International stocks for diversification sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a hint of originality from the outset. Diving into the world of international stocks can open up a realm of opportunities and possibilities for investors looking to expand their horizons.

Importance of International Stocks for Diversification

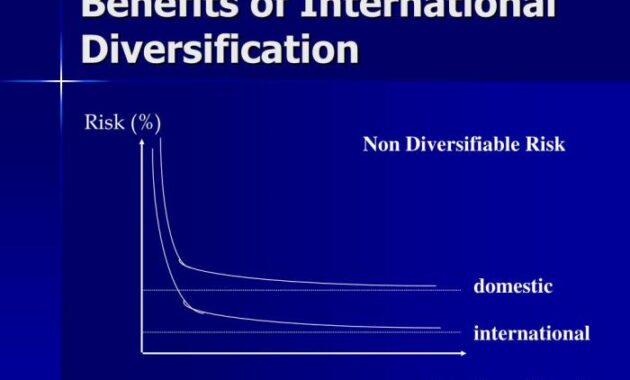

Investing in international stocks plays a crucial role in diversifying an investment portfolio. By spreading investments across different asset classes, sectors, and geographical regions, investors can reduce the overall risk and volatility in their portfolios. International stocks offer unique benefits that domestic stocks may not provide, making them essential for a well-rounded investment strategy.

Reducing Risk Through Diversification

Diversification is key to minimizing risk in an investment portfolio. By investing in international stocks along with domestic stocks, investors can reduce their exposure to country-specific risks, economic downturns, or political instability that may impact a single market. For example, if the U.S. stock market experiences a downturn, having international stocks can help offset the losses and maintain portfolio stability.

Exposure to Different Economies and Industries

International stocks offer exposure to a wide range of economies and industries that may not be available in the domestic market. By investing in companies from emerging markets or sectors that are thriving overseas, investors can benefit from growth opportunities that are not present in their home country. This diversification allows investors to participate in the global economy and capitalize on trends that may not be prevalent locally.

Benefits of Including International Stocks

Including international stocks in a diversified portfolio provides several advantages. Firstly, it enhances portfolio diversification by spreading risk across different markets and currencies. Secondly, it offers the potential for higher returns by tapping into growing economies and industries abroad. Lastly, international stocks can act as a hedge against domestic market downturns, providing a buffer against volatility and economic uncertainties.

Factors to Consider When Choosing International Stocks

When selecting international stocks for diversification, investors should take into account various factors that can impact their investment decisions. These factors range from currency fluctuations to geopolitical events that can influence the performance of international stocks. It is crucial to have a clear understanding of these factors to make informed investment choices.

Currency Fluctuations

Currency fluctuations play a significant role in the performance of international stocks. When investing in stocks denominated in foreign currencies, changes in exchange rates can affect the value of investments. A strong or weak currency can impact returns for investors, making it essential to consider currency risk when selecting international stocks.

Geopolitical Events

Geopolitical events such as political instability, trade wars, or conflicts can have a direct impact on international stock markets. These events can create volatility and uncertainty, affecting the performance of stocks in different regions. Investors need to stay informed about geopolitical developments and consider how these events may influence their international investments.

Mitigating Risks

To mitigate risks associated with investing in international stocks, investors can employ various strategies. Diversification across different countries and industries can help spread risk and reduce exposure to specific market events. Utilizing hedging techniques or investing in multinational companies with global operations can also help manage risks associated with currency fluctuations and geopolitical events.

Popular International Stock Markets: International Stocks For Diversification

When it comes to investing in international stocks, there are several popular stock markets that investors can consider. Each market has its own unique characteristics and performance, making it important for investors to understand the differences before making investment decisions.

Comparison of Performance

- The New York Stock Exchange (NYSE): The NYSE is one of the largest and most well-known stock exchanges in the world, with a long history of strong performance and stability.

- The Tokyo Stock Exchange (TSE): The TSE is the largest stock exchange in Japan and plays a crucial role in the Asian financial market.

- The London Stock Exchange (LSE): The LSE is one of the oldest stock exchanges in the world and serves as a key hub for European stock trading.

Regulatory Differences, International stocks for diversification

- The regulatory environment can vary significantly between international stock markets, with different rules and requirements governing investor protection and market transparency.

- Investors should be aware of the regulatory differences in each market to ensure compliance and mitigate risks associated with investing in foreign markets.

Liquidity and Trading Volumes

- Liquidity and trading volumes can vary widely between international stock exchanges, impacting the ease of buying and selling securities.

- Investors should consider the liquidity of a market before investing, as higher liquidity typically results in tighter bid-ask spreads and lower trading costs.

Building a Diversified Portfolio with International Stocks

When it comes to building a diversified portfolio, incorporating international stocks is essential to reduce risk and enhance potential returns. International stocks can provide exposure to different economies, industries, and currencies, offering investors a way to spread their risk across various markets.

Steps to Effectively Incorporate International Stocks into a Diversified Portfolio

- Conduct thorough research on international markets and companies to understand the opportunities and risks involved.

- Determine the ideal allocation percentage for international stocks based on your risk tolerance, investment goals, and time horizon.

- Select a mix of individual international stocks or consider investing in international mutual funds or exchange-traded funds (ETFs) for diversification.

- Regularly monitor the performance of your international holdings and rebalance your portfolio as needed to maintain your desired asset allocation.

Ideal Allocation Percentage for International Stocks in a Diversified Portfolio

Experts often recommend allocating between 10% to 30% of your portfolio to international stocks, depending on your risk appetite and investment objectives. A balanced approach that combines domestic and international investments can help spread risk and potentially enhance returns.

Examples of How International Stocks Can Complement Domestic Investments for Diversification

By adding international stocks to your portfolio, you can reduce the impact of domestic market fluctuations and benefit from growth opportunities in foreign markets. For example, investing in emerging markets can provide exposure to fast-growing economies and industries that may not be available in your home country.

Tips on Monitoring and Rebalancing an International Stock Portfolio

- Regularly review the performance of your international holdings and assess whether they align with your investment goals.

- Rebalance your portfolio by buying or selling international stocks to maintain your target asset allocation.

- Stay informed about global economic and political developments that could impact your international investments.

Closure

As we wrap up our exploration of international stocks for diversification, it’s clear that venturing into global markets can add a layer of complexity and depth to your investment strategy. By broadening your portfolio with international stocks, you not only spread risk but also tap into the growth potential of diverse economies.

When looking for investment opportunities, penny stocks with high potential can be an attractive option for investors. These stocks, which are priced below $5, have the potential for significant growth and can provide substantial returns. However, it’s important to conduct thorough research and due diligence before investing in penny stocks with high potential.

By analyzing market trends and company performance, investors can identify promising penny stocks that align with their investment goals. For more information on penny stocks with high potential, you can refer to this article.

When it comes to investing, many people are drawn to penny stocks due to their high potential for growth. However, it’s important to do thorough research before diving in. One great resource to learn more about penny stocks with high potential is this article that provides valuable insights and tips for investors.