Managing leverage in Forex is a critical aspect of trading that can either boost profits or lead to significant losses. In this comprehensive guide, we will explore the various strategies, risks, and psychological impacts associated with leverage in the forex market.

Understanding how leverage works and the importance of managing it effectively is crucial for any forex trader looking to navigate the complexities of the financial markets.

Understanding Leverage in Forex

When it comes to forex trading, leverage plays a crucial role in amplifying both potential gains and losses. Understanding how leverage works is essential for traders to manage their risk effectively.

Defining Leverage in Forex Trading

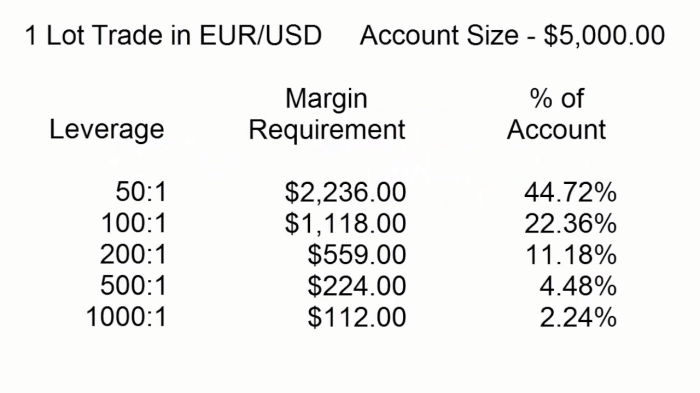

In forex trading, leverage allows traders to control a larger position size with a smaller amount of capital. For example, with a leverage of 1:100, a trader can control a position worth $100,000 with only $1,000 in their trading account.

When it comes to trading in the forex market, understanding how to read forex charts is essential. These charts provide valuable insights into price movements and trends, helping traders make informed decisions. By analyzing different indicators and patterns on these charts, traders can predict potential future price movements.

If you’re new to forex trading, learning how to read forex charts is a crucial skill that can greatly enhance your trading success. Check out this detailed guide on How to read Forex charts to start mastering this important aspect of trading.

Amplifying Gains and Losses

- Leverage magnifies the potential profits that traders can make on successful trades. For instance, a 1% price movement with 1:100 leverage can result in a 100% return on investment.

- However, it is important to note that leverage also amplifies losses. A small price movement in the opposite direction can lead to significant losses, especially when using high leverage ratios.

Importance of Managing Leverage

Effective management of leverage is crucial in forex trading to control risk and protect capital. Traders should use leverage responsibly, consider their risk tolerance, and implement risk management strategies to avoid excessive losses.

When it comes to navigating the complex world of Forex trading, understanding how to read Forex charts is essential. These charts provide valuable insights into market trends and price movements, helping traders make informed decisions. By learning how to interpret different indicators and patterns on these charts, traders can gain a competitive edge in the market.

To master this skill, check out this detailed guide on How to read Forex charts and start enhancing your trading strategy today.

Risks Associated with High Leverage: Managing Leverage In Forex

High leverage in forex trading can amplify both potential gains and losses, making it a double-edged sword for traders. While leverage can magnify profits during successful trades, it also significantly increases the risk of losses. Here are some key risks associated with using high leverage in forex trading:

Potential Risks of Using High Leverage

- Increased Volatility: High leverage can expose traders to higher levels of market volatility, leading to rapid and significant price fluctuations that can result in substantial losses.

- Margin Calls: One of the most significant risks of high leverage is the potential for margin calls. When trades move against a trader, and their account balance falls below the required margin level, brokers may issue a margin call, requiring additional funds to maintain the position.

- Overleveraging: Using excessive leverage can lead to overtrading and taking on larger positions than a trader’s account can handle. This can result in a faster depletion of the account balance and increased exposure to market risks.

How High Leverage Can Lead to Margin Calls

- Margin calls occur when a trader’s account balance falls below the required margin level to support their open positions. High leverage magnifies the impact of market movements on account balances, increasing the likelihood of margin calls during adverse price fluctuations.

- Traders using high leverage may find themselves in a situation where a small price movement against their position results in a significant loss, pushing their account balance below the required margin level and triggering a margin call from the broker.

- Margin calls can force traders to either close positions at a loss or deposit additional funds to meet margin requirements, potentially leading to further losses and financial strain.

Impact of Leverage on Account Balance During Volatile Market Conditions

- During volatile market conditions, high leverage can exacerbate the impact of price movements on a trader’s account balance. Sharp and unpredictable price swings can quickly wipe out gains or lead to substantial losses, especially when using high levels of leverage.

- Traders with high leverage may experience rapid account depletion during volatile periods, as small price fluctuations can result in significant changes to their account balance. It is essential for traders to carefully manage leverage and risk exposure to navigate through turbulent market conditions effectively.

Strategies for Managing Leverage

Effective management of leverage is crucial in Forex trading to minimize risks and maximize potential profits. Let’s explore different techniques for managing leverage effectively.

Position Sizing for Leverage Control

Position sizing is a key strategy for controlling leverage in Forex trading. By determining the size of each position based on your account size and risk tolerance, you can effectively manage leverage. This involves calculating the appropriate position size to ensure that a potential loss does not exceed a certain percentage of your trading account.

- Calculate position size based on risk percentage: Determine the percentage of your account that you are willing to risk on a single trade. This will help you adjust your position size accordingly to control leverage.

- Use stop-loss orders: Set stop-loss orders to limit potential losses on each trade. This helps in managing risk and preventing excessive leverage.

By implementing proper position sizing techniques, traders can effectively control leverage and minimize the impact of potential losses on their trading accounts.

Leverage Ratio and Risk Management

The leverage ratio is a crucial factor in risk management in Forex trading. It represents the proportion of a trader’s own capital to the borrowed capital from the broker. Understanding the significance of leverage ratio is essential for managing risks effectively.

- Impact of leverage ratio on risk: Higher leverage ratios amplify both profits and losses in trading. Traders with high leverage ratios are exposed to greater risks, as small market movements can lead to significant losses.

- Setting appropriate leverage levels: It is important to choose leverage levels that align with your risk tolerance and trading strategy. Lower leverage ratios are often recommended for novice traders to avoid excessive risks.

By carefully monitoring and adjusting leverage ratios, traders can maintain better risk management practices and safeguard their trading capital.

Setting Leverage Limits

Setting leverage limits is a crucial aspect of risk management in Forex trading. Traders need to determine the appropriate level of leverage based on their risk tolerance and overall trading strategy. This helps in protecting their capital and avoiding significant losses in volatile market conditions.

Adjusting Leverage According to Market Conditions

- During periods of high market volatility, traders may consider reducing their leverage to minimize the risk of substantial losses. This cautious approach can help in safeguarding capital in turbulent market environments.

- Conversely, in stable market conditions with lower volatility, traders might opt to increase their leverage to capitalize on potential opportunities for higher profits. This strategic adjustment allows traders to optimize their trading positions based on market dynamics.

Importance of Regularly Reviewing and Adjusting Leverage Limits

Regularly reviewing and adjusting leverage limits is essential to adapt to changing market conditions and ensure effective risk management. By regularly assessing their risk tolerance and market volatility, traders can make informed decisions regarding their leverage levels to protect their capital and maximize profitability.

Impact of Leverage on Trading Psychology

Leverage plays a significant role in shaping the psychological aspect of traders’ decision-making processes. The ability to amplify gains with leverage can lead to a heightened sense of confidence, but it can also magnify losses, triggering fear and anxiety. Understanding how leverage affects trading psychology is crucial for maintaining emotional discipline in the forex market.

Influence on Traders’ Emotions and Decision-making

When traders utilize high leverage, they may experience increased emotional intensity during trading activities. The potential for quick profits or substantial losses can evoke feelings of greed, fear, and impulsiveness, impacting their decision-making process. It is essential for traders to remain rational and avoid making impulsive decisions driven by emotions when managing leverage.

Psychological Effects on Risk Appetite

The availability of leverage can influence traders’ risk appetite by creating a false sense of security or invincibility. Traders may be tempted to take on more significant positions than they can handle, leading to excessive risk-taking behavior. This can result in substantial losses if the market moves against their positions. It is crucial for traders to assess their risk tolerance and avoid over-leveraging to maintain a healthy risk appetite.

Tips for Maintaining Emotional Discipline, Managing leverage in Forex

- Establish clear risk management strategies before entering trades to limit potential losses and manage leverage effectively.

- Practice mindfulness and self-awareness to recognize and control emotional responses to market fluctuations.

- Avoid chasing losses or becoming overconfident after a string of successful trades by sticking to a well-defined trading plan.

- Take breaks and step away from the screen to prevent emotional decision-making during periods of heightened volatility.

- Seek support from mentors or trading communities to share experiences and learn from others’ strategies for managing leverage and emotions in trading.

Concluding Remarks

In conclusion, mastering the art of managing leverage in Forex is key to achieving long-term success in trading. By implementing the right strategies, setting appropriate limits, and maintaining emotional discipline, traders can mitigate risks and enhance their overall performance in the dynamic forex market.