How to assess risk tolerance in stock investing sets the stage for understanding the crucial relationship between risk and investment decisions, offering valuable insights for investors looking to navigate the stock market successfully.

Factors affecting risk tolerance in stock investing

When it comes to investing in the stock market, there are various factors that can influence an individual’s risk tolerance. Understanding these factors is crucial in making informed investment decisions.

Personal financial goals play a significant role in determining risk tolerance. If an individual has short-term financial goals, they may be more risk-averse to protect their capital. On the other hand, those with long-term financial goals may be willing to take on more risk in pursuit of higher returns.

Age and investment timeframe are also important determinants of risk tolerance. Younger investors with a longer investment horizon may have a higher risk tolerance as they have more time to recover from any potential losses. In contrast, older investors nearing retirement may have a lower risk tolerance to preserve their savings.

Impact of financial goals on risk tolerance

- Short-term goals may lead to lower risk tolerance to protect capital.

- Long-term goals can result in higher risk tolerance for potential higher returns.

Role of age and investment timeframe

- Younger investors with longer horizons may have higher risk tolerance.

- Older investors nearing retirement may exhibit lower risk tolerance.

Assessing risk tolerance levels

Assessing an individual’s risk tolerance is crucial in stock investing as it helps determine the level of risk they are comfortable with when making investment decisions. There are different methods to assess risk tolerance, including questionnaires and evaluating past investment experiences.

Significance of risk assessment questionnaires

Risk assessment questionnaires are widely used tools to determine an individual’s risk tolerance level. These questionnaires typically consist of a series of questions related to financial goals, investment knowledge, time horizon, and comfort level with market fluctuations. By analyzing the responses, financial advisors and investors can gauge the individual’s risk tolerance and recommend suitable investment options accordingly. The structured format of these questionnaires helps in providing a clear and objective assessment of risk tolerance, guiding investors towards making informed decisions aligned with their risk profile.

Past investment experiences in gauging risk tolerance levels

Past investment experiences play a significant role in assessing an individual’s risk tolerance. By reflecting on previous investment decisions, successes, and failures, investors can better understand their reactions to market volatility and risk exposure. For example, if an investor remained calm during a market downturn and stayed invested for the long term, it indicates a higher risk tolerance level. On the other hand, if an investor panicked and sold off investments during a downturn, it suggests a lower risk tolerance. Analyzing past behaviors and emotional responses to market fluctuations can provide valuable insights into an individual’s risk tolerance level and help in making more suitable investment choices in the future.

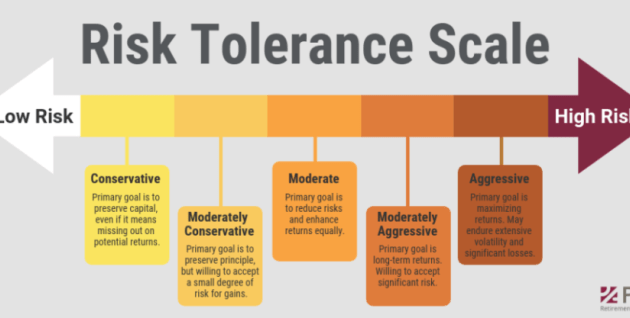

Understanding risk tolerance profiles

When it comes to investing in the stock market, understanding your risk tolerance profile is crucial. Different investors have varying levels of comfort when it comes to taking risks with their investments. Let’s delve into the different risk tolerance profiles that investors may fall into and the investment strategies suitable for each profile.

When it comes to investing, beginners often look for value stocks that can provide long-term growth. Understanding the concept of value investing is crucial for those who are just starting out in the stock market. Value stocks are undervalued companies that have strong fundamentals and potential for growth.

By focusing on these types of stocks, beginners can build a solid portfolio that can withstand market fluctuations. To learn more about value stocks for beginners, check out this informative guide on Value stocks for beginners.

Conservative Risk Tolerance Profile

Investors with a conservative risk tolerance profile are typically risk-averse and prioritize capital preservation over high returns. They prefer low-risk investments that provide steady, predictable returns over time.

When it comes to investing, beginners often find value stocks to be a safe starting point. These stocks are known for being undervalued by the market, offering potential for long-term growth. If you’re new to the world of investing, understanding the basics of value stocks can provide you with a solid foundation for building your portfolio.

By focusing on companies with strong fundamentals and stable earnings, you can mitigate risks and set yourself up for success in the stock market.

- Examples of suitable investment strategies for conservative investors include investing in government bonds, certificates of deposit (CDs), and high-quality blue-chip stocks.

- These investors may also opt for diversified portfolios with a higher allocation towards fixed-income securities to minimize risk.

Moderate Risk Tolerance Profile, How to assess risk tolerance in stock investing

Investors with a moderate risk tolerance profile are willing to take on a moderate level of risk in exchange for potentially higher returns. They seek a balance between growth and capital preservation.

- Examples of suitable investment strategies for moderate investors include investing in a mix of stocks and bonds, mutual funds, and exchange-traded funds (ETFs).

- These investors may also consider diversifying their portfolios across different asset classes to manage risk effectively.

Aggressive Risk Tolerance Profile

Investors with an aggressive risk tolerance profile are comfortable with taking on high levels of risk in pursuit of maximum returns. They are willing to tolerate significant fluctuations in the value of their investments.

- Examples of suitable investment strategies for aggressive investors include investing in growth stocks, options trading, and venture capital investments.

- These investors may focus on high-growth sectors or emerging markets to capitalize on opportunities for exponential returns.

Strategies for aligning risk tolerance with investment decisions

Aligning risk tolerance with investment decisions is crucial to ensure that an individual’s investment portfolio matches their financial goals and comfort level with risk.

Concept of Diversification in Managing Risk

Diversification is a strategy that involves spreading your investments across different asset classes, industries, and geographic regions. This helps reduce the impact of a single investment performing poorly on your overall portfolio.

- Diversification plays a key role in managing risk based on tolerance levels by minimizing the potential losses from a specific investment.

- By diversifying your portfolio, you can lower the overall risk while still potentially achieving solid returns.

- Investors with a lower risk tolerance may opt for a more conservative portfolio with a higher allocation to less volatile assets, such as bonds or real estate.

- On the other hand, investors with a higher risk tolerance may choose a more aggressive portfolio with a larger allocation to stocks and other growth-oriented assets.

Adjusting Investment Portfolios to Match Risk Tolerance

It is essential to periodically review and adjust your investment portfolio to ensure that it aligns with your risk tolerance level. Here are some tips for adjusting your investment portfolio:

- Reassess Your Risk Tolerance: Regularly evaluate your risk tolerance based on changes in your financial situation, investment goals, and market conditions.

- Review Asset Allocation: Ensure that your asset allocation aligns with your risk tolerance, adjusting the mix of stocks, bonds, and other investments as needed.

- Consider Time Horizon: Your investment time horizon can impact your risk tolerance. Short-term investors may have a lower risk tolerance compared to long-term investors.

- Consult with a Financial Advisor: Seeking professional advice can help you make informed decisions about adjusting your investment portfolio to match your risk tolerance.

Closure: How To Assess Risk Tolerance In Stock Investing

In conclusion, understanding and evaluating your risk tolerance is key to making informed investment choices in the stock market. By aligning your risk tolerance with your financial goals and investment timeframe, you can create a balanced portfolio that suits your individual needs and preferences.