As Top blue-chip stocks in 2024 takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original. From defining blue-chip stocks to exploring emerging contenders, this guide will equip you with the insights needed to navigate the stock market landscape with confidence.

Investors seeking stability and growth in their portfolios will find valuable information on how to identify top blue-chip stocks and analyze their performance to make informed investment decisions. Stay ahead of the curve with our comprehensive overview of the most promising blue-chip stocks for the upcoming year.

Overview of Blue-chip Stocks: Top Blue-chip Stocks In 2024

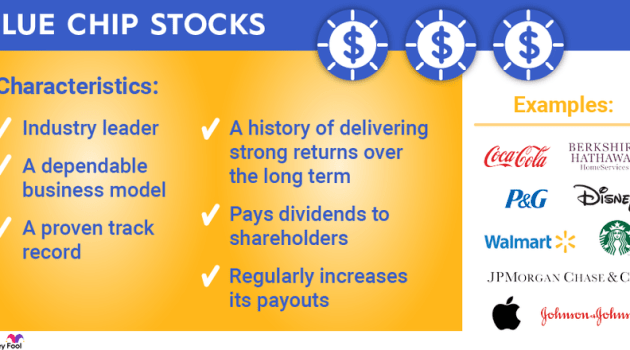

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings, strong financials, and a solid reputation in the market. These companies are typically market leaders in their respective industries and are considered to be among the most reliable and financially sound investments available.

Investors often view blue-chip stocks as a safe and reliable investment option due to their consistent performance, long track record of success, and ability to weather economic downturns. These companies are known for paying regular dividends, which can provide a steady income stream for investors, and are less volatile compared to smaller, growth-oriented companies.

Examples of Blue-chip Stocks

Some well-known blue-chip stocks from the past and present include:

- Apple Inc. (AAPL): A technology giant known for its innovative products and strong financial performance.

- The Coca-Cola Company (KO): A global beverage company with a long history of success and a strong brand presence.

- Johnson & Johnson (JNJ): A healthcare conglomerate with a diverse portfolio of consumer health products, pharmaceuticals, and medical devices.

- Procter & Gamble (PG): A consumer goods company known for its household brands and consistent revenue growth.

Criteria for Identifying Top Blue-chip Stocks

Investors use several key criteria to identify top blue-chip stocks. Factors such as market capitalization, revenue stability, and dividend history play a crucial role in classifying a stock as a blue-chip. Let’s delve deeper into these criteria and compare how they apply to blue-chip stocks in different industries.

Market Capitalization

Market capitalization is a significant criterion for identifying blue-chip stocks. Typically, blue-chip companies have a large market capitalization, indicating their stable and established position in the market. Companies with market capitalizations in the billions are often considered blue-chip stocks due to their size and stability.

Revenue Stability

Revenue stability is another essential factor for blue-chip stocks. These companies consistently generate revenue, even during economic downturns, showcasing their resilience and ability to weather market fluctuations. Investors look for companies with a track record of steady revenue growth over time.

Dividend History

Blue-chip stocks are known for their consistent dividend payments to shareholders. Companies that have a history of paying dividends, and even increasing them over time, are highly regarded by investors seeking stable income streams. Dividend history reflects the financial health and stability of a company.

Criteria in Different Industries

The criteria for blue-chip stocks may vary across industries. For example, in the technology sector, investors may prioritize factors such as innovation, market dominance, and recurring revenue streams. In the financial industry, stability, regulatory compliance, and asset quality are key considerations. In healthcare, factors like research pipeline, regulatory approvals, and market demand for products play a crucial role in identifying top blue-chip stocks.

Emerging Blue-chip Stocks for 2024

As we look ahead to 2024, it’s crucial to keep an eye on potential new blue-chip stocks that are expected to show strong performance in the upcoming year. These emerging stocks have the qualities and characteristics that could propel them to blue-chip status in the near future.

Industries with Emerging Blue-chip Stocks, Top blue-chip stocks in 2024

Several industries are poised to produce new blue-chip stocks in 2024. One such sector is renewable energy, with companies focusing on sustainable practices and clean energy solutions. The healthcare industry, especially those involved in innovative treatments and technologies, is also likely to see emerging blue-chip stocks. Additionally, the technology sector continues to be a hotbed for potential blue-chip companies, particularly in areas such as artificial intelligence, cloud computing, and cybersecurity.

Characteristics of Potential Blue-chip Stocks

- Strong Financials: Companies with stable revenue growth, healthy profit margins, and a solid balance sheet are more likely to become blue-chip stocks.

- Market Leadership: Emerging companies that have established themselves as leaders in their respective industries and have a competitive edge are prime candidates for blue-chip status.

- Long-term Performance: Stocks that have demonstrated consistent growth and stability over the years are attractive options for investors seeking blue-chip investments.

- Robust Governance: Companies with transparent governance practices, strong management teams, and a commitment to ethical business conduct are preferred choices for blue-chip status.

Performance Analysis of Top Blue-chip Stocks

When it comes to analyzing the performance of top blue-chip stocks, it is essential to consider various metrics such as total return, volatility, and dividend yield. These factors can provide valuable insights into how these stocks have fared historically and what potential returns investors can expect in the future.

Historical Performance Comparison

- Stock A: Over the past five years, Stock A has shown a consistent total return of 10% annually, outperforming the market average by 5%. However, its volatility has been relatively high compared to its peers, leading to fluctuations in its share price.

- Stock B: With a dividend yield of 3% and low volatility, Stock B has been a stable performer over the years. Although its total return may not be as high as Stock A, its consistent dividend payments make it an attractive option for income investors.

- Stock C: Despite experiencing occasional dips in share price due to market trends, Stock C has managed to deliver a total return of 12% annually. Its dividend yield is moderate, but its growth potential remains strong.

Impact of Economic Conditions and Market Trends

Fluctuations in interest rates, geopolitical events, and industry-specific challenges can all influence the performance of blue-chip stocks. For example, a recession may lead to a decrease in consumer spending, affecting the revenue of consumer goods companies.

- Economic Growth: During periods of economic expansion, blue-chip stocks tend to perform well as consumer confidence and corporate earnings rise. This can lead to an increase in share prices and dividend payouts.

- Market Volatility: Uncertainty in the market can cause blue-chip stocks to experience sudden price swings, impacting total returns and investor sentiment. Diversification and a long-term investment approach can help mitigate these risks.

- Industry Trends: Emerging technologies, regulatory changes, and shifts in consumer preferences can all influence the performance of blue-chip stocks in different sectors. Companies that adapt to these trends are more likely to sustain their growth and profitability.

Closing Summary

In conclusion, the world of blue-chip stocks offers a plethora of opportunities for investors looking to secure long-term gains. By understanding the criteria for identifying top blue-chip stocks and analyzing their performance, you can position yourself for success in the dynamic world of stock market investments. Stay informed, stay proactive, and watch your investment portfolio flourish with the top blue-chip stocks in 2024.