Kicking off with How to invest in dividend stocks, this guide will provide valuable insights on understanding, researching, building a diversified portfolio, and reinvesting dividends in dividend stocks. Dive in to learn more!

Understanding Dividend Stocks

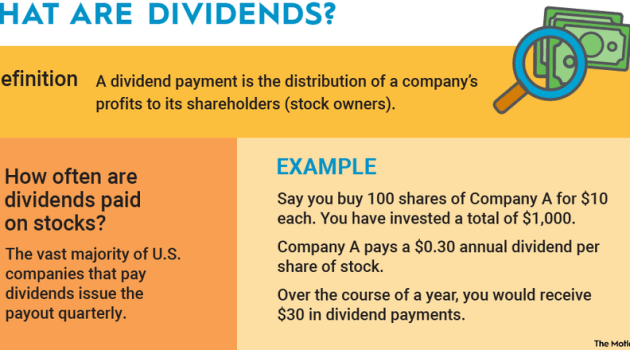

Dividend stocks are shares of companies that pay out a portion of their earnings to shareholders in the form of dividends. These dividends are typically paid on a regular basis, providing investors with a steady stream of income. Unlike growth stocks, which reinvest their earnings back into the company for expansion, dividend stocks are known for their consistent dividend payments.

Investing in dividend stocks can be particularly beneficial for long-term financial goals. Not only do they provide a reliable source of passive income, but they also offer the potential for capital appreciation over time. By reinvesting dividends and taking advantage of compound interest, investors can see their wealth grow significantly over the years.

Benefits of Investing in Dividend Stocks

- Steady Income: Dividend stocks offer a reliable source of income through regular dividend payments.

- Capital Appreciation: In addition to dividends, these stocks have the potential for long-term growth in share price.

- Lower Volatility: Dividend-paying companies tend to be more stable and less volatile than non-dividend-paying stocks.

- Inflation Hedge: Dividends can help protect against the eroding effects of inflation on purchasing power.

Examples of Well-Known Dividend-Paying Companies

- Johnson & Johnson: A multinational corporation known for its healthcare products and consistent dividend payments.

- The Coca-Cola Company: A global beverage giant that has a long history of rewarding shareholders with dividends.

- Procter & Gamble: A consumer goods company that has been paying dividends for over a century.

Researching Dividend Stocks: How To Invest In Dividend Stocks

When it comes to investing in dividend stocks, thorough research is crucial to identify potential opportunities and make informed decisions. By understanding key metrics and analyzing the financial health of a company, investors can better assess the viability of investing in its dividend stocks.

Key Metrics to Consider

- Dividend Yield: This metric indicates the annual dividend payment as a percentage of the stock price. A higher dividend yield may suggest a more attractive investment, but it’s essential to evaluate if the yield is sustainable.

- Payout Ratio: The payout ratio measures the percentage of earnings that a company pays out as dividends. A lower payout ratio indicates that a company has room to increase dividends in the future.

- Dividend Growth History: Analyzing a company’s dividend growth history can provide insights into its commitment to rewarding shareholders and its ability to sustain and grow dividends over time.

Importance of Financial Health Analysis

Analyzing the financial health and stability of a company is crucial before investing in its dividend stocks. It’s essential to look at key financial ratios, such as:

- Profitability Ratios: Assessing metrics like return on equity (ROE) and net profit margin can help determine if a company is generating sufficient profits to sustain dividend payments.

- Debt Levels: Evaluating a company’s debt levels and debt-to-equity ratio can indicate its ability to manage debt and maintain dividend payments, especially during economic downturns.

- Cash Flow: Examining a company’s operating cash flow can provide insights into its ability to generate the cash needed to support dividend payments and future growth.

Building a Diversified Portfolio

When it comes to investing in dividend stocks, building a diversified portfolio is essential to reduce risk and maximize returns. Diversification involves spreading your investments across different assets to minimize the impact of any one investment underperforming.

Sector Diversification in Dividend Stocks, How to invest in dividend stocks

Sector diversification is the practice of investing in dividend stocks from various industries or sectors. By diversifying across sectors, you can reduce the risk of your portfolio being heavily impacted by economic downturns or sector-specific challenges. For example, if you only invest in tech stocks and the tech sector experiences a downturn, your entire portfolio could suffer significant losses.

- Ensure you have exposure to various sectors such as healthcare, consumer goods, finance, and energy.

- Monitor the weightings of each sector in your portfolio to avoid overconcentration in one area.

- Rebalance your portfolio periodically to maintain the desired sector diversification.

Remember, sector diversification can help protect your portfolio from sector-specific risks.

Balance Between High-Yield and Stable Dividend Stocks

Achieving a balance between high-yield and stable dividend stocks is crucial for a well-rounded portfolio. High-yield stocks offer the potential for greater income, but they may come with higher risk. On the other hand, stable dividend stocks provide consistent payouts and reliability, albeit with lower yields.

- Allocate a portion of your portfolio to high-yield stocks for income generation.

- Balance this with stable dividend stocks to provide stability and reduce overall risk.

- Consider your risk tolerance and investment goals when determining the ratio of high-yield to stable dividend stocks in your portfolio.

Reinvesting Dividends

When it comes to investing in dividend stocks, one crucial strategy that can significantly impact your wealth accumulation over time is reinvesting dividends. This practice involves taking the dividends you receive from your investments and using them to purchase more shares of the same stock.

Different Reinvestment Options

- DRIP (Dividend Reinvestment Plans): Many companies offer DRIP programs that allow investors to automatically reinvest their dividends back into additional shares of the company’s stock. This can be a convenient way to steadily increase your investment without incurring additional transaction fees.

- Manual Reinvestment: Alternatively, investors can choose to manually reinvest their dividends by using the cash received to purchase more shares of the stock themselves. This gives investors more control over when and how they reinvest their dividends.

The compounding effect of reinvesting dividends is a powerful wealth-building tool that can lead to exponential growth over time.

Long-Term Benefits of Reinvesting Dividends

- Accelerated Wealth Accumulation: By reinvesting dividends, investors can take advantage of the compounding effect, where reinvested dividends generate additional dividends, leading to accelerated growth of their investment portfolio.

- Increased Portfolio Value: Over the long term, reinvesting dividends can significantly increase the total value of an investor’s portfolio, as the number of shares owned continues to grow with each reinvestment.

- Reduced Market Volatility Impact: Reinvesting dividends can help cushion the impact of market volatility, as the continuous reinvestment of dividends can help average out the cost of purchasing shares over time.

Conclusion

In conclusion, mastering the art of investing in dividend stocks can pave the way for long-term financial success. By following the strategies Artikeld in this guide, you can build a strong portfolio and watch your wealth grow steadily over time. Start your journey to financial freedom today!