Most traded currency pairs open the doors to the world of forex trading, showcasing the dynamic interplay of currencies on a global scale. Get ready to dive into the exciting realm of currency pairs and trading volumes, where fortunes are made and lost in the blink of an eye.

Currency pairs serve as the foundation of the forex market, with their values fluctuating based on a myriad of factors. Understanding the nuances of major, minor, and exotic currency pairs is essential for any trader looking to navigate the turbulent waters of international finance.

Overview of Most Traded Currency Pairs

Currency pairs are the quotation of two different currencies in the foreign exchange market, representing the exchange rate between the two. The first currency in the pair is the base currency, while the second is the quote currency. For example, in the EUR/USD pair, the euro is the base currency and the US dollar is the quote currency.

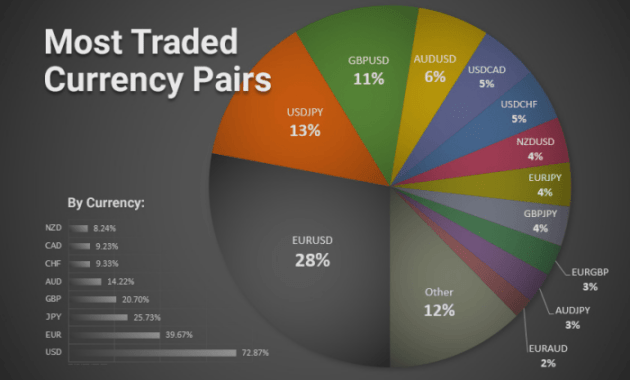

The trading volume of currency pairs is a crucial factor in determining the most traded pairs in the forex market. Higher trading volume indicates greater liquidity, making it easier to buy and sell the currencies. The most traded currency pairs are typically the ones with the highest trading volume, as they offer more opportunities for traders to enter and exit positions quickly.

Currency pairs in the foreign exchange market are quoted using a bid/ask price. The bid price is the highest price that a buyer is willing to pay for the currency pair, while the ask price is the lowest price that a seller is willing to accept. The difference between the bid and ask price is known as the spread, which represents the transaction cost for trading the currency pair.

Major Currency Pairs

When it comes to the forex market, major currency pairs play a crucial role in trading. These pairs are the most liquid and widely traded currencies in the world, making them popular among traders of all levels.

List of Major Currency Pairs

- Euro/US Dollar (EUR/USD)

- US Dollar/Japanese Yen (USD/JPY)

- British Pound/US Dollar (GBP/USD)

- Australian Dollar/US Dollar (AUD/USD)

- US Dollar/Canadian Dollar (USD/CAD)

- US Dollar/Swiss Franc (USD/CHF)

Characteristics of Major Currency Pairs, Most traded currency pairs

Major currency pairs typically include currencies from some of the world’s largest economies, such as the United States, Eurozone, Japan, and the United Kingdom. These pairs are highly liquid, meaning there is a high volume of trading activity, leading to tighter bid-ask spreads. As a result, major currency pairs tend to have lower transaction costs compared to minor currency pairs.

Comparison of Liquidity

Major currency pairs are known for their high liquidity, which means that traders can easily enter and exit positions without significant price fluctuations. This makes major pairs more attractive to traders looking for quick and efficient trades. In contrast, minor currency pairs may have lower liquidity, leading to wider spreads and potentially higher transaction costs for traders.

Factors Influencing Trading Volume

Trading volume of specific currency pairs is influenced by a variety of factors, ranging from economic indicators to geopolitical events. Understanding these factors is crucial for traders looking to navigate the foreign exchange market effectively.

Economic Indicators Impact

- Economic indicators such as GDP growth, inflation rates, and employment data play a significant role in influencing trading activity. Positive economic data typically leads to increased demand for the currency, driving up trading volume.

- Central bank announcements regarding interest rates and monetary policy decisions can also impact currency pairs. Traders closely monitor these announcements for clues about future economic conditions.

- Trade balance and current account data can influence the strength of a country’s currency and subsequently impact trading volume. A country with a strong trade surplus is likely to see increased demand for its currency.

Geopolitical Events Impact

- Geopolitical events such as elections, conflicts, and trade disputes can create uncertainty in the market and lead to fluctuations in trading volume. Traders often react to geopolitical developments by adjusting their positions in currency pairs.

- Political stability and geopolitical risk are important considerations for traders when assessing currency pairs. Countries with stable political environments tend to attract more trading activity compared to those facing political turmoil.

- Global events such as natural disasters or pandemics can also impact currency pairs by affecting investor sentiment and risk appetite. These events can lead to shifts in trading volume as market participants adjust their strategies accordingly.

Exotic Currency Pairs: Most Traded Currency Pairs

Exotic currency pairs are currency pairs that consist of one major currency and one currency from a developing or emerging market. These pairs are not as commonly traded as major or minor currency pairs, and they typically have lower liquidity and higher spreads in the forex market.

Comparison with Major and Minor Currency Pairs

Exotic currency pairs differ from major currency pairs, such as EUR/USD or USD/JPY, in terms of liquidity and trading volume. Major currency pairs are the most liquid and widely traded pairs in the forex market, making them less volatile and more predictable. On the other hand, exotic currency pairs have lower liquidity, which can lead to wider spreads and increased price fluctuations.

Compared to minor currency pairs, exotic currency pairs are also less liquid and have higher spreads. Minor currency pairs consist of currencies from smaller economies, but they are still more actively traded than exotic pairs. Traders who are looking for more volatility and potential opportunities may turn to exotic currency pairs, but they should be aware of the risks involved.

Risks and Opportunities

Trading exotic currency pairs can offer both risks and opportunities for forex traders. The lower liquidity of exotic pairs can result in wider spreads, which may increase trading costs. Additionally, the higher volatility of exotic pairs can lead to unpredictable price movements, making them riskier to trade.

On the other hand, the higher volatility of exotic currency pairs can also present opportunities for traders to profit from sharp price movements. Some traders may find exotic pairs appealing due to the potential for larger profits, especially if they are able to accurately predict market movements.

Overall, trading exotic currency pairs requires careful consideration of the risks involved and a solid understanding of the market dynamics. Traders should be prepared for increased volatility and potentially higher trading costs when trading exotic pairs in the forex market.

Last Word

Exploring the realm of forex trading and currency pairs unveils a world of endless possibilities and risks. From major currency pairs dominating the market to exotic pairs offering unique opportunities, the landscape is ever-evolving. Keep a keen eye on the trends and factors influencing trading volumes to stay ahead of the game in the fast-paced world of forex.