Protecting stock investments during a market crash involves understanding the risks, implementing effective strategies, and considering safe-haven assets. This comprehensive guide explores the key elements to safeguard your investments when the market is turbulent.

As we delve into the nuances of market crashes and risk management, you’ll gain valuable insights on how to navigate through challenging times and protect your portfolio from significant losses.

Understanding Market Crashes

When it comes to stock investments, understanding market crashes is crucial. A market crash refers to a sudden and severe drop in the overall market, leading to a significant decline in stock prices. This can have a devastating impact on investments, causing investors to incur substantial losses within a short period of time.

Common Causes of Market Crashes:

Common Causes, Protecting stock investments during a market crash

Market crashes can be triggered by various factors, such as economic downturns, geopolitical events, financial crises, or even investor panic. One of the common causes is a sudden shift in market sentiment due to unexpected news or events, leading to a rapid sell-off of stocks. Additionally, excessive speculation or overvaluation of stocks can create a bubble that eventually bursts, causing a market crash.

Historical Examples:

Historical Examples

One of the most infamous market crashes in history is the Great Depression of 1929, triggered by the stock market crash of October 1929. This event led to a prolonged period of economic hardship and a significant decline in stock prices. Another notable example is the Dot-Com Bubble burst in the early 2000s, where many technology stocks plummeted after reaching inflated prices.

It is essential for investors to be aware of the causes and effects of market crashes to protect their investments and make informed decisions during turbulent market conditions.

Risk Management Strategies

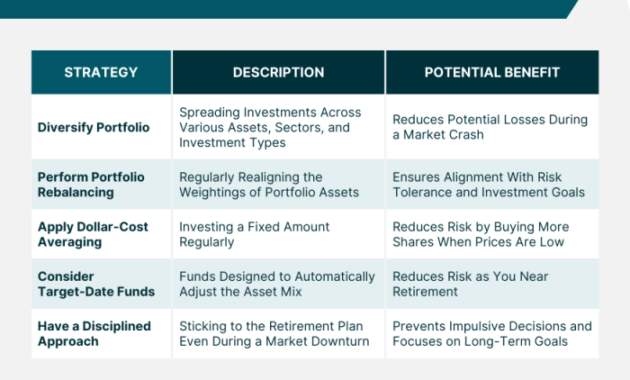

When it comes to protecting stock investments during a market crash, having effective risk management strategies in place is crucial. These strategies help investors minimize potential losses and navigate through turbulent market conditions with more confidence.

Diversification Techniques

Diversification is a key risk management technique that involves spreading investments across different asset classes, industries, and geographical regions. By diversifying your portfolio, you reduce the impact of a market crash on your overall investment value. This strategy helps to offset losses in one area with gains in another, providing a more balanced and stable investment approach.

- Investing in a mix of stocks, bonds, real estate, and other asset classes

- Allocating investments across various industries to reduce sector-specific risks

- Considering international investments to decrease exposure to domestic market fluctuations

Stop-Loss Orders and Risk Management Tools

Stop-loss orders are risk management tools that automatically sell a security when it reaches a predetermined price, helping investors limit potential losses. Setting stop-loss orders can protect your investments during a market crash by allowing you to exit positions before experiencing significant declines. Additionally, other risk management tools such as options contracts and hedging strategies can provide further protection against market downturns.

Setting stop-loss orders can help investors maintain discipline and avoid emotional decision-making during volatile market conditions.

Asset Allocation and Rebalancing

Asset allocation involves dividing your investments among different asset classes based on your risk tolerance, investment goals, and time horizon. By spreading your investments across a mix of assets, you can reduce the impact of market volatility on your portfolio. Regularly rebalancing your portfolio to maintain target asset allocations ensures that you stay aligned with your investment objectives and risk tolerance levels.

- Reviewing and adjusting asset allocations periodically to reflect changing market conditions

- Selling overperforming assets and buying underperforming assets to maintain desired allocations

- Rebalancing can help investors stay on track with their long-term investment strategies and manage risk effectively

Safe-Haven Investments

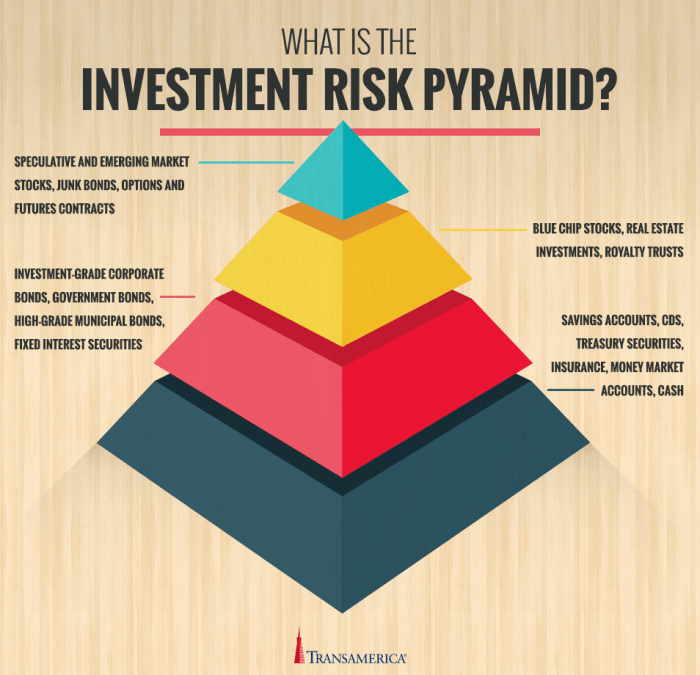

In times of market crashes, investors often seek refuge in safe-haven assets to protect their investments from the volatility of the stock market. These assets are known for their stability and ability to retain or increase in value during turbulent times.

Gold

Gold has long been considered a safe-haven asset due to its intrinsic value and reputation as a store of wealth. During market downturns, the price of gold typically rises as investors flock to this precious metal as a hedge against economic uncertainty. One of the key advantages of investing in gold is its historical track record of preserving wealth over the long term. However, gold prices can be volatile in the short term, and investors may face challenges related to storage and liquidity.

US Treasury Bonds

US Treasury bonds are another popular safe-haven asset that investors turn to during market crashes. These government-issued securities are backed by the full faith and credit of the US government, making them relatively low-risk investments. During times of market turmoil, investors often flock to Treasury bonds, driving up prices and lowering yields. One of the main advantages of holding Treasury bonds is their stability and guaranteed returns. However, in a low-interest-rate environment, the potential for capital appreciation may be limited.

Cash

Cash is often considered the ultimate safe-haven asset as it provides liquidity and stability during market downturns. Holding cash allows investors to weather the storm and take advantage of investment opportunities when markets stabilize. One of the key benefits of holding cash is the ability to quickly deploy funds when needed. However, the downside of holding cash is the risk of inflation eroding its purchasing power over time.

Real Estate

Real estate is also considered a safe-haven asset by some investors due to its tangible nature and potential for long-term appreciation. During market crashes, real estate prices may remain relatively stable compared to stocks, providing a buffer against market volatility. Investing in real estate can offer diversification benefits and a potential source of passive income. However, owning real estate comes with its own set of risks, such as property market fluctuations and maintenance costs.

Psychological Aspects of Investing: Protecting Stock Investments During A Market Crash

Investing in the stock market is not just about numbers and charts; it also involves the psychological aspect of handling emotions during turbulent times like market crashes. Emotions such as fear, greed, and panic can significantly influence investment decisions and lead to irrational behavior.

Emotional Influence on Investment Decisions

- During a market crash, fear can cause investors to panic and sell their investments at a loss, instead of staying calm and riding out the storm.

- Greed may lead investors to take on excessive risks in the hope of higher returns, which can backfire during market downturns.

- Panic selling is a common reaction to market crashes, driven by the fear of losing money, resulting in significant losses for investors.

Tips for Staying Rational During Market Crashes

- Focus on the long-term goals of your investments and avoid making impulsive decisions based on short-term market fluctuations.

- Have a well-defined investment strategy in place and stick to it, even when the market is experiencing volatility.

- Avoid checking your investment portfolio too frequently during market downturns to prevent emotional reactions to temporary fluctuations.

Role of Behavioral Finance in Understanding Investor Behavior

Behavioral finance studies how psychological biases and emotions influence financial decision-making. Understanding behavioral finance can help investors recognize their own biases and emotions, enabling them to make more rational investment decisions during turbulent market conditions.

Final Review

In conclusion, safeguarding your stock investments during a market crash requires a combination of knowledge, preparedness, and a strategic approach. By diversifying your portfolio, utilizing risk management tools, and considering safe-haven assets, you can better weather the storm and emerge stronger in the aftermath.

When it comes to investing, it’s important to look for stocks with the best long-term growth potential. These stocks have strong fundamentals and a track record of consistent performance, making them ideal for investors looking to build wealth over time.

By focusing on companies that have a history of growth and a solid business model, investors can increase their chances of seeing significant returns on their investments. To learn more about stocks with the best long-term growth potential, check out this article.

When it comes to investing, it’s crucial to look for stocks with the best long-term growth potential. These stocks have the ability to generate consistent returns over time, making them a valuable addition to any investment portfolio. By analyzing market trends and company performance, investors can identify opportunities for growth and capitalize on them.

To learn more about stocks with the best long-term growth potential, check out this informative article: Stocks with the best long-term growth potential.