Delving into How to use stop-loss orders effectively, this introduction immerses readers in a unique and compelling narrative, with engaging and thought-provoking insights from the very first sentence.

Stop-loss orders are a crucial tool in trading, helping to manage risk and protect investments. Understanding how to use them effectively can make a significant difference in your trading success.

Understand stop-loss orders

A stop-loss order is a risk management tool used in trading to automatically sell a security when it reaches a certain price, helping to limit potential losses. This type of order is placed with a broker and is triggered once the security hits the specified stop price.

Are you interested in learning how to trade EUR/GBP? Understanding the intricacies of this currency pair can be a valuable skill for any trader. By following the link to How to trade EUR/GBP , you can gain insights into the factors that influence the exchange rate between the Euro and British Pound.

This resource covers various strategies and tips to help you navigate the market effectively.

Importance of stop-loss orders

Stop-loss orders are crucial in trading as they help traders protect their investments and manage risk effectively. By setting a stop-loss order, traders can minimize potential losses and prevent emotional decision-making during volatile market conditions.

When it comes to trading EUR/GBP, it’s crucial to understand the factors that influence the exchange rate between the Euro and British Pound. Traders need to keep an eye on economic indicators, political events, and central bank policies that can impact the currency pair.

By analyzing charts, using technical analysis tools, and staying updated on market news, traders can make informed decisions on when to buy or sell EUR/GBP. To learn more about how to trade EUR/GBP effectively, check out this comprehensive guide on How to trade EUR/GBP.

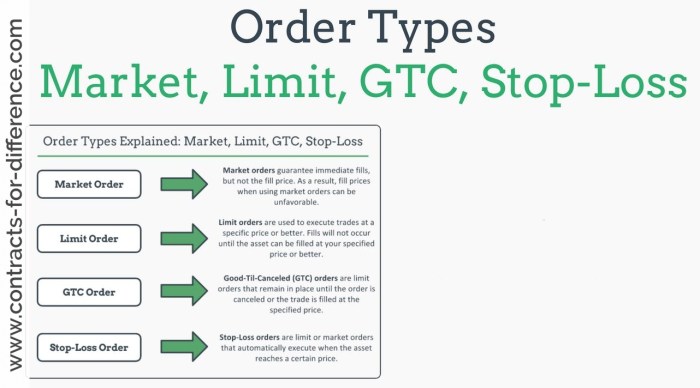

Types of stop-loss orders

- Market stop-loss order: This type of order is executed at the next available price once the stop price is reached, regardless of the actual market price.

- Limited stop-loss order: With this order, the security is sold once it reaches the stop price or a better price. However, there is no guarantee that the order will be executed if the price continues to fall.

- Trailing stop-loss order: This order is set based on a percentage or dollar amount below the market price. As the market price increases, the stop price also rises, helping to lock in profits while still protecting against losses.

Setting up stop-loss orders

Setting up stop-loss orders is a crucial step in managing risk when trading in the financial markets. By setting a stop-loss order, you can protect your investment from significant losses in case the market moves against your position. Below are the steps on how to set up a stop-loss order on a trading platform, tips on choosing the right stop-loss order price, and considerations when setting the stop-loss order distance from the entry price.

Steps to set up a stop-loss order, How to use stop-loss orders effectively

- Log in to your trading platform and locate the position you want to set a stop-loss order for.

- Find the option to add a stop-loss order to your position. This is usually located near the entry price of your trade.

- Enter the stop-loss price at which you want the order to trigger. This price should be based on your risk tolerance and market analysis.

- Double-check the order details and confirm the stop-loss order. Once confirmed, the order will be in place to protect your position.

Tips for choosing the right stop-loss order price

- Consider the level of volatility in the market. Higher volatility may require a wider stop-loss order to account for price fluctuations.

- Factor in your risk tolerance and trading strategy. A more aggressive strategy may use a tighter stop-loss order, while a conservative approach may use a wider stop-loss order.

- Avoid setting the stop-loss order too close to the entry price, as this could result in the order being triggered prematurely due to normal market fluctuations.

Considerations when setting the stop-loss order distance from the entry price

- Take into account the average daily price movement of the asset you are trading. Setting the stop-loss order beyond this range can help avoid premature triggering.

- Adjust the stop-loss order distance based on the timeframe of your trade. Short-term trades may require a tighter stop-loss order, while long-term trades may benefit from a wider stop-loss order.

- Monitor the market conditions and be prepared to adjust your stop-loss order if necessary. Market dynamics can change rapidly, impacting the effectiveness of your initial stop-loss order.

Adjusting stop-loss orders

Adjusting stop-loss orders is an important aspect of risk management in trading. Knowing when and how to adjust your stop-loss orders can help protect your investments and maximize profits. Let’s explore when it might be appropriate to adjust a stop-loss order and strategies for doing so effectively.

When to adjust a stop-loss order

It may be appropriate to adjust a stop-loss order when the market conditions have changed significantly since the order was initially placed. This could be due to unexpected news or events that impact the price movement of the asset. Additionally, if the price has moved significantly in your favor, you may consider adjusting your stop-loss order to lock in profits and reduce the risk of giving back gains.

- When there is a significant change in market conditions

- After a substantial price movement in your favor

Strategies for adjusting stop-loss orders

When adjusting stop-loss orders, it’s essential to have a clear plan in place. One strategy is to trail your stop-loss order behind the price as it moves in your favor, known as a trailing stop. This allows you to capture profits while still protecting against potential reversals. Another strategy is to adjust your stop-loss based on key support or resistance levels, ensuring that you are not stopped out prematurely.

- Implementing a trailing stop to lock in profits

- Adjusting stop-loss orders based on key support or resistance levels

Benefits of adjusting stop-loss orders

Adjusting stop-loss orders can be beneficial in various scenarios. For example, by tightening your stop-loss as the price moves in your favor, you can protect your profits and reduce the risk of losing gains. Additionally, adjusting your stop-loss based on changing market conditions can help you stay ahead of potential reversals and minimize losses.

- Protecting profits and reducing the risk of giving back gains

- Staying ahead of potential reversals in the market

Common mistakes to avoid: How To Use Stop-loss Orders Effectively

When it comes to using stop-loss orders effectively, there are some common mistakes that traders often make. By being aware of these pitfalls, you can improve your risk management and enhance your trading strategy.

Avoid setting stop-loss orders too close to the entry price

Setting stop-loss orders too close to the entry price can result in premature exits from trades. This often occurs when traders set their stop-loss orders based on arbitrary levels or without considering market volatility. To avoid this mistake, it is essential to conduct proper technical analysis and determine a reasonable distance from the entry price that accounts for potential price fluctuations.

- Avoid setting stop-loss orders at round numbers or psychological levels without considering market conditions.

- Take into account the average true range (ATR) or historical price movements to set stop-loss orders at levels that are statistically significant.

- Consider the specific characteristics of the asset being traded, such as volatility and liquidity, when determining the appropriate distance for stop-loss orders.

Avoid moving stop-loss orders further away from the entry point

One common mistake that traders make is moving their stop-loss orders further away from the entry point once a trade is in progress. This behavior is often driven by emotions like fear of missing out or hope that the trade will eventually turn profitable. However, moving stop-loss orders in this manner can increase the risk exposure and potentially lead to larger losses.

It is crucial to stick to your initial risk management plan and avoid making impulsive decisions to adjust stop-loss orders based on short-term market movements.

- Set a clear risk-reward ratio before entering a trade and adhere to it to prevent emotional decision-making.

- Regularly review your trading plan and make adjustments based on objective criteria rather than emotions.

- Consider using trailing stop-loss orders to lock in profits while allowing for potential upside in a trade.

Ending Remarks

In conclusion, mastering the art of using stop-loss orders effectively can lead to more strategic and profitable trading decisions. By following the right techniques and avoiding common mistakes, traders can enhance their overall trading performance.