Navigating the complexities of mergers and acquisitions effectively requires a strategic approach that encompasses due diligence, negotiation, integration, and post-merger evaluation. From meticulously assessing the target company’s value to navigating the intricate dance of legal and financial considerations, the M&A journey is fraught with potential pitfalls and unexpected challenges. This deep dive explores the key phases of successful M&A, offering insights and strategies to help you steer clear of common mistakes and achieve optimal outcomes.

This article will dissect each stage of the M&A process, providing practical advice and real-world examples. We’ll examine the crucial role of due diligence in mitigating risks, the art of effective negotiation to secure favorable terms, the challenges of integrating disparate corporate cultures, and the importance of establishing clear KPIs for post-merger success. By understanding the nuances of each phase, businesses can significantly increase their chances of a smooth and profitable merger or acquisition.

Due Diligence and Valuation: Navigating The Complexities Of Mergers And Acquisitions Effectively

Navigating the complex world of mergers and acquisitions (M&A) requires a meticulous approach, and none is more critical than due diligence and valuation. These processes are intertwined, with a thorough understanding of the target company’s financials, legal standing, and operational efficiency directly impacting its valuation. A flawed valuation can lead to disastrous consequences, while insufficient due diligence can expose the acquiring company to unforeseen liabilities and risks.

Stages of Due Diligence

Due diligence is a systematic investigation of a target company before a merger or acquisition. It’s not a single event, but a multi-stage process that aims to verify the information provided by the seller and uncover any potential problems. The process typically unfolds in several phases. Initially, a preliminary review assesses the target’s basic financials and strategic fit with the acquirer.

This is followed by a more in-depth investigation, focusing on specific areas like financial statements, legal compliance, intellectual property, and operational efficiency. A detailed review of contracts, customer relationships, and regulatory compliance then follows. Finally, a final report summarizes the findings and makes recommendations for the acquisition. Each stage relies heavily on the previous one, building a comprehensive picture of the target’s health and potential.

Negotiation and Deal Structuring

Navigating the complexities of mergers and acquisitions (M&A) requires a keen understanding of negotiation and deal structuring. This phase determines the ultimate success or failure of the transaction, impacting not only financial outcomes but also the long-term integration of the merging entities. Effective negotiation hinges on strategic planning, a thorough understanding of the deal’s intricacies, and a skilled legal team.

Effective Negotiation Strategies

Securing favorable terms in an M&A deal demands a multi-faceted approach. Preparation is paramount. This involves comprehensive due diligence, a clear understanding of the target company’s value, and a well-defined set of objectives. Experienced negotiators often employ strategies such as principled negotiation, focusing on interests rather than positions, to reach mutually beneficial agreements. For example, instead of fixating on a specific purchase price, negotiators might focus on achieving a return on investment that aligns with both parties’ expectations.

Another effective strategy involves leveraging alternative options, demonstrating a willingness to walk away if necessary. This strengthens the negotiating position and can lead to more favorable concessions. Finally, building rapport and trust with the counterparty can foster collaboration and facilitate a smoother negotiation process. This includes open communication and a willingness to compromise on less critical aspects of the deal.

Deal Structures and Tax Implications

The choice of deal structure significantly impacts the tax implications for both the buyer and the seller. Different structures have varying levels of complexity and potential liabilities.

| Deal Structure | Description | Tax Implications (Buyer) | Tax Implications (Seller) |

|---|---|---|---|

| Stock Purchase | Buyer acquires all outstanding shares of the target company. | Generally, a step-up in basis for the assets, allowing for increased depreciation deductions. May be subject to corporate tax on any future profits. | Capital gains tax on the sale of shares, potentially at a higher rate than other structures. |

| Asset Purchase | Buyer acquires specific assets of the target company. | Buyer can allocate the purchase price to individual assets, influencing depreciation and amortization deductions. May result in lower tax burden. | Seller may face a mix of capital gains and ordinary income tax depending on the type of assets sold. |

| Merger | Target company is absorbed by the acquiring company, ceasing to exist as a separate legal entity. | Generally, a step-up in basis for the assets, similar to a stock purchase. | Shareholders of the target company receive shares in the acquiring company, potentially triggering capital gains tax. |

The Role of Legal Counsel in Deal Structuring, Navigating the complexities of mergers and acquisitions effectively

Legal counsel plays a crucial role in protecting the interests of all parties involved in an M&A transaction. They review and negotiate the terms of the agreement, ensuring compliance with all applicable laws and regulations. Experienced M&A lawyers help identify and mitigate potential risks, advise on the optimal deal structure, and draft comprehensive legal documentation to protect their client’s interests.

They also ensure that all necessary approvals and regulatory filings are obtained. For example, legal counsel can help navigate antitrust issues, ensuring compliance with competition laws. Furthermore, they help manage the risk of undisclosed liabilities by conducting thorough due diligence and incorporating appropriate warranties and indemnities into the deal structure.

Negotiating Key Deal Terms

Negotiating key terms such as price, payment method, and closing conditions requires a strategic and methodical approach. The price is often determined through valuation analysis, but negotiation may involve adjustments based on market conditions, synergies, and other factors. Payment methods can range from cash to stock, each with different tax and financial implications. Closing conditions, such as the satisfaction of due diligence requirements or regulatory approvals, are crucial for ensuring a smooth and successful transaction.

For instance, a common closing condition is the successful completion of a financial audit of the target company. Thorough negotiation of these terms safeguards both parties’ interests and reduces the likelihood of disputes arising after the deal closes. Failure to properly address these aspects can lead to significant financial and legal complications later.

Integration Planning and Execution

Successfully navigating a merger or acquisition hinges not just on securing the deal, but on seamlessly integrating the acquired entity into the acquiring company. This phase, often overlooked, is crucial for realizing the anticipated synergies and achieving long-term success. Effective integration planning requires a multifaceted approach, addressing cultural differences, IT systems, employee retention, and communication strategies.

Navigating the complexities of mergers and acquisitions effectively requires meticulous planning. A crucial aspect involves understanding and overcoming common challenges in the strategic business planning process, which is expertly detailed in this insightful guide: overcoming common challenges in strategic business planning process. By addressing these hurdles proactively, businesses can significantly improve their chances of a successful and seamless integration, ultimately maximizing the value of the merger or acquisition.

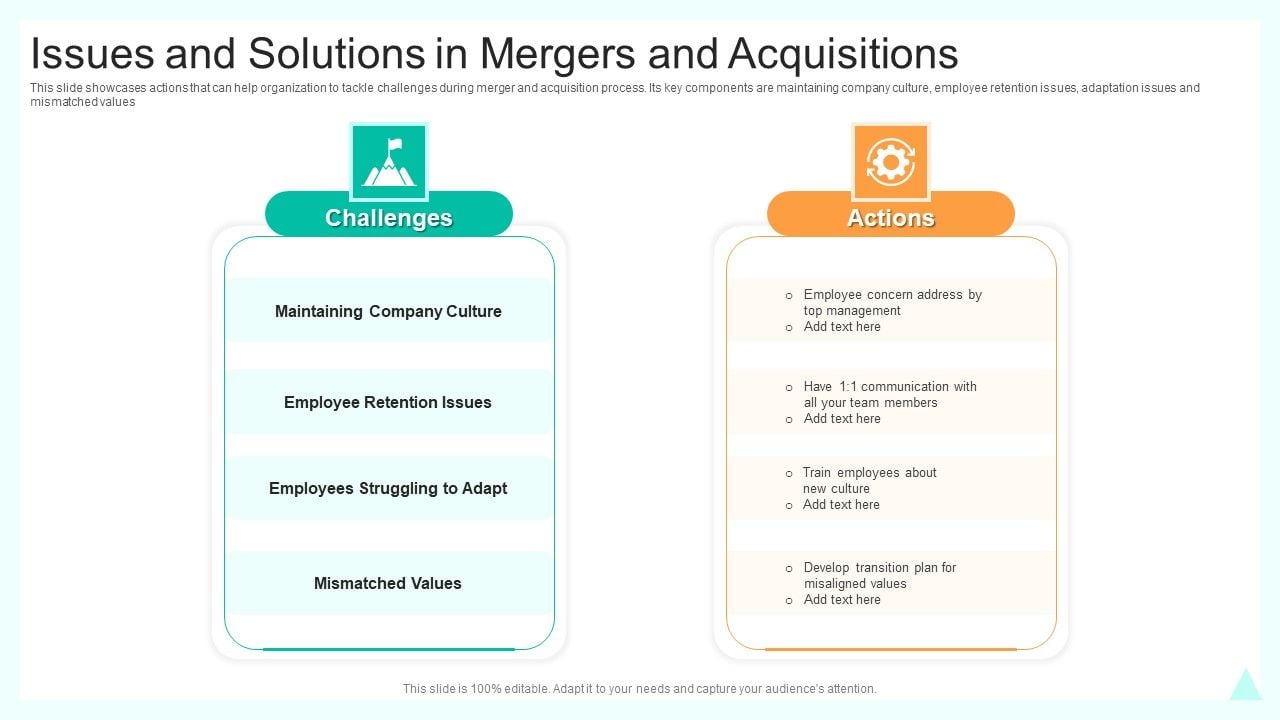

Potential Challenges and Solutions in Integrating Corporate Cultures

Merging two distinct corporate cultures can be a significant hurdle. Differences in communication styles, decision-making processes, and organizational values can lead to conflict, decreased productivity, and employee attrition. A proactive approach is vital. Pre-merger cultural assessments can identify potential friction points. Establishing clear communication channels and fostering open dialogue are crucial.

Successfully navigating the complexities of mergers and acquisitions often hinges on a clear post-merger strategy. A crucial element of this involves robust marketing to integrate brands and reach new customer bases, which is why understanding how to developing a successful marketing plan for small business growth is vital. This ensures a smooth transition and maximizes the value of the combined entity, ultimately contributing to the overall success of the merger or acquisition.

Creating a shared vision and values statement that incorporates elements from both cultures can build a sense of unity. Cross-functional teams composed of members from both organizations can facilitate collaboration and knowledge sharing. Leadership training programs focused on inclusive leadership and conflict resolution can equip managers to effectively navigate cultural differences. For example, a tech startup acquired by a large, established corporation might find differences in communication style (fast-paced vs.

formal) and decision-making processes (agile vs. hierarchical). Addressing these differences through clear communication guidelines and joint training programs can bridge the gap.

Step-by-Step IT System Integration Plan

A well-defined plan is essential for integrating IT systems to minimize operational disruption. This process often involves a phased approach. Phase 1: Assessment – Conduct a thorough assessment of both companies’ IT infrastructure, applications, and data security protocols. Phase 2: Prioritization – Prioritize critical systems and applications based on business impact. Phase 3: Migration Planning – Develop a detailed migration plan, outlining timelines, resources, and potential risks.

Phase 4: System Integration – Implement the migration plan, ensuring data integrity and minimal downtime. Phase 5: Testing and Validation – Thoroughly test integrated systems to identify and resolve any issues. Phase 6: Post-Integration Support – Provide ongoing support to address any lingering problems. For instance, migrating customer relationship management (CRM) systems requires careful planning to ensure data consistency and avoid loss of customer information.

A phased approach allows for testing and refinement, reducing the risk of major disruptions.

Strategies for Retaining Key Employees

Losing key employees during and after integration can significantly impact the success of the merger. Open and transparent communication about the integration process is paramount. Employees need to understand the rationale behind the merger and their role in the new organization. Providing opportunities for career development and advancement within the combined entity can incentivize retention. Offering competitive compensation and benefits packages is also crucial.

For example, offering retention bonuses or stock options to key employees can demonstrate commitment and provide a financial incentive to stay. Furthermore, engaging employees through town hall meetings and surveys allows for feedback and address concerns proactively. A well-structured integration plan, focusing on employee engagement and clear communication, can help to mitigate employee turnover.

Best Practices for Effective Communication and Change Management

Effective communication is the cornerstone of successful integration. Establishing clear communication channels and utilizing multiple communication methods (e.g., town hall meetings, emails, intranet) ensures that all stakeholders are informed. Developing a comprehensive change management plan helps to anticipate and address employee concerns. This plan should include strategies for addressing resistance to change, providing training and support, and celebrating successes.

Regular feedback mechanisms, such as surveys and focus groups, allow for identifying and addressing issues promptly. Transparency and consistent communication build trust and foster a sense of shared purpose. For instance, a regular newsletter providing updates on the integration progress and addressing employee questions can build confidence and reduce uncertainty. A structured approach to change management, combined with consistent and transparent communication, can significantly improve the integration process.

Post-Merger Performance and Evaluation

Successfully navigating a merger or acquisition isn’t just about closing the deal; it’s about realizing the envisioned synergies and achieving the strategic objectives that drove the decision in the first place. Post-merger performance evaluation is crucial for determining whether the integration process was effective and whether the expected value was created. This involves meticulously tracking key performance indicators (KPIs) against pre-defined goals and making necessary adjustments along the way.Measuring the success of a merger or acquisition requires a multifaceted approach.

It’s not simply about looking at the bottom line; it’s about understanding whether the integration process has created value across various aspects of the combined entity. This includes assessing financial performance, operational efficiency, market share, employee satisfaction, and customer retention, all in relation to the initial projections and strategic goals. A robust evaluation framework allows for timely identification of areas needing improvement and informed decision-making.

Measuring Success with KPIs

Post-merger success hinges on accurately measuring progress against pre-determined KPIs. These should be establishedbefore* the merger, aligning with the strategic objectives. Examples include revenue growth, cost synergies achieved, market share increase, employee retention rates, and customer satisfaction scores. Regular monitoring and reporting against these KPIs are vital, allowing for early detection of potential problems and enabling proactive interventions.

For instance, if projected cost synergies aren’t materializing, a detailed analysis can reveal bottlenecks and facilitate corrective actions. Similarly, a decline in customer satisfaction might indicate integration challenges requiring immediate attention. Regular comparison of actual performance with projected performance will reveal the true value generated by the merger.

Essential Post-Merger Activities Checklist

A structured approach to post-merger integration is critical for minimizing disruption and maximizing value creation. The following checklist Artikels key activities:

Effective communication is paramount throughout the integration process. Transparency builds trust and minimizes uncertainty among employees from both organizations. This involves regular updates, town hall meetings, and open forums to address concerns and maintain morale.

- Develop a detailed integration plan: This plan should Artikel specific tasks, timelines, and responsibilities for each team involved.

- Establish clear communication channels: Open communication is key to ensuring a smooth transition.

- Implement robust change management strategies: Address employee concerns and manage resistance to change.

- Conduct regular performance reviews: Track progress against KPIs and identify areas needing improvement.

- Maintain a strong focus on customer retention: Ensure a seamless experience for customers during and after the integration.

Common Post-Merger Pitfalls and Proactive Solutions

Several common pitfalls can derail even the most well-planned mergers and acquisitions. Proactive planning and mitigation strategies are crucial.

Ignoring cultural differences can lead to conflict and decreased productivity. A thorough cultural assessment before the merger, followed by integration strategies that address these differences, is essential.

- Underestimating cultural differences: Develop strategies to bridge cultural gaps and foster a unified corporate culture.

- Poor communication: Establish clear communication channels and keep employees informed throughout the process.

- Lack of integration planning: Develop a comprehensive integration plan that addresses all aspects of the merger.

- Ignoring employee concerns: Actively address employee concerns and manage resistance to change.

- Overlooking IT integration challenges: Plan for potential IT integration issues and allocate sufficient resources.

Case Studies: Successful and Unsuccessful M&A Integrations

Analyzing both successful and unsuccessful mergers provides valuable lessons. A successful integration, like the merger of Disney and Pixar, demonstrated the importance of maintaining creative autonomy while leveraging synergies in distribution and marketing. Conversely, the AOL-Time Warner merger serves as a cautionary tale, highlighting the dangers of overpaying and underestimating the challenges of integrating vastly different corporate cultures and business models.

The key difference often lies in meticulous pre-merger planning, effective communication, and a strong focus on creating a unified and productive organizational culture.

Risk Management in M&A

Mergers and acquisitions (M&A) are inherently risky endeavors. The complexity of integrating two distinct organizations, navigating legal and regulatory landscapes, and managing financial expectations creates a high-stakes environment where careful planning and proactive risk mitigation are paramount to success. Failing to adequately address potential pitfalls can lead to significant financial losses, reputational damage, and even the complete failure of the transaction.

A robust risk management strategy is therefore crucial for navigating the M&A process effectively.

Types of Risks in M&A

Mergers and acquisitions expose businesses to a wide array of risks that can be broadly categorized into financial, legal, operational, and cultural dimensions. Financial risks encompass issues like debt financing, valuation discrepancies, and post-merger integration costs exceeding projections. Legal risks involve antitrust concerns, intellectual property disputes, and compliance with relevant regulations. Operational risks center on the disruption of business processes, technology integration challenges, and the loss of key employees.

Finally, cultural clashes between merging entities, differing management styles, and difficulties in integrating corporate cultures can significantly impact the success of the merger. A thorough understanding of these risk categories is essential for developing a comprehensive risk management plan.

Identifying and Mitigating Potential Risks

Effective risk identification involves a multi-faceted approach. Due diligence, a critical phase of the M&A process, plays a vital role in uncovering potential problems. This involves detailed financial audits, legal reviews, and operational assessments of the target company. Furthermore, engaging experienced advisors, including legal counsel, financial experts, and industry consultants, provides valuable insights and helps anticipate potential challenges.

Mitigating risks requires proactive strategies, such as developing contingency plans, establishing clear communication channels, and securing appropriate insurance coverage. For example, a detailed integration plan can minimize operational disruptions, while thorough legal review can help avoid costly litigation.

Developing a Comprehensive Risk Management Plan

A comprehensive risk management plan should be a dynamic document that evolves throughout the M&A lifecycle. It should clearly define potential risks, assign ownership for mitigation strategies, establish timelines for risk assessment and response, and Artikel procedures for escalation and reporting. Regular monitoring and review of the plan are crucial to ensure its effectiveness. The plan should also incorporate mechanisms for tracking key performance indicators (KPIs) related to the integration process, allowing for early identification of potential issues and enabling timely corrective actions.

For instance, regular performance reviews of key integration milestones can alert management to potential problems before they escalate.

Regulatory Hurdles and Compliance Issues

Navigating the regulatory landscape is a significant challenge in M&A. Potential regulatory hurdles include antitrust reviews, which scrutinize the impact of the merger on competition; foreign investment regulations, particularly for cross-border transactions; and data privacy compliance, especially concerning the handling of sensitive customer information. Failure to comply with these regulations can result in substantial fines, delays in closing the deal, and even the termination of the transaction.

Therefore, securing legal advice specializing in M&A and regulatory compliance is crucial to ensure smooth navigation of this complex area. For example, a thorough review of antitrust regulations in relevant jurisdictions is necessary before proceeding with a merger.