As How to use a Forex demo account for practice takes center stage, this opening passage beckons readers with ahrefs author style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Forex trading can be a complex world to navigate, but utilizing a demo account for practice can be a game-changer. Learn how to hone your trading skills effectively through simulated trading environments.

Introduction to Forex Demo Account

A Forex demo account is a practice account offered by Forex brokers that allows traders to simulate real trading conditions without risking any actual money. It provides a risk-free environment for beginners to learn how to trade currencies and for experienced traders to test new strategies.

Purpose of using a demo account for practice

Utilizing a Forex demo account for practice serves as a valuable tool for traders to gain hands-on experience in the forex market. It helps traders familiarize themselves with the trading platform, understand market dynamics, and develop and test trading strategies.

Benefits of utilizing a demo account in Forex trading

- Risk-Free Environment: Allows traders to practice trading without risking real money.

- Learning Opportunity: Helps traders understand how the forex market works and gain experience.

- Strategy Testing: Enables traders to test different trading strategies and analyze their effectiveness.

- Platform Familiarization: Helps traders become comfortable with the trading platform and its features.

Setting Up a Forex Demo Account

When it comes to setting up a Forex demo account, the process is relatively simple and straightforward. This allows traders to practice their skills and strategies in a risk-free environment before committing real money to trading.

Step-by-Step Guide to Create a Forex Demo Account

- Choose a Forex broker: Start by selecting a reputable broker that offers a demo account. Look for one that suits your trading style and preferences.

- Register for the demo account: Fill out the registration form with your personal details, including name, email address, and phone number.

- Verify your email: Some brokers may require you to verify your email address before granting access to the demo account.

- Download the trading platform: Once your account is set up, download the broker’s trading platform to start practicing.

- Start trading: Use the virtual funds provided in the demo account to execute trades and test different strategies.

Information Required to Register for a Demo Account

- Personal details: Name, email address, phone number.

- Trading experience: Some brokers may ask about your level of experience in trading Forex.

- Financial information: You may need to provide details about your financial situation and investment goals.

Comparison of Different Platforms Offering Forex Demo Accounts

- MetaTrader 4: One of the most popular trading platforms, known for its user-friendly interface and advanced charting tools.

- MetaTrader 5: A more advanced version of MT4, offering additional features and capabilities for experienced traders.

- cTrader: Another popular platform with a focus on fast execution and advanced order types.

- NinjaTrader: Ideal for traders interested in automated trading strategies and advanced analysis tools.

Navigating the Demo Account Interface

Navigating the interface of a Forex demo account is essential for practicing trading strategies effectively. Understanding the layout and features can help traders make the most of their simulation experience before venturing into live trading.

Layout and Features of a Forex Demo Account Interface

Typically, a Forex demo account interface consists of various elements that mimic a real trading platform. These include:

- Charts: Displaying real-time price movements of currency pairs to analyze trends.

- Order Types: Allowing users to place market orders, limit orders, stop orders, and other trade types.

- Account Balance: Showing the virtual balance available for trading activities.

Customizing the Interface for Personalized Experience, How to use a Forex demo account for practice

Traders can customize the demo account interface to suit their preferences and trading style. This may involve:

- Adjusting chart settings such as timeframes, indicators, and drawing tools for technical analysis.

- Organizing the layout by resizing windows, arranging panels, and adding or removing widgets.

- Setting up alerts and notifications for price movements or specific trading conditions.

Practicing Strategies with a Demo Account: How To Use A Forex Demo Account For Practice

Utilizing a Forex demo account is an excellent way to practice various trading strategies in a risk-free environment. By designing a plan for your practice sessions and organizing a trading journal to track your progress, you can refine your skills and boost your confidence before trading with real money.

When it comes to long-term Forex trading strategies , patience and discipline are key. Traders who focus on long-term trends often look for opportunities to enter the market based on fundamental analysis and economic indicators. By holding positions for weeks or even months, these traders aim to capitalize on larger market movements and reduce the impact of short-term fluctuations.

Successful long-term traders understand the importance of risk management and continuously adapt their strategies to changing market conditions.

Creating a Strategy Plan

Before you start practicing with a demo account, it’s essential to create a strategy plan outlining the techniques you want to try and the goals you aim to achieve. Consider experimenting with different types of strategies, such as trend following, range trading, or breakout trading, to gain a broad understanding of the market dynamics.

When it comes to long-term Forex trading strategies , patience and discipline are key. Successful traders focus on trends and economic indicators to make informed decisions. By analyzing charts and using risk management tools, they aim for steady growth over time.

It’s essential to have a clear plan and stick to it, avoiding impulsive moves that can lead to losses.

- Set specific objectives for each practice session, such as mastering a particular indicator or testing a new risk management technique.

- Allocate dedicated time slots for practicing different strategies to ensure comprehensive coverage.

- Regularly review and adjust your plan based on the outcomes of your practice sessions to optimize your learning experience.

Examples of Strategies for Beginners

For beginners, it’s advisable to start with simple and widely-used trading strategies to build a strong foundation. Here are some examples of strategies suitable for practice on a demo account:

- Trend Following: This strategy involves identifying and following the prevailing market trend, aiming to profit from the momentum. Practice identifying trends using indicators like moving averages or trendlines.

- Support and Resistance: Learn to spot key support and resistance levels on price charts and practice trading bounces or breakouts from these levels.

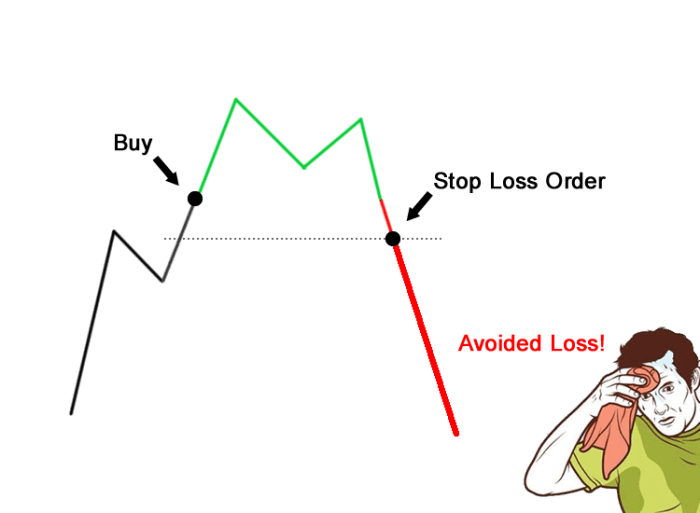

- Risk Management: Develop and practice risk management techniques, such as setting stop-loss orders and calculating position sizes based on your account balance.

Remember, the key to successful trading is not just about the strategy itself but also about proper risk management and discipline in executing your trades.

Managing Risks and Emotions

Effective risk management and emotional control are crucial aspects of successful forex trading, even when using a demo account for practice. Here, we will discuss how to handle risks, control emotions, and develop discipline and patience through demo trading.

Managing Risk Effectively

When using a demo account, it’s essential to treat it as if you were trading with real money to simulate actual market conditions. Here are some tips to manage risks effectively:

- Set a stop-loss order for each trade to limit potential losses.

- Diversify your trades to spread risk across different currency pairs.

- Avoid over-leveraging your trades, as it can magnify both profits and losses.

- Regularly review and adjust your risk management strategy based on your trading performance.

Controlling Emotions in Demo Trading

Emotions like fear and greed can cloud judgment and lead to irrational decisions. Here are some ways to control emotions during demo trading:

- Stick to your trading plan and strategy, regardless of market fluctuations.

- Acknowledge and accept that losses are part of trading and learn from them.

- Avoid impulsive trading decisions driven by emotions, such as revenge trading after a loss.

- Practice mindfulness and stay focused on the long-term goals of your trading strategy.

Developing Discipline and Patience

Discipline and patience are key virtues for successful traders. Here are some tips to cultivate these qualities through demo trading:

- Follow a routine and trading schedule to develop consistency in your trading habits.

- Stay patient and avoid rushing into trades without proper analysis and confirmation.

- Keep a trading journal to track your progress, analyze your decisions, and identify areas for improvement.

- Practice delayed gratification by waiting for the right opportunities to execute trades based on your strategy.

Final Wrap-Up

In conclusion, mastering the art of Forex trading through a demo account is a crucial step towards success in the financial markets. By practicing different strategies, managing risks, and controlling emotions, you can enhance your trading skills and build a solid foundation for profitable trading ventures.