Delving into How to use Dai for DeFi lending, this introduction immerses readers in a unique and compelling narrative, with a focus on understanding Dai and DeFi lending, setting up wallets, acquiring Dai, and managing loans effectively.

Introduction to Dai and DeFi Lending: How To Use Dai For DeFi Lending

Dai is a stablecoin cryptocurrency that is pegged to the US dollar, providing stability in value compared to other cryptocurrencies that experience price volatility. It is created on the Ethereum blockchain through a system of smart contracts known as the Maker Protocol.

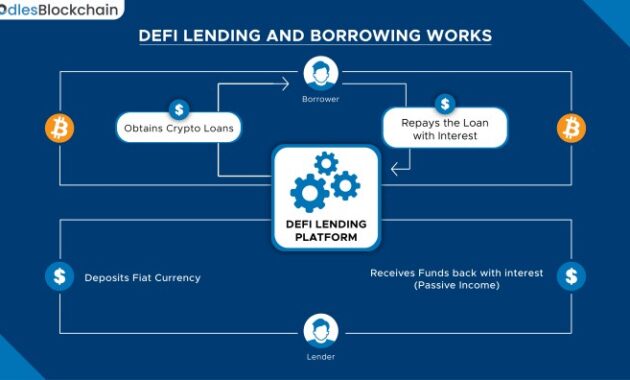

DeFi lending, or decentralized finance lending, refers to the process of lending and borrowing cryptocurrencies without the need for traditional financial intermediaries like banks. This allows users to earn interest on their crypto holdings or borrow assets directly from peers on decentralized platforms.

Dai: A Stablecoin for Stability

Dai stands out from other cryptocurrencies due to its stability, maintaining a value of approximately $1 USD through various mechanisms within the Maker Protocol. This stability makes Dai a reliable option for users looking to transact or hold assets without being exposed to the volatility of other digital currencies.

Benefits of DeFi Lending

- Decentralization: DeFi lending eliminates the need for intermediaries, giving users full control over their funds and transactions.

- Global Accessibility: Anyone with an internet connection can participate in DeFi lending, opening up financial opportunities to a wider audience.

- Lower Fees: Traditional financial institutions may charge high fees for lending services, while DeFi platforms often have lower costs due to automated processes.

- Transparency: Transactions on DeFi lending platforms are recorded on the blockchain, providing a transparent and immutable ledger of activities.

Setting up a wallet for Dai

Creating a wallet that supports Dai is essential for engaging in DeFi lending. This wallet will serve as your gateway to managing Dai transactions securely.

When setting up a wallet for Dai, it is crucial to prioritize security. Choose a wallet that offers robust security features, such as two-factor authentication and encryption, to safeguard your funds from potential threats.

Choosing a Secure Wallet

- Research and select a reputable wallet provider known for its security measures.

- Ensure the wallet supports Dai and other ERC-20 tokens for seamless transactions.

- Enable all available security features, such as biometric authentication or hardware wallet integration.

- Regularly update your wallet software to patch any vulnerabilities and protect against cyber attacks.

Acquiring Dai for DeFi lending

When it comes to acquiring Dai for DeFi lending, users have several options available to them. It is important to choose a reputable platform or exchange to ensure the safety of your transactions and holdings. Here are some tips on how to safely purchase Dai and transfer it to your wallet.

Platforms and Exchanges for Acquiring Dai

- One popular platform for acquiring Dai is decentralized exchanges like Uniswap or SushiSwap. These platforms allow users to swap other cryptocurrencies for Dai directly.

- Centralized exchanges such as Coinbase or Binance also offer Dai for purchase. Users can buy Dai using fiat currency or other cryptocurrencies on these exchanges.

- Dai can also be acquired through peer-to-peer platforms like LocalBitcoins or LocalCryptos, where users can buy Dai directly from other individuals.

Tips for Safely Purchasing and Transferring Dai

- Before purchasing Dai, ensure that you are using a secure and reputable platform to avoid any potential security risks.

- When transferring Dai to your wallet, double-check the wallet address to ensure that you are sending it to the correct destination.

- Consider using a hardware wallet for storing your Dai for an added layer of security.

- Monitor the transaction fees associated with acquiring and transferring Dai to optimize your costs.

- Stay informed about the latest developments in the cryptocurrency space to make informed decisions when acquiring Dai.

Understanding DeFi lending protocols

DeFi lending protocols are decentralized platforms that allow users to lend and borrow cryptocurrencies without the need for traditional financial intermediaries. When it comes to lending Dai in the DeFi space, there are several popular protocols that support this functionality. Let’s delve into some of them and explore the risks and rewards associated with participating in DeFi lending using Dai.

Popular DeFi lending protocols supporting Dai lending

- Compound: Compound is a decentralized lending platform that enables users to earn interest on their deposited assets, including Dai. Users can lend their Dai to borrowers and earn interest in return. However, it’s essential to note that the interest rates on Compound are variable and can fluctuate based on supply and demand.

- Aave: Aave is another DeFi lending protocol that supports Dai lending. Users can deposit their Dai into Aave’s lending pool and earn interest on their holdings. Aave also offers unique features like flash loans and collateralized borrowing, providing users with additional opportunities to interact with their Dai holdings.

Risks and rewards of participating in DeFi lending with Dai

- Risks:

- Smart contract risk: DeFi lending protocols are built on smart contracts, which are susceptible to vulnerabilities. In the event of a smart contract exploit, users could potentially lose their deposited funds.

- Market volatility: The cryptocurrency market is highly volatile, and the value of Dai can fluctuate. Users participating in DeFi lending with Dai are exposed to the risk of their holdings losing value.

- Rewards:

- High-interest rates: DeFi lending platforms often offer higher interest rates compared to traditional financial institutions. Users can earn substantial returns on their Dai holdings by participating in DeFi lending.

- Decentralization: DeFi lending protocols operate without central intermediaries, providing users with more control over their funds and financial activities.

Depositing Dai for lending

When it comes to DeFi lending, depositing Dai into a lending platform is a crucial step to start earning interest on your holdings. Here, we will detail the process of depositing Dai and provide insights on how to maximize returns by optimizing your deposits.

Depositing Dai into a DeFi lending platform

To deposit Dai into a DeFi lending platform, you first need to connect your wallet to the platform. Then, you can navigate to the deposit section and select the amount of Dai you wish to deposit. Follow the instructions provided by the platform to complete the deposit process. Once your Dai is successfully deposited, you will start earning interest on your holdings.

Maximizing returns by optimizing your Dai deposits

– Monitor interest rates: Keep an eye on the interest rates offered by different DeFi lending platforms and choose the one that offers the best returns for your Dai deposits.

– Diversify your deposits: Consider spreading your Dai deposits across multiple lending platforms to reduce risk and maximize your overall returns.

– Reinvest your earnings: Instead of withdrawing your interest earnings, consider reinvesting them back into your Dai deposits to compound your returns over time.

– Stay informed: Stay up to date with the latest developments in the DeFi space to make informed decisions about your Dai deposits and maximize your earnings.

Monitoring and managing Dai loans

Monitoring and managing Dai loans is crucial to ensure the profitability and safety of your investments in DeFi lending. By keeping a close eye on the performance of your loans and effectively managing them, you can minimize risks and maximize profits.

Strategies for monitoring the performance of your Dai loans, How to use Dai for DeFi lending

- Regularly check the interest rates offered on your Dai loans to ensure they are competitive and in line with market trends.

- Monitor the utilization rate of your loans to gauge demand for borrowing Dai and adjust your lending strategy accordingly.

- Keep track of the overall health of the DeFi lending platforms you are using to ensure the safety of your funds.

Managing your loans effectively to minimize risks and maximize profits

- Diversify your lending across multiple platforms to spread risk and avoid overexposure to any single platform.

- Set stop-loss limits to automatically liquidate your loans if they start underperforming or if the platform faces any issues.

- Reinvest your earned interest to compound your returns and maximize profitability over time.

Risks and security considerations

When using Dai for DeFi lending, it is essential to be aware of potential risks and security considerations to protect your funds and investments. By understanding these risks and implementing best practices, you can mitigate the chances of falling victim to vulnerabilities in the DeFi space.

Potential Risks

- Smart Contract Risks: DeFi lending platforms operate on smart contracts, which are susceptible to bugs and vulnerabilities. It is crucial to research and choose platforms with a strong track record of security audits to minimize the risk of smart contract exploits.

- Price Volatility: The value of Dai and other crypto assets can be highly volatile, leading to potential losses if the market experiences significant fluctuations. Diversifying your investments and using risk management strategies can help mitigate this risk.

- Counterparty Risks: When lending Dai on DeFi platforms, there is a risk that borrowers may default on their loans, resulting in a loss of funds for lenders. Conducting due diligence on borrowers and using platforms with robust collateralization requirements can reduce this risk.

Security Best Practices

- Secure Your Private Keys: Safeguard your private keys and never share them with anyone. Consider using hardware wallets or secure storage solutions to protect your funds from unauthorized access.

- Use Multi-Sig Wallets: Utilize multi-signature wallets to add an extra layer of security to your transactions. This requires multiple signatures to approve a transaction, reducing the risk of unauthorized transfers.

- Stay Informed: Keep abreast of the latest security threats and developments in the DeFi space. Join communities, forums, and follow reputable sources to stay informed about potential risks and security best practices.

Diversification and portfolio management

When it comes to DeFi lending, diversification of your portfolio beyond Dai is crucial for mitigating risks and maximizing returns. By spreading your investments across different assets, you can reduce the impact of any single asset underperforming or facing volatility.

Importance of Diversification

Diversification helps to protect your investment from the specific risks associated with a single asset. By including a variety of assets in your portfolio, you can balance out potential losses in one area with gains in another. This can lead to a more stable and profitable overall portfolio.

- Diversifying across different DeFi lending protocols helps spread the risk of smart contract vulnerabilities or platform failures.

- Including stablecoins, cryptocurrencies, and other digital assets in your portfolio can provide exposure to various market conditions and trends.

- Combining high-risk and low-risk assets can help achieve a balance between potential returns and security.

Managing a Diversified Portfolio

Once you have diversified your DeFi lending portfolio, it’s essential to have a strategy in place to manage it effectively. Here are some strategies for managing a diversified portfolio:

- Regular Rebalancing: Periodically review your portfolio and adjust the allocation of assets to maintain your desired risk level and investment objectives.

- Monitoring Performance: Keep track of how each asset in your portfolio is performing and make informed decisions based on market trends and changes.

- Stress Testing: Assess how your portfolio would fare under different market scenarios and adjust your holdings accordingly to strengthen its resilience.

- Risk Management: Implement risk management techniques such as setting stop-loss orders or using hedging strategies to protect your portfolio from potential downturns.

Wrap-Up

In conclusion, mastering the use of Dai for DeFi lending opens up a world of opportunities for investors in the decentralized finance space, offering both risks and rewards that need to be carefully navigated.

When looking at the top performing altcoins in 2024, it’s important to consider factors such as market trends, technological advancements, and overall adoption. One of the standout altcoins to keep an eye on is Ethereum, with its strong ecosystem and potential for growth.

Another promising altcoin is Cardano, known for its focus on security and scalability. For those seeking innovation, Solana is a popular choice due to its fast transaction speeds and low fees. To stay ahead in the cryptocurrency market, it’s crucial to stay informed about these top altcoins and their developments.

Learn more about the top performing altcoins in 2024 to make informed investment decisions.

When it comes to investing in the cryptocurrency market, keeping an eye on the top performing altcoins is crucial for maximizing your returns. In 2024, some altcoins have shown exceptional growth potential, making them worth considering for your portfolio. To find out more about the top performing altcoins in 2024, check out this comprehensive guide: Top performing altcoins in 2024.