Delving into How to use scalping in Forex, this introduction immerses readers in a unique and compelling narrative, with ahrefs author style that is both engaging and thought-provoking from the very first sentence.

Scalping in Forex trading involves quick trades to capitalize on small price movements, making it a popular strategy for active traders. In this guide, we will explore the key techniques and strategies for successful scalping in the Forex market.

Introduction to Scalping in Forex

Scalping in Forex refers to a trading strategy where traders aim to make small profits by entering and exiting trades quickly. This approach involves taking advantage of small price movements in the market.

When it comes to trading forex, choosing currency pairs with low spreads can make a significant difference in your profitability. Low spreads mean lower transaction costs, which can ultimately lead to higher returns. If you’re looking for some of the best currency pairs with low spreads, check out this comprehensive guide on Currency pairs with low spreads to help you make informed decisions in your trading endeavors.

Key Characteristics of Scalping

- Short-term trading: Scalping involves opening and closing trades within a short period, often minutes or even seconds.

- High frequency: Scalpers execute multiple trades throughout the trading session to capitalize on small price fluctuations.

- Tight stop-loss: Scalping requires setting tight stop-loss orders to minimize losses in case the trade moves against the trader.

- Focus on small gains: Scalpers aim for small profits per trade, relying on the cumulative effect of multiple trades to generate returns.

Benefits and Risks of Scalping

Scalping offers the advantage of quick profits and the potential for high trading activity. However, it also comes with certain risks:

- Benefits:

- Opportunity for quick profits

- Ability to capitalize on short-term price movements

- High trading activity can lead to increased opportunities

- Risks:

- High transaction costs due to frequent trading

- Increased susceptibility to market noise and slippage

- Requires strong risk management due to tight stop-loss orders

Effective Use of Scalping in Forex Trading

Scalping can be effective in the following scenarios:

- During periods of high market volatility

- When trading liquid currency pairs with tight spreads

- For traders who can devote time to monitor the market closely

Setting Up for Scalping

When it comes to setting up for scalping in Forex, there are several key factors to consider in order to optimize your trading strategy for success.

Necessary Tools and Resources, How to use scalping in Forex

- Fast and reliable internet connection: Since scalping relies on quick trades and reactions to market movements, having a stable internet connection is crucial to avoid delays.

- High-speed computer or laptop: A powerful device is essential for executing trades swiftly and efficiently.

- Scalping strategy: Develop and test a scalping strategy that suits your trading style and risk tolerance.

- Real-time news sources: Stay informed of economic events and market news that can impact currency prices.

Trading Platforms for Scalping

- MetaTrader 4 (MT4): A popular platform known for its user-friendly interface and customizable features, making it ideal for scalping.

- cTrader: Another platform favored by scalpers for its advanced charting tools and fast execution speeds.

- NinjaTrader: Offers advanced analysis tools and automated trading capabilities that can enhance scalping strategies.

Choosing the Right Currency Pairs

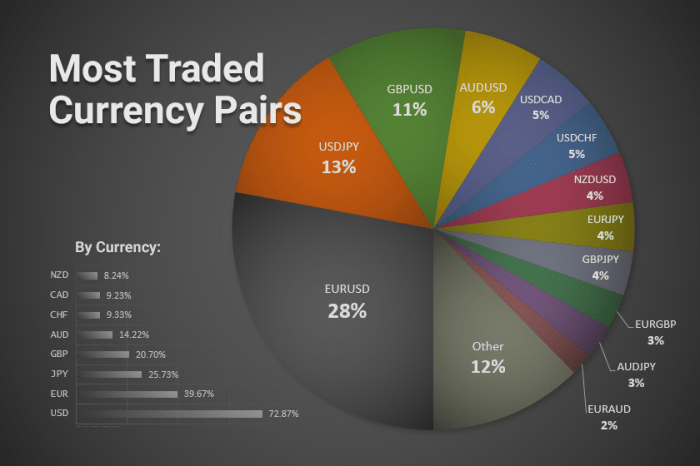

- Majors and minors: Focus on major currency pairs like EUR/USD, GBP/USD, and USD/JPY, which tend to have high liquidity and tighter spreads suitable for scalping.

- Avoid exotic pairs: Exotic currency pairs may have wider spreads and lower liquidity, making them riskier for scalping.

- Consider volatility: Choose currency pairs with moderate volatility to capitalize on price movements while minimizing risk.

Importance of Timing and Market Conditions

- Overlap of trading sessions: Scalping during overlapping sessions like the London-New York overlap can provide increased liquidity and trading opportunities.

- Avoid news releases: Price volatility during major economic announcements can be unpredictable and risky for scalping, so it’s best to avoid trading during these times.

- Monitor market conditions: Keep an eye on technical indicators and market trends to identify optimal entry and exit points for your scalping trades.

Scalping Techniques and Strategies

When it comes to scalping in Forex trading, there are several popular strategies that traders often employ to capitalize on short-term price movements. These strategies are designed to help traders identify entry and exit points quickly, manage risks effectively, and adapt to different market conditions.

Popular Scalping Strategies

- One-minute Scalping: This strategy involves making quick trades based on short-term price movements within a one-minute time frame.

- Support and Resistance Levels: Traders look for key support and resistance levels to enter and exit trades quickly.

- Scalping the News: Traders capitalize on market volatility around economic news releases by entering and exiting trades rapidly.

Identifying Entry and Exit Points

- Use technical indicators such as moving averages, RSI, and MACD to pinpoint potential entry and exit points.

- Look for price action signals like pin bars, engulfing patterns, and inside bars to confirm entry and exit points.

- Set strict profit targets and stop-loss orders to manage risk and protect your capital.

Risk Management Techniques

- Only risk a small percentage of your trading account on each trade to limit potential losses.

- Avoid over-leveraging your trades to prevent significant drawdowns in case of adverse price movements.

- Regularly review and adjust your risk management plan to ensure it aligns with your trading goals and risk tolerance.

Adapting to Different Market Conditions

- In a trending market, focus on trading in the direction of the trend to maximize profits.

- In a ranging market, look for key support and resistance levels to enter and exit trades swiftly.

- Stay informed about upcoming economic events and news releases to anticipate market volatility and adjust your strategy accordingly.

Practicing Scalping: How To Use Scalping In Forex

When it comes to practicing scalping in Forex, beginners should approach it with caution and patience. It is essential to start small and gradually increase trading size as you gain more experience and confidence in your scalping strategies. Here are some tips for beginners looking to practice scalping in a simulated environment:

Starting Small and Gradually Increasing Trading Size

- Begin by using a demo account to practice scalping without risking real money.

- Start with small trade sizes to minimize potential losses while you refine your scalping techniques.

- Gradually increase your trading size as you become more comfortable and consistent in your scalping approach.

Common Mistakes to Avoid

- Avoid overleveraging your trades, as this can lead to significant losses in a short period of time.

- Do not chase the market or enter trades based on emotions, as this can cloud your judgment and result in poor decision-making.

- Stay disciplined and stick to your trading plan, even if the market conditions are not favorable.

Importance of Discipline and Patience

- Scalping requires quick decision-making and the ability to react to market movements swiftly.

- Developing discipline and patience is crucial to avoid impulsive trading behavior and stick to your trading strategy.

- Practice risk management techniques to protect your capital and minimize losses while scalping.

Ending Remarks

In conclusion, mastering the art of scalping in Forex requires a combination of skill, strategy, and patience. By understanding the nuances of this trading approach and implementing effective techniques, traders can enhance their success in the fast-paced world of Forex.

When it comes to trading, finding currency pairs with low spreads can make a significant difference in your profits. Low spreads mean lower transaction costs, which can maximize your gains. By focusing on currency pairs with low spreads , you can potentially increase your trading opportunities and improve your overall performance in the forex market.