Risk control techniques for Forex traders takes center stage, beckoning readers into a world crafted with good knowledge. This topic explores various strategies to manage risks effectively in the realm of forex trading.

As we dive deeper into the intricacies of risk management, we uncover key concepts like position sizing, stop-loss orders, and diversification that play a crucial role in mitigating risks for forex traders.

Risk Management Strategies

Risk management is a crucial aspect of forex trading as it helps traders minimize potential losses and protect their capital. By implementing effective risk management strategies, traders can enhance their chances of long-term success in the forex market.

When it comes to risk control techniques used by forex traders, there are several options available. Some of the common risk management strategies include setting stop-loss orders, using proper position sizing, diversifying trades, and utilizing risk-reward ratios.

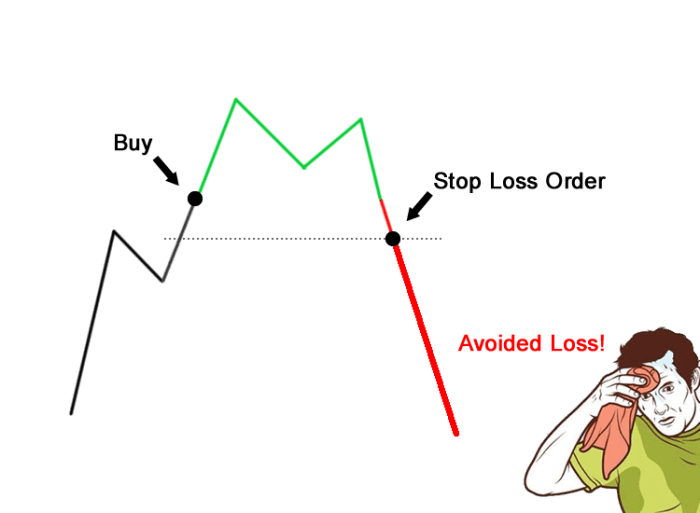

Stop-Loss Orders, Risk control techniques for Forex traders

One of the most popular risk management tools used by forex traders is the stop-loss order. This order automatically closes a trade when the price reaches a specific level, helping traders limit their losses and avoid emotional decision-making.

Position Sizing

Proper position sizing is another essential risk management technique in forex trading. By determining the correct position size based on account size and risk tolerance, traders can control the amount of capital at risk in each trade.

Diversification

Diversifying trades across different currency pairs can also help mitigate risk in forex trading. By spreading out investments, traders can reduce the impact of any single trade on their overall portfolio.

Risk-Reward Ratios

Utilizing risk-reward ratios is another effective way to manage risk in forex trading. By setting predetermined ratios for potential profit and loss before entering a trade, traders can ensure that the potential reward outweighs the risk.

In conclusion, implementing a combination of risk management strategies such as stop-loss orders, position sizing, diversification, and risk-reward ratios is essential for forex traders to protect their capital and improve their overall trading performance.

Position Sizing

Position sizing is a crucial risk management technique used by forex traders to determine the appropriate amount of a currency pair to buy or sell based on their risk tolerance and the size of their trading account. By calculating the correct position size, traders can control the amount of risk they are exposed to in each trade.

Calculating Position Sizes

Position sizing is calculated based on the trader’s risk tolerance, the distance between the entry and stop-loss levels, and the size of their trading account. Here is a step-by-step guide on how to calculate position sizes:

- Determine the percentage of your trading account you are willing to risk on a single trade, known as the risk percentage.

- Calculate the dollar amount of risk for the trade by multiplying the risk percentage by the total account balance.

- Identify the distance in pips between your entry point and the stop-loss level for the trade.

- Calculate the dollar value per pip for the currency pair you are trading.

- Divide the dollar amount of risk for the trade by the dollar value per pip to determine the position size in lots.

Stop Loss Orders: Risk Control Techniques For Forex Traders

Stop-loss orders are an essential risk management tool used by forex traders to limit potential losses on a trade. These orders are set at a predetermined price level, below the entry price for a long position or above the entry price for a short position. When the market reaches the stop-loss price, the order is triggered automatically, closing the trade and preventing further losses.

Best Practices for Placing Stop-Loss Orders

- Set stop-loss orders based on technical analysis, support and resistance levels, or volatility indicators to determine optimal placement.

- Avoid placing stop-loss orders too close to the entry price, as this can result in premature triggering due to market volatility.

- Adjust stop-loss orders as the trade progresses to lock in profits and protect capital effectively.

- Consider the size of the position and account balance when determining the appropriate stop-loss level to maintain proper risk management.

Potential Impact of Stop-Loss Orders on Trading Outcomes

Stop-loss orders can help traders control risk and prevent large losses by automatically closing out losing trades. While they can limit downside potential, stop-loss orders can also result in being stopped out of a trade prematurely if set too close to the entry price. Traders must carefully consider their risk tolerance, market conditions, and trading strategy when placing stop-loss orders to achieve a balance between risk management and trade profitability.

Diversification

Diversification plays a crucial role in risk management for forex traders by spreading out investments across different assets to reduce overall risk exposure. This strategy helps to minimize potential losses that may arise from adverse movements in a single currency pair.

Reducing Risks through Diversifying Currency Pairs

- Diversifying currency pairs involves trading in multiple pairs simultaneously to offset potential losses in one pair with gains in another. For example, if one currency pair experiences a sharp decline, profits from other pairs can help balance out the overall portfolio.

- By diversifying across various currency pairs, traders can mitigate the impact of geopolitical events, economic data releases, or other market factors that may affect specific currencies.

- For instance, a trader holding positions in EUR/USD, GBP/JPY, and AUD/CAD can reduce risk compared to concentrating solely on one pair like USD/JPY. This way, fluctuations in one pair are less likely to have a significant impact on the overall trading account.

Pros and Cons of Diversification Strategies

- Pros:

- Diversification can help protect against large losses by spreading risk across different assets.

- It allows traders to benefit from multiple market opportunities and reduces dependency on the performance of a single currency pair.

- By diversifying, traders can increase the stability of their trading portfolio and improve the overall risk-adjusted returns.

- Cons:

- Over diversification can lead to diluted returns, as spreading investments too thin may reduce the potential for significant profits.

- Managing multiple positions across various currency pairs can be complex and time-consuming, requiring careful monitoring and adjustment.

- Unexpected correlations between currency pairs may result in losses across the entire diversified portfolio during certain market conditions.

Last Point

In conclusion, mastering risk control techniques is essential for every forex trader looking to navigate the turbulent waters of the financial markets with confidence and precision. By implementing these strategies effectively, traders can safeguard their investments and increase their chances of long-term success.

When it comes to trading in the forex market, having solid Forex risk management strategies is crucial for success. Traders need to carefully plan their risk management approach to protect their investments and minimize potential losses. By setting stop-loss orders, diversifying their portfolios, and using leverage wisely, traders can effectively manage risks and improve their chances of profitability in the volatile forex market.

When it comes to trading in the forex market, having effective Forex risk management strategies is crucial for success. Traders need to implement risk management techniques such as setting stop-loss orders, diversifying their portfolio, and using proper position sizing to minimize potential losses.

By carefully managing risk, traders can protect their capital and ensure long-term profitability in the volatile forex market.