Reducing stock market risk with diversification, this introduction immerses readers in a unique and compelling narrative, with ahrefs author style that is both engaging and thought-provoking from the very first sentence.

Diving into the importance of diversification in investing and the various strategies that can be employed to build a diversified portfolio.

Why Diversification is Important in Stock Market Risk Reduction: Reducing Stock Market Risk With Diversification

Diversification is a strategy used by investors to spread their investments across different assets in order to reduce risk. Instead of putting all your money into a single stock or sector, diversification allows you to mitigate the impact of a potential loss in one investment by having exposure to a variety of assets.

Benefits of Diversification

- Diversifying your portfolio can reduce the overall risk as losses in one asset can be offset by gains in another. For example, if you invest in a mix of stocks, bonds, and real estate, a decline in the stock market may be balanced out by stable returns from bonds or real estate investments.

- By spreading your investments, you can also lower the volatility of your portfolio. This means that the value of your investments may not fluctuate as drastically as a concentrated portfolio, providing a more stable return over time.

- Comparatively, a non-diversified portfolio, heavily concentrated in one asset or sector, is more susceptible to the risks associated with that specific investment. For instance, if all your money is in tech stocks and the tech sector experiences a downturn, your entire portfolio could suffer significant losses.

Types of Diversification Strategies

Diversification is a crucial risk management strategy for investors looking to protect their portfolios from market volatility. There are several types of diversification strategies that investors can employ to achieve this goal. Each strategy comes with its own set of benefits and drawbacks, and understanding these can help investors make informed decisions when building their investment portfolios.

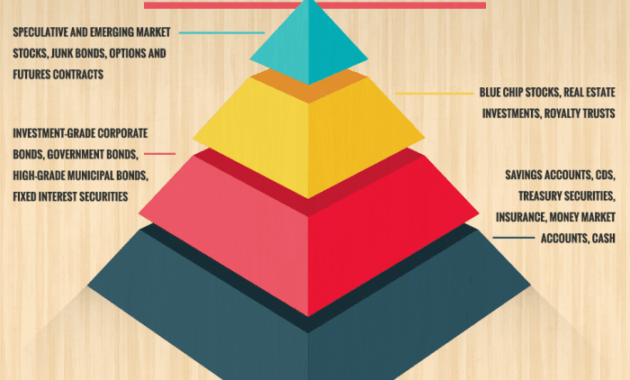

Asset Class Diversification, Reducing stock market risk with diversification

Asset class diversification involves spreading investments across different asset classes such as stocks, bonds, real estate, and commodities. The main benefit of this strategy is that different asset classes tend to perform differently under various market conditions, reducing the overall risk in the portfolio. However, the drawback is that if one asset class underperforms, it may not be offset by the performance of another asset class. An example of successful implementation of asset class diversification is a portfolio that includes a mix of stocks, bonds, and real estate investment trusts (REITs).

Sector Diversification

Sector diversification involves investing in different sectors of the economy, such as technology, healthcare, consumer goods, and energy. By spreading investments across various sectors, investors can reduce the impact of sector-specific risks on their portfolios. The benefit of sector diversification is that it can help protect the portfolio from downturns in a particular sector. However, the drawback is that if the entire market experiences a downturn, sector diversification may not provide adequate protection. An example of successful sector diversification is a portfolio that includes investments in both technology and healthcare sectors.

Geographic Diversification

Geographic diversification involves investing in companies or assets located in different regions around the world. This strategy helps mitigate the risk of country-specific events impacting the portfolio. The benefit of geographic diversification is that it can reduce the impact of political instability, economic downturns, or natural disasters in any single country. However, the drawback is that currency fluctuations and regulatory changes in different countries can still affect the portfolio. An example of successful geographic diversification is a portfolio that includes investments in both developed and emerging markets.

Building a Diversified Portfolio

Building a diversified investment portfolio is essential for reducing risk and maximizing returns. By spreading your investments across different asset classes, you can minimize the impact of market fluctuations on your overall portfolio.

Steps to Build a Diversified Investment Portfolio

- Identify Your Investment Goals: Determine your financial goals, risk tolerance, and time horizon to establish a clear investment strategy.

- Asset Allocation: Allocate your investments across different asset classes such as stocks, bonds, real estate, and commodities to reduce risk.

- Diversify Within Asset Classes: Within each asset class, diversify further by investing in different industries, regions, and company sizes.

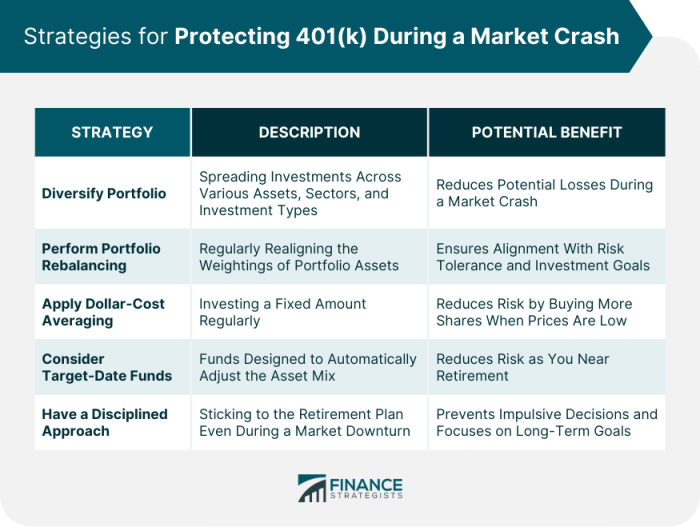

- Rebalance Regularly: Monitor your portfolio and rebalance it periodically to maintain the desired asset allocation.

Recommendations on Asset Allocation for Diversification

Asset allocation is a crucial component of building a diversified portfolio. Here are some recommendations:

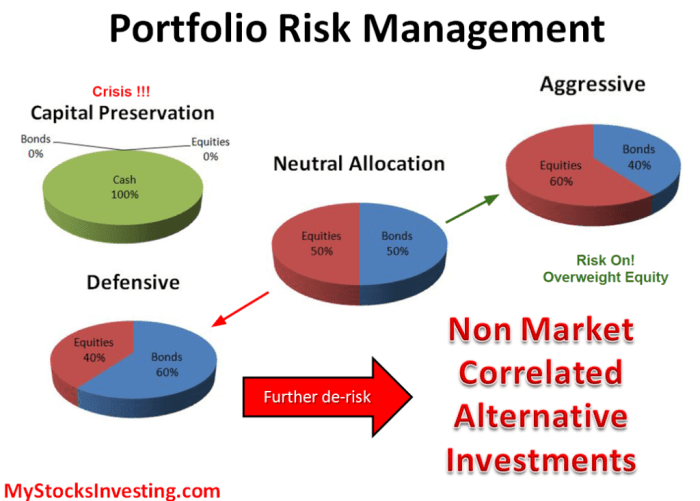

- Consider Your Risk Tolerance: Adjust your asset allocation based on your risk tolerance and investment goals.

- Use a Mix of Asset Classes: Allocate your investments across different asset classes to spread risk and maximize returns.

- Rebalance Periodically: Regularly review your portfolio and rebalance it to maintain the desired asset allocation.

How to Rebalance a Diversified Portfolio Over Time

Rebalancing a diversified portfolio involves adjusting the asset allocation to bring it back to the target weights. Here’s how you can do it:

- Set Rebalancing Thresholds: Determine the percentage deviations from the target allocation that would trigger a rebalance.

- Review Your Portfolio: Regularly review your portfolio to identify any deviations from the target asset allocation.

- Buy and Sell Assets: Buy or sell investments to bring your portfolio back to the desired asset allocation.

- Consider Tax Implications: Be mindful of tax consequences when rebalancing your portfolio to minimize any tax liabilities.

Monitoring and Adjusting Diversification

Maintaining a diversified portfolio is not a one-time task, but an ongoing process that requires constant monitoring and adjustments to ensure effectiveness in reducing stock market risk.

Methods to Monitor Diversification

- Regularly review the allocation of assets in your portfolio to ensure a balanced mix of different types of investments.

- Monitor correlations between asset classes to identify if certain investments are moving in the same direction.

- Track the performance of individual securities to see if any particular stock is dominating the portfolio.

When and How to Make Adjustments

- Adjustments should be made when the original asset allocation deviates significantly from the target mix due to market fluctuations.

- Rebalance the portfolio by selling overperforming assets and buying underperforming ones to restore the desired diversification.

- Consider changing the asset allocation based on your risk tolerance, investment goals, and market conditions.

Optimizing Diversification for Different Market Conditions

- In times of high market volatility, consider increasing diversification to spread risk across a wider range of assets.

- During periods of economic uncertainty, focus on safe-haven assets like bonds or gold to protect your portfolio.

- When the market is bullish, maintain diversification but also take advantage of growth opportunities in specific sectors.

Final Thoughts

In conclusion, diversification remains a key strategy for mitigating stock market risk, offering investors a way to safeguard their investments in an ever-changing market landscape.

When it comes to investing in the stock market, the importance of diversification in stock portfolios cannot be overstated. Diversifying your investments across different asset classes and industries can help reduce risk and protect your portfolio from market volatility. By spreading your investments, you can potentially increase your chances of earning consistent returns over the long term.

To learn more about the importance of diversification in stock portfolios , it’s crucial to understand how diversification works and how it can benefit your overall investment strategy.

When it comes to investing in the stock market, one key strategy that every investor should consider is the importance of diversification in stock portfolios. Diversifying your investments across different sectors and industries can help reduce risk and increase potential returns.

By spreading your investments across a variety of assets, you can protect your portfolio from market volatility and potentially maximize your long-term gains.