Position sizing in Forex trading takes center stage, beckoning traders into a world of crucial risk management strategies. By understanding the nuances of position sizing, traders can optimize their trading outcomes and achieve long-term success in the Forex market.

Exploring various methods, calculations, and strategies, this guide delves into the intricacies of position sizing to equip traders with the knowledge needed to navigate the volatile world of Forex trading effectively.

Overview of Position Sizing in Forex Trading

Position sizing in Forex trading refers to the process of determining the size of a position based on the amount of capital you are willing to risk on a trade. It is a crucial aspect of risk management in trading as it helps traders control their exposure to potential losses. By properly sizing their positions, traders can protect their capital and increase their chances of long-term success in the Forex market.

Importance of Position Sizing for Risk Management

Position sizing plays a vital role in managing risk in Forex trading. By determining the appropriate position size for each trade, traders can limit the impact of potential losses on their overall account balance. For example, if a trader risks too much on a single trade, a series of losing trades could wipe out their entire account. On the other hand, if a trader uses proper position sizing techniques, they can protect their capital and stay in the game even during periods of drawdown.

- Position sizing helps traders maintain consistency in their risk exposure across different trades.

- Proper position sizing reduces the likelihood of emotional decision-making based on the size of potential profits or losses.

- It allows traders to set stop-loss levels effectively based on their risk tolerance and the volatility of the market.

Impact of Position Sizing on Trading Outcomes

The size of your positions can heavily influence the outcomes of your trades. For instance, using a position size that is too small may limit your profit potential, while using a position size that is too large could expose you to significant losses. Proper position sizing can help traders achieve a balance between risk and reward, enhancing their chances of long-term profitability in the Forex market.

- Optimal position sizing can help maximize profits during winning trades while minimizing losses during losing trades.

- It allows traders to diversify their risk exposure across multiple trades, reducing the impact of individual losses on their overall account balance.

- By incorporating position sizing strategies, traders can create a systematic approach to managing risk and maintaining discipline in their trading activities.

Methods of Position Sizing

Position sizing in Forex trading can be approached using various methods, each aiming to manage risk and optimize returns based on different strategies and risk tolerance levels. Let’s explore some of the common methods used for position sizing and compare their effectiveness for different trading styles.

Fixed Fractional Position Sizing

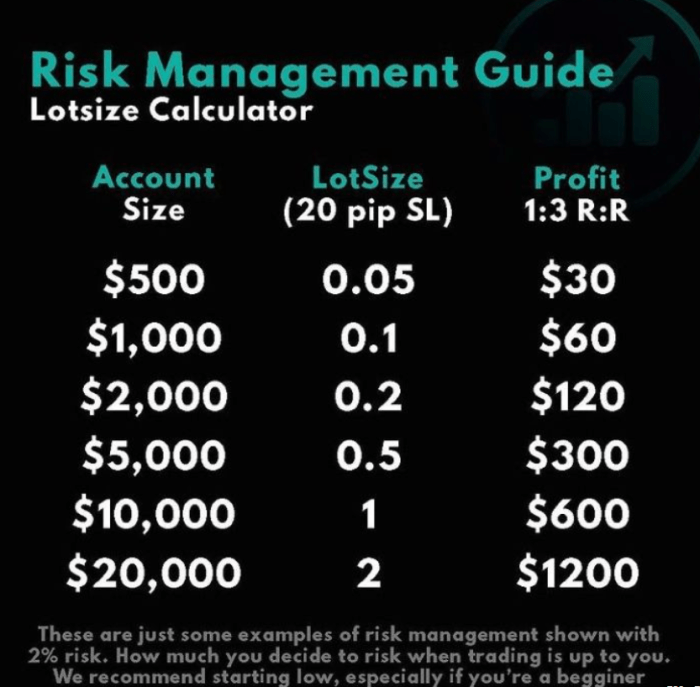

Fixed fractional position sizing involves risking a set percentage of your trading account on each trade. For example, if you decide to risk 2% of your account on each trade, the position size would be adjusted based on the size of your account. This method helps to ensure consistent risk management and can be suitable for traders looking to protect their capital while still allowing for potential growth.

Percentage Risk Position Sizing, Position sizing in Forex trading

Percentage risk position sizing is similar to fixed fractional position sizing but focuses on risking a specific percentage of the total account equity on each trade. For instance, if you decide to risk 3% of your total equity on a trade, the position size would be calculated accordingly. This method allows for dynamic adjustments based on the changing size of the trading account.

Volatility-Based Position Sizing

Volatility-based position sizing takes into account the volatility of the currency pair being traded. Traders using this method adjust their position sizes based on the market’s current volatility levels. For example, during high volatility periods, traders may reduce their position sizes to account for increased risk. This method aims to adapt to market conditions and reduce the impact of sudden price movements on the trading account.

Overall, each position sizing method has its advantages and considerations. Fixed fractional position sizing provides consistency and helps protect capital, while percentage risk position sizing allows for dynamic adjustments based on account size. On the other hand, volatility-based position sizing aims to adapt to changing market conditions. Traders should consider their risk tolerance, trading style, and market conditions when selecting the most suitable position sizing method for their Forex trading strategy.

Calculating Position Size

Determining the appropriate position size in Forex trading is crucial for managing risk and maximizing potential profits. This involves careful calculations based on various factors such as risk tolerance, account size, stop-loss level, and pip value.

Factors to Consider

- Risk Percentage: Determine the percentage of your trading account that you are willing to risk on a single trade. This is typically recommended to be between 1-2% to protect your capital.

- Stop-Loss Level: Define the price level at which you will exit a losing trade to limit your losses. This level is crucial in calculating the position size.

- Pip Value: Understand the value of each pip movement in the currency pair you are trading. This value varies depending on the size of the position and the currency pair.

Step-by-Step Examples

- Example 1: Let’s say you have a $10,000 trading account and are willing to risk 1% on a trade with a 50 pip stop-loss. The pip value for the EUR/USD pair is $10. To calculate the position size, you would use the formula:

Position Size = (Account Size * Risk Percentage) / (Stop-Loss in Pips * Pip Value)

Plugging in the values:

Position Size = ($10,000 * 0.01) / (50 * $10) = $10 / $500 = 0.02 lots - Example 2: If you have a $5,000 account and want to risk 2% on a trade with a 30 pip stop-loss in the GBP/JPY pair with a pip value of $12, the calculation would be:

Position Size = ($5,000 * 0.02) / (30 * $12) = $100 / $360 = 0.2777 lots (round to 0.28 lots)

This calculation helps you determine the appropriate position size based on your risk tolerance and account size for each trade scenario.

Position Sizing Strategies: Position Sizing In Forex Trading

Position sizing strategies are crucial in forex trading as they help traders manage risk and maximize potential returns. Let’s explore some popular position sizing strategies used by traders, along with their advantages and disadvantages.

Kelly Criterion

The Kelly Criterion is a position sizing strategy that aims to maximize returns based on the probability of success and the size of the trading account. It calculates the optimal position size by considering the edge of the trade and the risk-reward ratio. One of the main advantages of the Kelly Criterion is its focus on maximizing returns while managing risk effectively. However, one disadvantage is that it can lead to aggressive position sizes that may not be suitable for all traders.

Fixed Ratio

The Fixed Ratio position sizing strategy involves adjusting the position size based on the performance of the trading account. For example, a trader may increase the position size after a series of winning trades and decrease it after a series of losing trades. This strategy helps to capitalize on winning streaks while minimizing losses during losing streaks. The advantage of the Fixed Ratio strategy is its dynamic nature that adapts to market conditions. However, a potential disadvantage is that it may lead to increased drawdowns during losing streaks.

Choosing the Right Strategy

When selecting a position sizing strategy, traders should consider their individual trading goals and risk appetite. Traders with a higher risk tolerance may opt for more aggressive strategies like the Kelly Criterion, while those with a conservative approach may prefer the Fixed Ratio strategy. It is essential to test different position sizing strategies and determine which one aligns best with your trading style and risk management principles.

Summary

In conclusion, mastering position sizing in Forex trading is essential for any trader looking to mitigate risks and enhance profitability. By implementing the right position sizing strategies, traders can pave the way for a successful trading journey filled with informed decisions and calculated risks.

When it comes to forex trading, understanding the most traded currency pairs is essential for investors. The Most traded currency pairs like EUR/USD, USD/JPY, and GBP/USD are known for their high liquidity and tight spreads, making them popular choices among traders.

These pairs offer ample opportunities for profit due to their frequent market movements and high trading volumes. By keeping an eye on these currency pairs, traders can capitalize on market trends and make informed trading decisions.

When it comes to forex trading, understanding the most traded currency pairs is essential. Major pairs like EUR/USD, USD/JPY, and GBP/USD dominate the market due to their liquidity and volatility. Traders often focus on these pairs for optimal trading opportunities and lower spreads.

Keeping an eye on these pairs can help traders make informed decisions and navigate the forex market effectively.