Swing trading strategies for Forex take the spotlight as we delve into a world of expertly crafted techniques aimed at maximizing profits and success in the dynamic Forex markets. Dive into this comprehensive guide for valuable insights and actionable strategies.

Explore the key components of successful swing trading strategies, from technical analysis tools to risk management techniques, and learn how to develop a solid plan for navigating the ever-changing landscape of Forex trading.

Introduction to Swing Trading Strategies for Forex

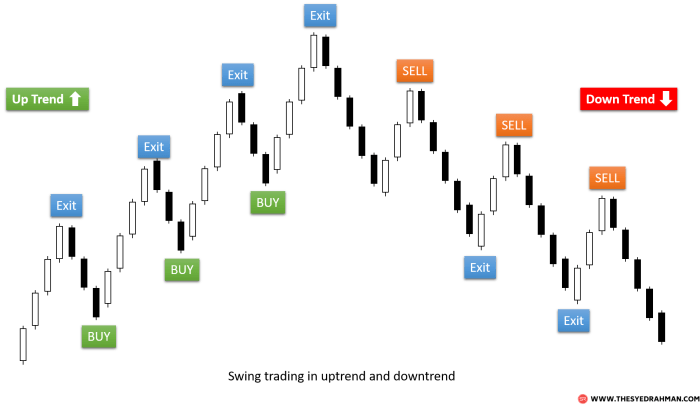

Swing trading in the context of Forex trading involves holding positions for a few days to weeks, taking advantage of short to medium-term price movements.

When it comes to forex trading, it’s crucial to choose currency pairs with low spreads. These pairs offer better opportunities for traders to profit due to tighter bid-ask spreads. Traders can check out this informative article on Currency pairs with low spreads to learn more about which pairs to consider for their trading strategies.

There are several benefits to using swing trading strategies in Forex, including the ability to capitalize on market fluctuations without needing to constantly monitor positions and the potential for higher returns compared to long-term investing.

When it comes to forex trading, choosing currency pairs with low spreads can significantly impact your profit margins. By focusing on pairs like EUR/USD or USD/JPY, you can take advantage of tighter spreads, meaning lower costs for each trade. To learn more about currency pairs with low spreads and how they can benefit your trading strategy, check out this informative article on Currency pairs with low spreads.

Examples of Successful Swing Trading Strategies in Forex Markets

- Identifying support and resistance levels to enter and exit trades at optimal points.

- Using technical indicators such as moving averages or MACD to confirm trends and make informed trading decisions.

- Implementing risk management strategies like setting stop-loss orders to protect capital and minimize losses.

Technical Analysis Tools for Swing Trading

Swing traders in the Forex market often rely on various technical analysis tools to make informed trading decisions. These tools help traders identify potential entry and exit points based on price trends and patterns.

Moving Averages:

Moving averages are one of the key technical indicators used in swing trading strategies. Traders commonly use simple moving averages (SMA) or exponential moving averages (EMA) to smooth out price data and identify trends. The crossover of short-term moving averages above or below long-term moving averages can signal potential buy or sell opportunities for swing traders.

Support and Resistance Levels:

Support and resistance levels play a crucial role in implementing swing trading strategies. Support levels represent price levels where a currency pair tends to find buying interest, preventing it from falling further. On the other hand, resistance levels indicate price levels where selling interest tends to emerge, preventing the currency pair from rising above that level. Swing traders often look for opportunities to enter or exit trades near these key support and resistance levels to maximize their profit potential.

Fundamental Analysis in Swing Trading: Swing Trading Strategies For Forex

Fundamental analysis plays a crucial role in complementing swing trading strategies in Forex by providing traders with a deeper understanding of the factors influencing market movements. While technical analysis focuses on price patterns and trends, fundamental analysis looks at the economic, social, and political factors that can impact currency values.

Impact of Economic Indicators on Swing Trading Decisions

Economic indicators such as GDP growth, interest rates, inflation, and employment data can have a significant impact on swing trading decisions. For example, a strong GDP growth report may signal a strengthening economy and lead to a bullish outlook on a currency, prompting swing traders to go long on that currency pair. Conversely, high inflation rates could weaken a currency and influence swing traders to take short positions.

- Employment Data: Unemployment rates and job creation numbers can provide insights into the health of an economy, influencing swing trading decisions.

- Interest Rates: Central bank decisions on interest rates can impact currency values and present opportunities for swing traders to capitalize on interest rate differentials.

- Inflation Rates: High inflation rates can erode purchasing power and devalue a currency, affecting swing trading strategies.

Geopolitical Events and Swing Trading Outcomes

Geopolitical events such as elections, trade agreements, and geopolitical tensions can also influence swing trading outcomes. For instance, a trade agreement between two countries could lead to increased trade and economic growth, positively impacting the currencies of those nations. On the other hand, political instability or conflicts can create uncertainty and volatility in the markets, affecting swing trading strategies.

- Elections: Political elections can introduce new policies and leadership changes that may impact currency values and create trading opportunities for swing traders.

- Trade Agreements: Agreements or disputes between countries can affect trade flows and currency values, impacting swing trading decisions.

- Geopolitical Tensions: Events such as conflicts or geopolitical tensions can lead to market uncertainty and fluctuations, influencing swing trading outcomes.

Risk Management Techniques for Swing Trading

Effective risk management is crucial in swing trading to minimize losses and protect capital. One of the key concepts in risk management for swing trading is the risk-reward ratio, which helps traders assess the potential profit against the risk of a trade. Understanding how to use stop-loss orders is also essential for managing risk in Forex swing trading.

Risk-Reward Ratio in Swing Trading, Swing trading strategies for Forex

The risk-reward ratio is a comparison between the potential profit of a trade and the amount of risk taken to achieve that profit. For example, a risk-reward ratio of 1:2 means that for every dollar risked, the trader aims to make two dollars in profit. A favorable risk-reward ratio helps traders maintain a profitable edge over time by ensuring that potential gains outweigh potential losses.

Importance of Risk-Reward Ratio in Forex Swing Trading

Maintaining a positive risk-reward ratio is essential for long-term success in swing trading. By consistently aiming for higher potential rewards than risks, traders can weather losses and still come out profitable overall. A good risk-reward ratio allows traders to be selective in their trades, focusing on high-probability setups that offer a favorable reward relative to the risk involved.

Using Stop-Loss Orders in Forex Swing Trading

Stop-loss orders are essential tools for managing risk in swing trading. These orders automatically close a trade when the price reaches a predetermined level, limiting potential losses. By setting stop-loss orders at strategic levels based on technical analysis or support/resistance areas, traders can protect their capital and prevent significant drawdowns in volatile markets.

Developing a Swing Trading Plan

Developing a comprehensive swing trading plan for Forex is crucial for success in the markets. A well-thought-out plan helps traders navigate the ups and downs of the market with a clear strategy in place.

Components of a Comprehensive Swing Trading Plan

- Entry and exit rules: Clearly define the criteria for entering and exiting trades based on technical indicators or price action signals.

- Position sizing: Determine the appropriate position size based on your risk tolerance and account size to manage risk effectively.

- Risk management strategy: Set stop-loss orders to limit potential losses and protect your capital. Consider implementing trailing stops to lock in profits as the trade moves in your favor.

- Trade management rules: Establish guidelines for managing open positions, such as when to take partial profits or move stop-loss orders to break-even.

Setting Realistic Goals and Objectives

- Define your trading goals: Whether it’s achieving a certain percentage return on investment or increasing your trading account size, set specific and measurable goals to work towards.

- Consider your risk tolerance: Determine how much capital you are willing to risk per trade and overall in your trading account. Align your goals with your risk tolerance to avoid taking excessive risks.

- Review and adjust goals regularly: Monitor your progress towards your goals and make adjustments as needed based on changing market conditions or personal circumstances.

Adapting and Adjusting a Swing Trading Plan

- Stay flexible: Markets are dynamic and can change rapidly. Be prepared to adapt your trading plan based on evolving market conditions and new information.

- Monitor performance: Regularly review your trading results and assess whether your plan is working effectively. Make adjustments to improve performance and address any weaknesses in your strategy.

- Seek feedback: Consider seeking feedback from experienced traders or mentors to gain insights into areas where you can improve your trading plan.

Last Word

In conclusion, mastering swing trading strategies for Forex can pave the way for lucrative opportunities and sustainable success in the fast-paced world of currency trading. By implementing the insights and tips provided in this guide, traders can enhance their skills and make informed decisions to achieve their financial goals.