Kicking off with How to identify trend reversals, this guide will delve into the various methods and indicators used to spot potential changes in market direction, providing traders and investors with valuable insights for their strategies.

Introduction to Trend Reversals

In the world of trading and investing, a trend reversal refers to a change in the direction of a financial asset’s price movement. This shift signifies the end of the current trend and the beginning of a new one, whether it’s from bullish to bearish or vice versa.

Identifying trend reversals is crucial for traders and investors as it can help them anticipate potential changes in market direction. By recognizing when a trend is about to reverse, market participants can adjust their strategies accordingly to capitalize on new opportunities or protect their existing positions from potential losses.

The impact of trend reversals on trading strategies can be significant. Traders who are able to accurately predict a trend reversal can enter or exit positions at optimal times, maximizing their profits or minimizing losses. However, failing to recognize a trend reversal can lead to missed opportunities or financial setbacks.

The Significance of Identifying Trend Reversals

- Anticipating changes in market direction

- Adapting trading strategies for better outcomes

- Minimizing losses and maximizing profits

- Staying ahead of market trends

Technical Analysis Indicators

When it comes to identifying trend reversals in the financial markets, traders often rely on a variety of technical analysis indicators. These indicators are essential tools that help traders analyze price movements and make informed decisions about potential trend changes.

Experienced traders use a combination of indicators to increase the accuracy of their predictions. Some of the most common technical analysis indicators used to identify trend reversals include Moving Averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands. Each of these indicators has its unique characteristics and signals that can help traders anticipate potential trend reversals.

Moving Averages

Moving Averages are widely used to smooth out price data and identify the direction of the trend. Traders often look for crossovers between short-term and long-term moving averages as potential signals of a trend reversal. For example, a golden cross (short-term moving average crossing above the long-term moving average) may indicate a bullish trend reversal, while a death cross (short-term moving average crossing below the long-term moving average) could signal a bearish trend reversal.

RSI (Relative Strength Index)

RSI is a momentum oscillator that measures the speed and change of price movements. An RSI reading above 70 is considered overbought and may signal a potential trend reversal to the downside. Conversely, an RSI reading below 30 is considered oversold and could indicate a potential trend reversal to the upside.

MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. Traders often look for MACD line crossovers as potential signals of trend reversals. For example, a bullish crossover (MACD line crossing above the signal line) may indicate a potential uptrend reversal, while a bearish crossover (MACD line crossing below the signal line) could signal a potential downtrend reversal.

Bollinger Bands, How to identify trend reversals

Bollinger Bands consist of a middle band (simple moving average) and two outer bands (standard deviations away from the middle band). Traders often look for price movements outside the bands as potential signals of trend reversals. For example, a price movement above the upper band may signal an overbought condition and a potential trend reversal to the downside, while a price movement below the lower band may signal an oversold condition and a potential trend reversal to the upside.

These technical analysis indicators play a crucial role in helping traders identify potential trend reversals in the financial markets. By understanding how each indicator works and interpreting their signals correctly, traders can improve their ability to anticipate and capitalize on trend changes.

Price Patterns and Chart Analysis

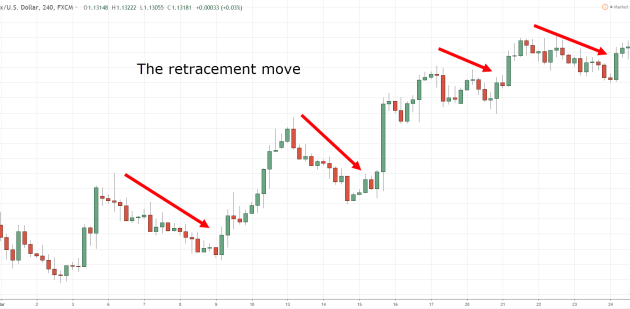

When it comes to identifying trend reversals, analyzing price patterns and charts plays a crucial role in determining potential shifts in market direction.

Key Price Patterns

- Head and Shoulders: This pattern consists of a peak (head) between two lower peaks (shoulders), indicating a potential reversal from an uptrend to a downtrend.

- Double Tops/Bottoms: These patterns occur when the price reaches a high (double top) or low (double bottom) twice without breaking through, signaling a possible trend reversal.

- Triangles: Symmetrical, ascending, and descending triangles can suggest trend reversals based on the breakout direction and volume.

Chart Analysis for Recognizing Trend Reversals

- Chart analysis involves studying price movements and patterns to identify potential trend reversals.

- By recognizing key patterns and formations on charts, traders can anticipate shifts in market sentiment and adjust their trading strategies accordingly.

Importance of Volume and Support/Resistance Levels

- Volume: An increase in trading volume can confirm a trend reversal, indicating strong market participation in the new direction.

- Support/Resistance Levels: These levels act as barriers that the price must break through to confirm a trend reversal, providing key areas for traders to monitor.

Candlestick Patterns

Candlestick patterns play a crucial role in identifying trend reversals in the financial markets. These patterns provide valuable insights into market sentiment and can help traders make informed decisions.

Types of Candlestick Patterns

- Doji: A Doji candlestick pattern occurs when the opening and closing prices are virtually the same. It indicates indecision in the market and suggests a potential reversal.

- Hammer: A Hammer candlestick has a small body and a long lower wick, signaling a potential bullish reversal after a downtrend.

- Shooting Star: The Shooting Star pattern has a small body and a long upper wick, indicating a possible bearish reversal after an uptrend.

Using Candlestick Patterns for Trend Reversals

Candlestick patterns can be used in conjunction with other technical analysis tools to validate trend reversals. Traders often look for confirmation from indicators like moving averages, trendlines, or volume analysis to increase the reliability of their signals. By combining candlestick patterns with other tools, traders can improve the accuracy of their trading decisions and better anticipate trend reversals in the market.

Closing Summary: How To Identify Trend Reversals

In conclusion, mastering the art of identifying trend reversals can be a game-changer for anyone involved in trading or investing, offering the ability to stay ahead of market movements and make informed decisions.

When it comes to trading the NZD/USD pair, it is essential to do it efficiently to maximize profits. By following the right strategies and staying updated on market trends, traders can make informed decisions. To learn more about how to trade NZD/USD efficiently, check out this Trade NZD/USD efficiently guide.

When it comes to trading the NZD/USD pair, efficiency is key. To trade NZD/USD efficiently , it’s essential to stay updated on market trends, economic indicators, and geopolitical events that could impact the currency pair. Utilizing technical analysis tools and risk management strategies can also help optimize your trading performance.

By keeping a close eye on the market and making well-informed decisions, you can enhance your chances of success in trading NZD/USD.