How to manage portfolio risk with bonds and stocks delves into the crucial aspects of risk management in investment portfolios, offering valuable insights and strategies for investors looking to navigate the complex world of finance with confidence and expertise.

Exploring the dynamics between bonds and stocks, this guide provides a comprehensive overview of risk characteristics and effective strategies to mitigate potential risks and optimize investment returns.

Understanding Portfolio Risk Management

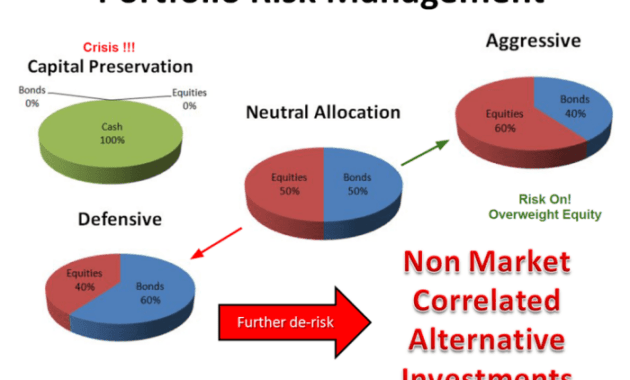

Portfolio risk refers to the potential for loss or underperformance in an investment portfolio. It is crucial to manage risk in a portfolio to protect capital and achieve long-term financial goals. Effective risk management can help investors navigate market uncertainties and minimize the impact of adverse events on their investments. Diversification plays a key role in managing portfolio risk by spreading investments across different asset classes, industries, and geographic regions. This strategy helps reduce the overall risk exposure of the portfolio and can enhance potential returns.

Role of Diversification in Risk Management

Diversification is a fundamental principle in risk management that involves spreading investments across a variety of assets to reduce exposure to any single investment. By diversifying a portfolio, investors can lower the overall risk level while potentially improving returns. This strategy helps mitigate the impact of market fluctuations or unforeseen events that may negatively affect specific assets. In essence, diversification allows investors to achieve a balance between risk and return by creating a well-rounded portfolio that is not overly reliant on any one investment.

Bonds and Stocks

When it comes to managing portfolio risk, understanding the risk characteristics of bonds and stocks is crucial. Both asset classes have distinct risk profiles that can impact a portfolio in different ways.

Risk Profiles Comparison

- Bonds are generally considered less risky than stocks. This is because bonds represent a debt obligation, and bondholders are entitled to receive fixed interest payments and the return of principal at maturity.

- Stocks, on the other hand, represent ownership in a company and are subject to market volatility. Stock prices can fluctuate significantly based on various factors such as company performance, economic conditions, and investor sentiment.

- While bonds offer more stable returns, they also have a lower potential for growth compared to stocks. Stocks have the potential for higher returns but come with higher volatility and risk.

Contribution to Portfolio Risk

- Bonds are often used in a portfolio to provide stability and income. They can help reduce overall portfolio risk by acting as a hedge against stock market volatility.

- Stocks, on the other hand, can increase the overall risk of a portfolio due to their higher volatility. However, they also offer the potential for higher returns, which can help boost portfolio performance over the long term.

Impact of Interest Rates

- Interest rates have a significant impact on bond prices. When interest rates rise, bond prices fall, and vice versa. This is because newly issued bonds with higher interest rates become more attractive to investors, causing the prices of existing bonds to decrease.

- For stocks, the relationship with interest rates is more complex. Generally, rising interest rates can lead to higher borrowing costs for companies, which can impact their profitability and stock prices. However, the impact of interest rates on stocks can vary depending on the overall economic environment and market conditions.

Strategies for Managing Portfolio Risk with Bonds

Bonds can play a crucial role in managing portfolio risk, especially when combined with stocks. They offer a more stable source of income compared to stocks and can act as a hedge against stock market volatility. Additionally, bonds typically have a lower correlation with stocks, providing diversification benefits to a portfolio.

Duration: Managing Interest Rate Risk

Duration is a key concept in bond investing that measures the sensitivity of a bond’s price to changes in interest rates. Bonds with longer durations are more sensitive to interest rate changes, which means they have higher interest rate risk. By understanding the concept of duration, investors can manage interest rate risk by selecting bonds with suitable durations based on their risk tolerance and investment objectives.

- Treasury Bonds: These are considered the safest type of bonds as they are backed by the U.S. government. They typically have lower yields compared to other types of bonds but offer a high level of safety and stability.

- Corporate Bonds: Issued by corporations, these bonds offer higher yields than treasury bonds but come with higher credit risk. Investors can choose investment-grade or high-yield corporate bonds based on their risk appetite.

- Municipal Bonds: Issued by state and local governments, municipal bonds provide tax-exempt income for investors. They are generally considered safer than corporate bonds but may offer lower yields.

Strategies for Managing Portfolio Risk with Stocks: How To Manage Portfolio Risk With Bonds And Stocks

Investors often turn to stocks to achieve high returns, but with the potential for higher rewards comes higher risks. Managing portfolio risk with stocks involves understanding key concepts like beta, utilizing fundamental analysis, and implementing strategies like stop-loss orders and diversification.

Understanding Beta and Stock Risk

Beta is a measure of a stock’s volatility compared to the overall market. Stocks with a beta greater than 1 are considered more volatile than the market, while those with a beta less than 1 are considered less volatile. Understanding a stock’s beta can help investors assess the level of risk they are taking on with that particular investment.

The Importance of Fundamental Analysis

Fundamental analysis involves evaluating a company’s financial health, management team, competitive position, and market trends to determine its intrinsic value. By conducting thorough fundamental analysis, investors can make more informed decisions about which stocks to include in their portfolio. This analysis helps in assessing the potential risks associated with individual stocks.

Strategies for Managing Stock Risk, How to manage portfolio risk with bonds and stocks

- Stop-Loss Orders: Implementing stop-loss orders can help investors limit their losses by automatically selling a stock when it reaches a certain price. This strategy can protect investors from significant downturns in stock prices.

- Diversification: Diversifying a stock portfolio by investing in a variety of industries, sectors, and asset classes can help spread risk. By not putting all their eggs in one basket, investors can reduce the impact of any single stock’s poor performance.

Ending Remarks

In conclusion, mastering the art of managing portfolio risk with bonds and stocks is essential for building a resilient investment portfolio that can withstand market fluctuations and deliver sustainable returns in the long run. By implementing the strategies Artikeld in this guide, investors can make informed decisions and enhance their overall investment success.

When it comes to understanding stock market trends, it’s essential to analyze various factors such as economic indicators, company performance, and market sentiment. By studying these elements closely, investors can make informed decisions on buying or selling stocks. For more insights on how to interpret stock market trends effectively, check out this comprehensive guide on How to interpret stock market trends.

When it comes to understanding the fluctuations of the stock market, it’s important to know how to interpret stock market trends. By analyzing patterns and indicators, investors can make informed decisions on when to buy or sell stocks. Learning how to read charts and graphs can provide valuable insights into market movements.

For more in-depth information on interpreting stock market trends, check out this comprehensive guide on How to interpret stock market trends.