As How to trade EUR/GBP takes center stage, this opening passage beckons readers with a deep dive into the intricacies of trading this currency pair. From fundamental analysis to technical strategies, this guide will equip you with the knowledge needed to navigate the EUR/GBP market with confidence and precision.

Overview of EUR/GBP Trading

When it comes to trading EUR/GBP, it involves buying or selling the Euro against the British Pound. This currency pair is one of the most popular in the forex market and is known for its liquidity and volatility.

Factors that influence the EUR/GBP exchange rate include economic indicators from both the Eurozone and the UK, such as GDP growth, inflation rates, interest rates, and political stability. Market sentiment, geopolitical events, and global economic trends also play a significant role in determining the value of the EUR/GBP pair.

The EUR/GBP is considered a major currency pair, and its movements are closely watched by traders and investors around the world. It is often used as a gauge of the overall strength of the Eurozone economy compared to the UK economy. Additionally, the EUR/GBP pair is popular among traders due to its relatively low spreads and high trading volume.

Significance of EUR/GBP in the forex market

The EUR/GBP is a key currency pair in the forex market, offering ample trading opportunities for both short-term and long-term traders. This pair is especially popular among traders who focus on European markets and are looking to diversify their portfolios.

- The EUR/GBP is often used by traders to hedge against currency risk or to speculate on the relative strength of the Eurozone and UK economies.

- Due to its liquidity, the EUR/GBP pair allows for quick execution of trades with minimal slippage.

- Traders often use technical analysis and chart patterns to identify potential entry and exit points when trading the EUR/GBP pair.

- As a major currency pair, the EUR/GBP is closely monitored by central banks, financial institutions, and market participants for insights into the health of the Eurozone and UK economies.

Fundamentals of EUR/GBP Trading: How To Trade EUR/GBP

When it comes to trading the EUR/GBP currency pair, it is essential to have a good understanding of the fundamentals that can impact its movements. Analyzing economic indicators, interpreting data, and considering geopolitical events are all crucial aspects of EUR/GBP trading.

Analyzing the EUR/GBP Currency Pair

Analyzing the EUR/GBP currency pair involves looking at the economic performance of the Eurozone and the United Kingdom. Factors such as interest rates, GDP growth, inflation rates, and political stability can all influence the value of the currency pair. Traders often use technical analysis tools and chart patterns to identify potential entry and exit points.

Interpreting Economic Indicators Affecting EUR/GBP

Economic indicators such as the Consumer Price Index (CPI), Purchasing Managers’ Index (PMI), and unemployment rates can have a significant impact on the EUR/GBP exchange rate. Positive economic data from the Eurozone or the UK can strengthen the respective currency, while negative data can lead to depreciation.

Impact of Brexit on EUR/GBP Trading, How to trade EUR/GBP

Brexit, the UK’s decision to leave the European Union, has had a profound impact on the EUR/GBP currency pair. Uncertainty surrounding Brexit negotiations, trade agreements, and economic implications have led to volatility in the exchange rate. Traders must stay informed about Brexit-related developments and their potential effects on the EUR/GBP pair.

Technical Analysis for EUR/GBP

When it comes to trading EUR/GBP, technical analysis plays a crucial role in helping traders make informed decisions based on historical price movements and chart patterns.

Key Technical Indicators for Trading EUR/GBP

- Moving Averages: Traders often use moving averages to identify trends and potential entry or exit points. The 50-day and 200-day moving averages are commonly used in EUR/GBP trading.

- Relative Strength Index (RSI): RSI helps traders determine if a currency pair is overbought or oversold, indicating potential trend reversals.

- Bollinger Bands: These bands help traders identify volatility and potential breakout points in the EUR/GBP pair.

- Fibonacci Retracement Levels: Traders use Fibonacci levels to identify potential support and resistance levels based on the golden ratio.

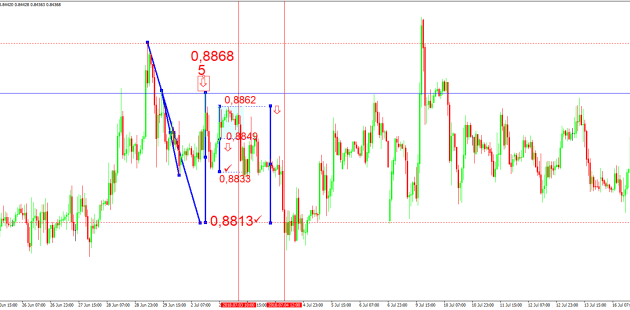

Using Charts to Analyze EUR/GBP Trends

Charts are essential tools for analyzing trends in the EUR/GBP pair. Traders commonly use candlestick charts to identify patterns such as head and shoulders, double tops, or flags. By analyzing these patterns along with key technical indicators, traders can make more informed decisions about their trades.

Common Technical Strategies for Trading EUR/GBP

- Trend Following: Traders can follow the trend by using moving averages to identify the direction of the trend and enter trades in the same direction.

- Breakout Trading: Traders can look for breakouts above key resistance levels or below key support levels to enter trades in the direction of the breakout.

- Support and Resistance: Identifying key support and resistance levels on the charts can help traders make decisions about entry and exit points.

- Divergence Trading: Traders can use indicators like RSI to identify divergences between price and the indicator, signaling potential trend reversals.

Strategies for Trading EUR/GBP

When it comes to trading EUR/GBP, there are various strategies that traders can employ based on their trading style, risk tolerance, and market conditions. It is essential to have a clear plan in place to navigate the volatility of this currency pair effectively.

Different Trading Strategies for EUR/GBP

- 1. Trend Following: This strategy involves identifying the prevailing trend in the EUR/GBP pair and trading in the direction of that trend. Traders can use technical indicators such as moving averages or trendlines to confirm the trend before entering a trade.

- 2. Range Trading: Range-bound markets can provide opportunities for traders to buy at support levels and sell at resistance levels. This strategy involves identifying key support and resistance levels in the EUR/GBP pair and executing trades accordingly.

- 3. Breakout Trading: Breakout traders look for instances where the price breaks out of a significant support or resistance level. They aim to capitalize on the momentum created by the breakout and enter trades in the direction of the breakout.

Short-term vs. Long-term Trading Approaches for EUR/GBP

- Short-term Trading: Short-term traders focus on capturing small price movements within a day or a few days. They rely heavily on technical analysis and short-term indicators to make quick trading decisions.

- Long-term Trading: Long-term traders take a more macroeconomic view of the market and hold positions for weeks, months, or even years. They analyze fundamental factors affecting the EUR/GBP pair and aim to profit from long-term trends.

Tips on Risk Management when Trading EUR/GBP

- 1. Use Stop Loss Orders: Implementing stop-loss orders can help limit potential losses in volatile markets and protect your trading capital.

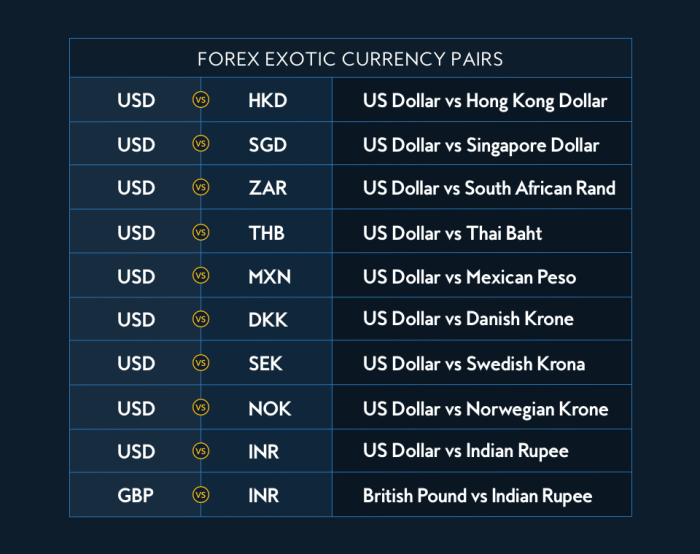

- 2. Diversify Your Portfolio: Avoid overexposure to a single currency pair like EUR/GBP by diversifying your trades across different asset classes or currency pairs.

- 3. Monitor Economic Events: Stay informed about key economic releases and events that could impact the EUR/GBP pair to make informed trading decisions.

Setting Up Trades for EUR/GBP

When setting up trades for EUR/GBP, it is essential to follow a systematic approach to maximize potential profits and minimize risks. Here are the steps to open a trade for EUR/GBP:

Factors to Consider when Setting Stop-Loss and Take-Profit Levels

- Consider the current market trend and overall market sentiment to determine the most suitable levels for stop-loss and take-profit.

- Set stop-loss levels based on key support and resistance levels, allowing for some room to withstand minor price fluctuations.

- Take-profit levels should be set at strategic points where the price is likely to encounter obstacles or reverse, maximizing potential profits.

- Adjust stop-loss and take-profit levels based on market volatility and news events that may impact the EUR/GBP exchange rate.

Recommendations for Managing Trades Effectively

- Regularly monitor the EUR/GBP exchange rate and stay informed about any developments that may affect your trade.

- Consider using trailing stop-loss orders to lock in profits as the trade moves in your favor.

- Diversify your trades and avoid overexposure to a single currency pair to spread out risks.

- Keep a trading journal to evaluate the success of your trades and identify areas for improvement.

Ultimate Conclusion

In conclusion, mastering the art of trading EUR/GBP requires a combination of analytical skills, strategic thinking, and risk management. By applying the insights shared in this guide, you can position yourself for success in the dynamic world of forex trading.