How to use candlestick patterns in trading opens up a world of possibilities for traders looking to enhance their technical analysis skills. From identifying common patterns to incorporating them into trading strategies, this guide will delve into the intricacies of candlestick patterns and how they can influence trading decisions.

Whether you’re a novice trader or an experienced investor, mastering candlestick patterns can provide valuable insights into market trends and potential price movements. Let’s explore the fascinating world of candlestick patterns together.

Introduction to Candlestick Patterns

Candlestick patterns are a form of technical analysis used in trading to predict price movements based on past market behavior. Each candlestick represents a specific time period and provides valuable information about the open, high, low, and close prices of an asset.

When trading in a high volatility market, having a solid scalping strategy is crucial for success. By utilizing a scalping strategy for high volatility , traders can take advantage of quick price movements to make profits. This strategy involves making numerous small trades throughout the day to capitalize on short-term price fluctuations.

It requires discipline, quick decision-making, and the ability to react swiftly to market changes. With the right approach, scalping can be a profitable trading technique in high volatility conditions.

Understanding candlestick patterns is crucial for traders as they can help identify potential trend reversals, market indecision, or continuation patterns. By recognizing these patterns, traders can make more informed decisions about when to enter or exit a trade.

When trading in high volatility markets, having a solid scalping strategy is crucial for success. One effective strategy involves taking advantage of quick price movements to make small profits throughout the day. By carefully analyzing market trends and using technical indicators, traders can identify entry and exit points with precision.

To learn more about how to implement a scalping strategy for high volatility, check out this Scalping strategy for high volatility guide.

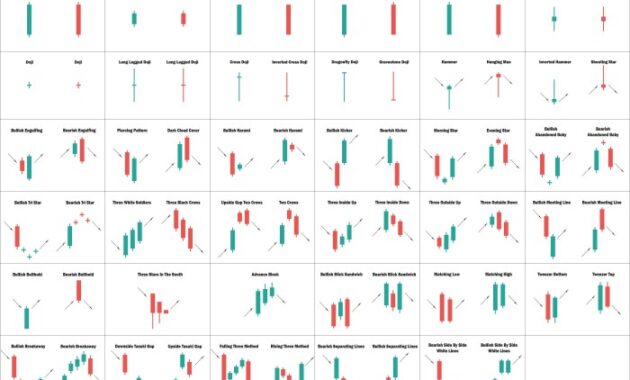

Common Candlestick Patterns, How to use candlestick patterns

- Doji: A doji candlestick has the same open and close price, indicating market indecision.

- Hammer: A hammer candlestick has a small body with a long lower wick, signaling a potential bullish reversal.

- Engulfing Pattern: An engulfing pattern occurs when a larger candlestick completely engulfs the previous one, suggesting a reversal in the prevailing trend.

- Dark Cloud Cover: This bearish reversal pattern consists of a large bullish candle followed by a bearish candle that opens above the previous close and closes below the midpoint of the first candle.

Types of Candlestick Patterns: How To Use Candlestick Patterns

Candlestick patterns can be broadly categorized into two main types: reversal patterns and continuation patterns. Reversal patterns indicate a potential change in the trend, while continuation patterns suggest that the current trend is likely to persist.

Bullish and Bearish Candlestick Patterns

- Bullish candlestick patterns are formations that indicate a potential upward movement in price. These patterns typically suggest buying opportunities.

- Bearish candlestick patterns, on the other hand, signal a potential downward movement in price. Traders may interpret these patterns as a signal to sell or short a particular asset.

Popular Candlestick Patterns and Their Implications

- Hammer: A bullish reversal pattern that indicates a potential trend reversal from bearish to bullish. It typically forms at the end of a downtrend.

- Doji: A neutral pattern that suggests indecision in the market. It can signal a potential reversal or continuation depending on the context.

- Engulfing Pattern: A two-candle reversal pattern where the second candle completely engulfs the body of the first candle. It can indicate a reversal of the current trend.

- Dark Cloud Cover: A bearish reversal pattern that forms after an uptrend. It consists of a bullish candle followed by a bearish candle that opens above the previous close and closes near or below the midpoint of the first candle.

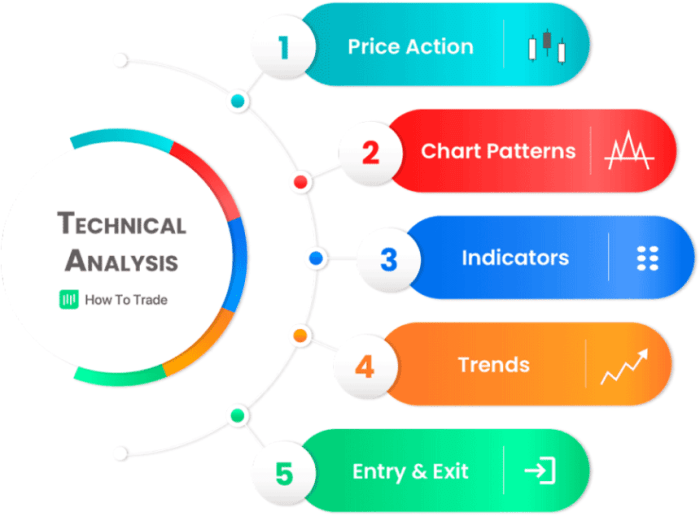

How to Use Candlestick Patterns in Trading

When incorporating candlestick patterns into trading strategies, it is essential to understand the significance of these patterns and how they can be used to predict market movements. By analyzing the shape, color, and position of candlesticks on a price chart, traders can gain valuable insights into market sentiment and potential price reversals.

Tips on Combining Candlestick Patterns with Other Technical Indicators

- Consider using candlestick patterns in conjunction with other technical indicators such as moving averages, RSI, or MACD to confirm signals and strengthen the overall analysis.

- Look for confluence between different indicators to increase the probability of successful trades.

- Avoid relying solely on candlestick patterns and always conduct thorough analysis using multiple tools for a comprehensive trading strategy.

Real-Life Scenarios Influenced by Candlestick Patterns

- During a downtrend, the formation of a bullish engulfing pattern signaled a potential trend reversal, leading to a profitable long position for traders who recognized the pattern.

- A doji candlestick appearing after a prolonged uptrend indicated indecision in the market, prompting traders to wait for confirmation from other indicators before making trading decisions.

- The presence of a hammer candlestick at a key support level provided a strong buying signal, resulting in a successful trade for those who identified the pattern and acted accordingly.

Candlestick Pattern Recognition Tools and Software

When it comes to analyzing candlestick patterns effectively, having access to reliable tools and software can make a significant difference. These tools can help traders identify patterns quickly and accurately, leading to more informed trading decisions.

Popular Candlestick Pattern Recognition Tools

- TradingView: TradingView is a popular platform among traders for analyzing charts and patterns. It offers a wide range of technical analysis tools, including candlestick pattern recognition features. Traders can customize their charts and set up alerts for specific patterns.

- MetaTrader: MetaTrader is a widely used trading platform that also provides tools for recognizing candlestick patterns. Traders can access various indicators and tools to enhance their analysis of patterns within the MetaTrader platform.

- StockCharts.com: StockCharts.com is another platform that offers candlestick pattern recognition tools. Traders can scan for specific patterns across different timeframes and customize their analysis based on their trading strategies.

Using Candlestick Pattern Recognition Tools Effectively

- Set Alerts: Utilize the alert feature in these tools to receive notifications when specific candlestick patterns are identified. This can help traders stay updated on potential trading opportunities without constantly monitoring the charts.

- Combine with Other Analysis: While candlestick patterns are valuable on their own, combining them with other technical analysis tools can provide a more comprehensive view of the market. Consider using indicators like moving averages or RSI in conjunction with candlestick patterns for better analysis.

- Backtesting: Use historical data to backtest the effectiveness of candlestick patterns in different market conditions. This can help traders assess the reliability of patterns and refine their trading strategies based on past performance.

Final Summary

In conclusion, mastering the art of using candlestick patterns can give traders a competitive edge in the market. By understanding the nuances of different patterns and how to effectively incorporate them into trading strategies, you can make more informed decisions and improve your overall trading performance. Start applying these techniques today and watch your trading skills soar to new heights.