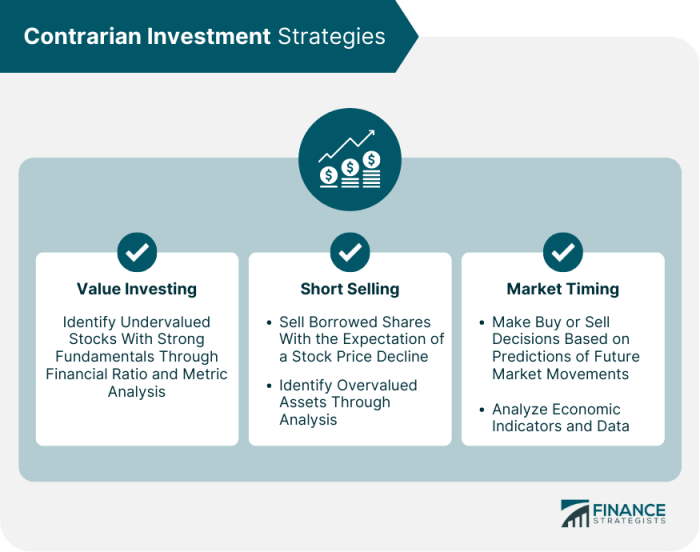

- Value Investing: This strategy involves identifying undervalued stocks that are trading below their intrinsic value. Investors following this approach believe that these stocks have the potential to increase in price over time.

- Growth Investing: Growth investors focus on companies that show strong potential for rapid earnings growth. They look for companies with high growth rates and invest in them with the expectation of significant capital appreciation.

- Dividend Investing: Dividend investors seek out stocks of companies that pay regular dividends. These investors prioritize steady income streams and long-term wealth accumulation through dividend payments.

- Momentum Investing: Momentum investors capitalize on the momentum of stock prices, buying stocks that have been performing well in the hope that the trend will continue. They aim to profit from short-term price movements.

Fundamental Analysis

Fundamental analysis is a method used by investors to evaluate stocks based on financial statements, economic indicators, and other relevant information. This analysis focuses on the intrinsic value of a stock, looking at factors such as revenue, earnings, growth potential, and industry trends.

Fundamental analysis helps investors identify valuable stocks by assessing the financial health and performance of a company. By analyzing key financial metrics like revenue growth, profit margins, and debt levels, investors can determine if a stock is undervalued or overvalued. This information can guide investment decisions and help investors make informed choices.

Comparison with Other Types of Stock Analysis

Fundamental analysis differs from other types of stock analysis, such as technical analysis and sentiment analysis. While fundamental analysis focuses on the underlying financial factors of a company, technical analysis looks at historical price movements and trading volume to predict future stock price movements. On the other hand, sentiment analysis evaluates market sentiment and investor behavior to gauge market trends.

- Fundamental analysis focuses on financial data and company performance metrics.

- Technical analysis relies on historical price data and chart patterns.

- Sentiment analysis considers market sentiment and investor behavior.

Technical Analysis

Technical analysis is a method used by traders and investors to evaluate securities and make investment decisions based on historical price trends and market activity. It focuses on analyzing charts, patterns, and various technical indicators to forecast future price movements.

Common Technical Indicators

- Moving Averages: Moving averages help smooth out price data to identify trends over a specific period. For example, the 50-day moving average crossing above the 200-day moving average is known as a “golden cross,” signaling a bullish trend.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements. A reading above 70 indicates an overbought condition, while a reading below 30 suggests an oversold condition.

- Bollinger Bands: Bollinger Bands consist of a middle band (simple moving average) and two outer bands that represent standard deviations from the average. Traders use them to identify potential price breakouts or reversals.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. Traders look for signal line crossovers to identify buy or sell opportunities.

Examples of Technical Analysis in Stock Investment

- Chart Patterns: Traders often look for chart patterns like head and shoulders, triangles, and flags to predict future price movements. For instance, a breakout above a resistance level following a bullish flag pattern could signal a potential uptrend.

- Support and Resistance Levels: Technical analysts pay attention to support (price floor) and resistance (price ceiling) levels on a stock chart. These levels can help determine entry and exit points for trades based on how the price reacts at these levels.

Growth Investing

Growth investing is a strategy where investors focus on stocks that have the potential for above-average growth in revenue, earnings, or cash flow. These companies typically reinvest their earnings back into the business to fuel expansion and increase market share.

Key Characteristics of Growth Stocks

- Growth stocks are typically found in sectors such as technology, healthcare, and consumer discretionary.

- These stocks tend to have high price-to-earnings ratios due to the market’s expectations for future growth.

- They often do not pay dividends, as they prefer to reinvest profits for further growth.

- Growth stocks may have volatile price movements due to market sentiment and earnings announcements.

Risk and Rewards of Growth Investing, Top stock investment strategies

- Risk: Investing in growth stocks can be risky as they are more susceptible to market downturns and economic cycles. Additionally, if the company fails to meet growth expectations, the stock price could plummet.

- Reward: The potential rewards of growth investing can be substantial, with the possibility of significant capital appreciation if the company successfully grows its earnings and market share.

- Long-Term Focus: Growth investing often requires a long-term perspective, as the true potential of a growth stock may take time to materialize.

Value Investing

Value investing is an investment approach that involves selecting stocks that are trading for less than their intrinsic value. The key principles of value investing include buying undervalued stocks, focusing on long-term growth potential, and conducting thorough fundamental analysis to identify strong companies with solid financials.

Comparison with Other Investment Approaches

- Value investing differs from growth investing, which focuses on companies with high growth potential regardless of their current stock price.

- Contrary to technical analysis, which relies on historical price movements and chart patterns, value investing emphasizes the underlying value of the company.

- Compared to momentum investing, where investors buy stocks that have shown recent positive price movements, value investors seek out stocks that are temporarily out of favor in the market.

Successful Value Investors and Strategies

- Warren Buffett is perhaps the most well-known value investor, following the principles of buying undervalued companies with strong fundamentals and holding for the long term.

- Benjamin Graham, known as the “father of value investing,” developed the concept of investing in companies trading below their intrinsic value and wrote the book “The Intelligent Investor.”

- Seth Klarman, founder of the Baupost Group, is another successful value investor known for his disciplined approach to finding undervalued securities and mitigating risk through thorough analysis.

Dividend Investing: Top Stock Investment Strategies

Dividend investing is a strategy where investors focus on purchasing stocks that pay out regular dividends to their shareholders. These dividends are a portion of the company’s profits that are distributed to investors as a reward for holding onto the stock.

Identifying Strong Dividend-Paying Stocks

- Look for companies with a history of consistent dividend payments.

- Check the dividend yield, which is the annual dividend amount divided by the stock price.

- Consider the company’s cash flow and earnings growth to ensure they can sustain their dividend payments.

- Analyzing the company’s dividend payout ratio can also provide insight into the sustainability of dividends.

Importance of Dividends in a Stock Investment Portfolio

- Dividends can provide a steady income stream for investors, especially during market downturns.

- Reinvesting dividends can help accelerate the growth of your investment portfolio through compounding.

- Companies that pay dividends tend to be more stable and mature, making them less volatile than growth stocks.

- Dividends can be a signal of a company’s financial health and management’s confidence in the business.

Sector Rotation

Sector rotation is a stock investing strategy that involves shifting investments between different sectors of the economy based on the economic cycle. The goal of sector rotation is to capitalize on the sectors that are expected to outperform in a particular economic environment.

Maximizing Returns with Sector Rotation

Sector rotation helps in maximizing returns by allowing investors to take advantage of the varying performance of different sectors at different stages of the economic cycle. By rotating investments into sectors that are poised to perform well in a particular economic environment, investors can potentially achieve higher returns compared to a buy-and-hold strategy.

- During an economic expansion, sectors such as technology and consumer discretionary tend to outperform. By rotating investments into these sectors, investors can benefit from the growth opportunities presented during this phase.

- Conversely, during an economic downturn, defensive sectors like utilities and consumer staples may outperform. Rotating investments into these sectors can help protect the portfolio during turbulent times.

Challenges of Implementing Sector Rotation

Implementing sector rotation can be challenging due to the need for accurate economic forecasting and the ability to time the shifts between sectors effectively. Some considerations include:

- Timing the rotations correctly is crucial, as moving in and out of sectors at the wrong time can lead to missed opportunities or losses.

- Identifying the sectors that are likely to outperform in a specific economic environment requires a deep understanding of macroeconomic trends and sector-specific factors.

- Overtrading or excessive portfolio turnover can result in increased transaction costs and tax implications, potentially eroding returns.

- Investors may also face the risk of sector-specific events or shocks that can impact the performance of a particular sector, making it challenging to predict outcomes accurately.

Last Word

In conclusion, mastering the top stock investment strategies discussed in this guide can lead to informed decision-making and potentially lucrative returns. By understanding the nuances of fundamental and technical analysis, as well as the principles behind growth, value, dividend investing, and sector rotation, investors can navigate the complex world of stock market investments with confidence and strategy.

Looking for top stocks for capital appreciation? Check out our carefully curated list of top-performing stocks that have shown consistent growth and potential for long-term gains. These stocks have been carefully analyzed by industry experts and are sure to provide you with a solid return on your investment.

Don’t miss out on the opportunity to grow your wealth with these promising stocks. Read more about it here.

When it comes to investing, finding the top stocks for capital appreciation is crucial. These stocks have the potential to provide significant returns over time. If you’re looking to grow your investment portfolio, consider researching and analyzing the market trends to identify the best opportunities.

Check out this list of top stocks for capital appreciation to help you make informed decisions and maximize your profits.