Tether (USDT) vs USD Coin (USDC) delves into the intricacies of these two prominent stablecoins, shedding light on their similarities, differences, and impact on the cryptocurrency market.

Exploring the technology, market adoption, regulation, and compliance aspects, this comprehensive comparison provides valuable insights into the world of stablecoins.

Overview of Tether (USDT) and USD Coin (USDC)

Tether (USDT) and USD Coin (USDC) are both examples of stablecoins in the cryptocurrency market. Stablecoins are digital assets designed to maintain a stable value by pegging their price to a fiat currency like the US Dollar. This stability makes them popular for traders looking to hedge against the volatility of other cryptocurrencies.

Key Similarities and Differences

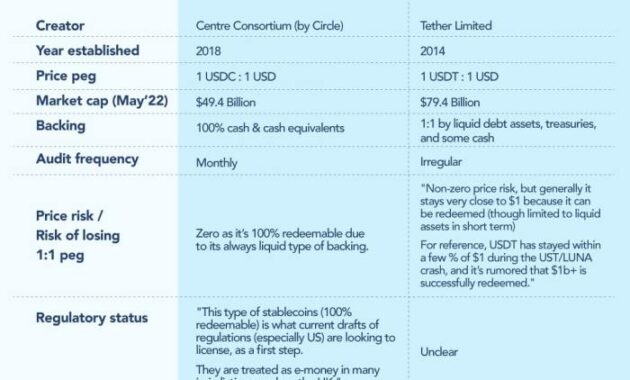

- Tether (USDT) and USD Coin (USDC) both serve as stablecoins, pegged to the US Dollar on a 1:1 basis.

- One key difference between the two is transparency. Tether has faced scrutiny regarding the actual reserves backing its tokens, while USD Coin is known for its transparent reserve holdings.

- Another difference lies in the companies behind the stablecoins. Tether is associated with Bitfinex, while USD Coin is a product of a collaboration between Coinbase and Circle.

- Despite these differences, both Tether and USD Coin play significant roles in facilitating transactions and providing stability in the cryptocurrency market.

Significance of Stablecoins

Stablecoins like Tether (USDT) and USD Coin (USDC) offer a bridge between traditional fiat currencies and the world of cryptocurrencies. Their stable value allows users to transact with the benefits of blockchain technology without being subject to the extreme price fluctuations often seen in other cryptocurrencies. Additionally, stablecoins provide a reliable store of value and a hedge against market volatility, making them essential tools for traders and investors in the crypto space.

Technology and Backing

When it comes to stablecoins like Tether (USDT) and USD Coin (USDC), the technology and backing play a crucial role in maintaining stability and trust in these digital assets.

Backing of Tether (USDT)

Tether (USDT) is backed by a reserve of traditional currency, primarily the US dollar. The company claims that each USDT token is backed 1:1 by the equivalent amount of USD held in reserves. However, there have been concerns and controversies regarding the transparency and adequacy of these reserves, with critics questioning whether Tether actually holds enough USD to back all issued USDT.

Backing of USD Coin (USDC)

USD Coin (USDC) is backed by a reserve of US dollars held by regulated financial institutions. The CENTRE consortium, which includes Coinbase and Circle, ensures that the USDC tokens are fully collateralized by the equivalent amount of USD in the reserve. This commitment to transparency and regular audits has helped USD Coin gain credibility in the market.

Underlying Technologies

Tether (USDT) operates on the Omni Layer protocol, which is built on top of the Bitcoin blockchain. This allows for the issuance and transfer of USDT tokens using the Bitcoin network. On the other hand, USD Coin (USDC) is an ERC-20 token, meaning it runs on the Ethereum blockchain. This enables faster transactions and lower fees compared to Tether.

Controversies and Issues

Tether has faced criticism over its lack of transparency regarding the reserves backing USDT. The company has been accused of market manipulation and artificially inflating the price of Bitcoin through the issuance of USDT. On the other hand, USD Coin has been praised for its regulatory compliance and transparent backing, but some skeptics still question the stability of the reserves.

Overall, the technology and backing of Tether and USD Coin play a significant role in shaping the perception of these stablecoins in the cryptocurrency market.

Market Adoption and Integration: Tether (USDT) Vs USD Coin (USDC)

Stablecoins like Tether (USDT) and USD Coin (USDC) have gained significant traction in the market due to their stability and utility in the crypto ecosystem.

When it comes to the fascinating world of cryptocurrencies, one cannot overlook the intriguing history of Dogecoin meme coin. Originally created as a joke based on a popular internet meme, Dogecoin has since gained a dedicated following and has even been used for various charitable causes.

Its journey from meme to a legitimate digital currency is a testament to the ever-evolving nature of the crypto market.

Integration into Exchanges

Both Tether and USD Coin are widely integrated into various cryptocurrency exchanges as trading pairs against other cryptocurrencies. This integration provides liquidity and ease of access for traders looking to hedge their positions or move in and out of volatile assets.

When exploring the history of cryptocurrencies, one cannot overlook the fascinating journey of Dogecoin. Originally created as a meme coin, Dogecoin has captured the attention of the crypto community with its unique branding and loyal fanbase. Despite its humble beginnings, Dogecoin has managed to carve out a niche for itself in the digital currency market, proving that even a joke can become a serious contender in the world of finance.

Payment Processors and Wallets

- Many payment processors and wallets now support Tether and USD Coin for seamless transactions and cross-border payments. This integration has made it easier for users to send and receive stablecoins across different platforms.

- Popular wallets like MetaMask and Trust Wallet have also integrated Tether and USD Coin, allowing users to store and manage their stablecoin holdings securely.

DeFi Platforms

- Decentralized Finance (DeFi) platforms have also embraced Tether and USD Coin for lending, borrowing, and yield farming activities. The integration of stablecoins in DeFi protocols has provided users with more options for earning passive income and accessing financial services.

- Platforms like Compound, Aave, and MakerDAO offer support for Tether and USD Coin, enabling users to collateralize their holdings and participate in various DeFi activities.

Impact on Value and Stability

The widespread adoption of Tether and USD Coin has had a positive impact on their value and stability. As more users and institutions use these stablecoins for transactions and investments, their market capitalization and liquidity have increased, leading to greater stability in their peg to the US dollar.

Regulation and Compliance

The regulatory environment surrounding Tether (USDT) and USD Coin (USDC) is a critical aspect of their operations in the cryptocurrency space. Both stablecoins have faced scrutiny and challenges in terms of legal compliance.

Regulatory Oversight, Tether (USDT) vs USD Coin (USDC)

- Tether (USDT) has faced allegations from regulators regarding the transparency of its reserves and the issuance of USDT tokens without proper backing.

- On the other hand, USD Coin (USDC) is known for its more transparent approach, with regular audits to ensure that each USDC token is backed by an equivalent amount of USD in reserve.

Legal Challenges

- Tether has been involved in legal disputes, including a case with the New York Attorney General’s office over allegations of covering up losses and misleading investors.

- USD Coin has not faced as many legal challenges as Tether, primarily due to its transparent and regulatory-compliant approach to stablecoin issuance.

Compliance Measures

- Tether has taken steps to improve transparency and compliance, such as publishing periodic attestations of its reserves and working towards regulatory approvals.

- USD Coin, backed by Circle and Coinbase, has focused on regulatory compliance from the start, including obtaining licenses and adhering to strict regulatory standards.

Ending Remarks

In conclusion, the battle between Tether (USDT) and USD Coin (USDC) continues to shape the landscape of digital currencies, with each stablecoin vying for dominance in the ever-evolving market. As investors navigate the complexities of these digital assets, understanding the nuances between them is crucial for making informed decisions in the volatile world of cryptocurrency.