Importance of volume in Forex trading sets the stage for understanding how volume influences price movements, trading decisions, and market trends in the Forex market. Dive into the realm of volume analysis and discover its crucial role in shaping trading strategies.

Importance of volume in Forex trading

Volume is a crucial factor in Forex trading as it represents the total number of contracts traded within a specified time frame. Understanding volume can provide valuable insights into market dynamics and help traders make informed decisions.

When it comes to trading, one of the most popular pairs is the EUR/USD. The EUR/USD volatility is known to attract both experienced and novice traders due to its dynamic nature. Traders closely monitor the fluctuations in this pair as it often presents profitable opportunities.

Understanding the factors that influence the volatility of EUR/USD is crucial for successful trading strategies.

Impact of volume on price movements

Volume plays a significant role in influencing price movements in the Forex market. High volume typically indicates strong market participation and can signal potential trend reversals or continuations. For example, a surge in trading volume during a price uptrend may indicate growing bullish momentum, while low volume could suggest a lack of interest and potential trend weakness.

When it comes to trading, understanding EUR/USD volatility is crucial. This currency pair is known for its high volatility, which offers both opportunities and risks for traders. By monitoring the volatility of EUR/USD, traders can make more informed decisions and adjust their strategies accordingly.

Keeping an eye on economic indicators and geopolitical events can help in predicting and managing this volatility effectively.

Significance of volume analysis in trading decisions, Importance of volume in Forex trading

- Volume analysis can help traders confirm the strength of a price trend. For instance, a breakout accompanied by high volume is more likely to be sustained compared to one with low volume.

- Volume analysis can also reveal potential market manipulation or insider trading activities. Unusual spikes in volume without corresponding price movements may indicate hidden motives behind market actions.

Examples of volume confirming or contradicting price trends

- Confirmation: A sharp increase in volume during a breakout above a key resistance level can validate the strength of the bullish move.

- Contradiction: A sudden drop in volume following a prolonged uptrend may signal weakening buyer interest and a potential trend reversal.

Factors influencing volume in Forex trading

When it comes to forex trading, the volume of trading plays a crucial role in determining market dynamics and price movements. Several factors can influence trading volume in the forex market, impacting market volatility and providing insights into market sentiment and trends.

Impact of High vs. Low Trading Volume on Market Volatility

High trading volume in the forex market typically indicates increased market activity and liquidity. This can lead to tighter spreads, faster order execution, and more accurate price movements. On the other hand, low trading volume may result in wider spreads, slower order execution, and increased price volatility due to fewer market participants. Traders often pay close attention to volume levels to gauge market volatility and adjust their trading strategies accordingly.

News Events and Economic Indicators Influence on Trading Volume

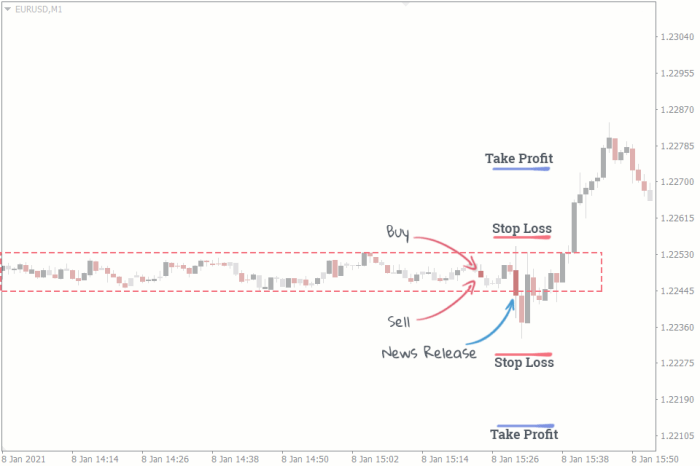

News events and economic indicators can significantly impact trading volume in the forex market. Major announcements such as central bank decisions, economic data releases, geopolitical events, and market sentiment can attract traders to the market, leading to spikes in trading volume. Traders closely monitor these events to capitalize on potential market movements driven by increased volume and volatility.

Volume as an Indicator of Market Sentiment and Trends

Volume can provide valuable insights into market sentiment and trends in the forex market. High trading volume accompanying a price movement indicates strong market interest and conviction, potentially signaling the continuation of a trend. Conversely, low trading volume during a price movement may suggest a lack of market participation and weaker conviction, raising concerns about the sustainability of the trend. Traders use volume analysis to confirm market trends, identify potential reversals, and make informed trading decisions.

Strategies for interpreting volume in Forex trading: Importance Of Volume In Forex Trading

When it comes to interpreting volume in Forex trading, traders rely on various strategies to gauge market sentiment and potential price movements. Analyzing volume data can provide valuable insights into the strength of a trend or the likelihood of a reversal.

Different methods for analyzing volume data

- Volume bars: Traders often look at the volume bars on a price chart to identify spikes in trading activity. A sudden increase in volume can indicate strong interest from market participants and signal a potential breakout or trend continuation.

- Volume indicators: Popular volume indicators like the Accumulation/Distribution Line, On-Balance Volume, and Chaikin Money Flow are used to analyze the relationship between price and volume. These indicators can help traders confirm the validity of a price move or identify potential divergences.

Examples of volume indicators commonly used by traders

- Accumulation/Distribution Line: This indicator evaluates the flow of money into or out of a security based on the close relative to the high and low for the period.

- On-Balance Volume (OBV): OBV measures buying and selling pressure by adding the volume on up days and subtracting it on down days. A rising OBV suggests accumulation, while a falling OBV indicates distribution.

How to interpret volume spikes and divergences for trading signals

- Volume spikes: A sudden increase in trading volume can signify a strong price move in the direction of the spike. Traders often look for volume confirmation to validate a breakout or trend reversal.

- Divergences: Divergences between price and volume can signal potential trend reversals. For example, if prices are rising but volume is decreasing, it may indicate weakening buying pressure and a possible trend change.

Role of volume in confirming or invalidating technical analysis patterns

- Confirmation: Volume can act as a confirming factor for technical analysis patterns such as chart patterns or trendlines. A breakout accompanied by high volume is considered more reliable than a breakout on low volume.

- Invalidation: Conversely, if a technical pattern forms but is not supported by significant volume, traders may be cautious about the validity of the pattern. Low volume can indicate a lack of conviction from market participants.

Final Conclusion

In conclusion, the discussion on the importance of volume in Forex trading sheds light on the vital role of volume analysis in understanding market dynamics and making informed trading decisions. Embrace the power of volume data to enhance your trading skills and stay ahead of the curve in the ever-evolving Forex market.