How to analyze interest rates in Forex, the backbone of successful trading strategies, is a crucial skill that every trader must master. Dive into the intricacies of interest rates and their impact on the forex market in this detailed guide.

Explore the various factors that influence interest rates, understand interest rate differentials, and learn how to interpret central bank policies to make informed trading decisions.

Understanding Interest Rates in Forex: How To Analyze Interest Rates In Forex

Interest rates play a crucial role in the forex market, impacting currency values and exchange rates. Let’s delve into what interest rates are in the context of forex trading, their significance, and how central banks influence them.

Definition of Interest Rates in Forex

Interest rates refer to the cost of borrowing or the return on investment. In forex trading, interest rates are the rates at which central banks lend money to commercial banks. These rates are crucial as they affect the value of a country’s currency.

Significance of Interest Rates in Forex Markets

Interest rates influence the flow of international capital, impacting currency exchange rates. Higher interest rates attract foreign investment, strengthening a country’s currency. Conversely, lower interest rates can lead to capital outflows and a weaker currency.

How Central Banks Influence Interest Rates

Central banks use monetary policy tools to adjust interest rates, aiming to control inflation and stimulate economic growth. Through measures like rate hikes or cuts, central banks influence borrowing costs, which in turn impact currency values in the forex market.

Factors Affecting Interest Rates

When analyzing interest rates in forex, it is crucial to consider the various factors that can influence them. These factors can range from economic indicators to geopolitical events, all of which play a significant role in shaping interest rate decisions.

Economic Indicators Influence Interest Rate Decisions, How to analyze interest rates in Forex

Economic indicators such as inflation, employment rates, and GDP growth are closely monitored by central banks when making decisions regarding interest rates. For example, if inflation is rising above the target rate set by the central bank, they may decide to increase interest rates to curb inflation. On the other hand, if the economy is experiencing slow growth, central banks may lower interest rates to stimulate borrowing and spending.

- Inflation: Central banks often raise interest rates to combat high inflation rates.

- Employment Rates: Low unemployment rates may lead to higher interest rates as a sign of a strong economy.

- GDP Growth: Strong GDP growth can prompt central banks to raise interest rates to prevent overheating of the economy.

Geopolitical Events Impact Interest Rates

Geopolitical events such as political instability, trade wars, and natural disasters can also affect interest rates in forex markets. For instance, a trade war between two major economies can lead to uncertainty and volatility in the markets, prompting central banks to adjust interest rates accordingly to stabilize the economy.

Geopolitical tensions can cause fluctuations in currency values and influence central banks’ decisions on interest rates.

- Political Instability: Uncertainty caused by political instability can lead to changes in interest rates to mitigate risks.

- Trade Wars: Trade disputes between countries can impact interest rates as they affect global economic stability.

- Natural Disasters: Events like hurricanes or earthquakes can disrupt economies, leading to adjustments in interest rates to support recovery efforts.

Analyzing Interest Rate Differentials

Interest rate differentials play a crucial role in forex trading as they refer to the difference in interest rates between two currencies. This difference is a key factor that influences the direction of currency pairs in the forex market.

Concept of Interest Rate Differentials

Interest rate differentials are used by traders to analyze the potential profit or loss when trading currency pairs. When a trader buys a currency with a higher interest rate and sells a currency with a lower interest rate, they may earn interest on the position held. Conversely, if the opposite scenario occurs, the trader may pay interest. This difference in interest rates can impact the overall return on investment and affect trading decisions.

- Traders use interest rate differentials to capitalize on carry trade opportunities, where they borrow money in a currency with a low-interest rate to invest in a currency with a higher interest rate.

- Interest rate differentials can also influence the direction of currency pairs, as central banks adjust interest rates to control inflation, economic growth, and currency valuation.

- Understanding interest rate differentials is essential for traders to anticipate potential market movements and make informed trading decisions.

Examples of Currency Pairs with Significant Interest Rate Differentials

- A classic example is the AUD/JPY currency pair, where the Australian Dollar (AUD) typically has a higher interest rate than the Japanese Yen (JPY). Traders may take advantage of this interest rate differential by buying AUD and selling JPY to earn interest on the position.

- Another example is the NZD/USD currency pair, where the New Zealand Dollar (NZD) often has a higher interest rate compared to the US Dollar (USD). Traders can use this interest rate differential to potentially profit from the interest rate spread between the two currencies.

- Currency pairs involving emerging market currencies like the USD/TRY (US Dollar/Turkish Lira) or USD/ZAR (US Dollar/South African Rand) may also exhibit significant interest rate differentials, providing opportunities for traders to capitalize on interest rate disparities.

Interpreting Interest Rate Policies

Interest rate policies are a crucial tool used by central banks to influence economic conditions, including inflation, employment, and overall economic growth. There are different types of interest rate policies that central banks employ to achieve their objectives.

Types of Interest Rate Policies

Central banks typically use three main types of interest rate policies:

- Neutral Interest Rate Policy: In this approach, central banks aim to maintain stability and avoid drastic changes in interest rates unless necessary. This policy is often used during times of economic stability.

- Hawkish Interest Rate Policy: A hawkish stance involves raising interest rates to curb inflation and prevent the economy from overheating. Central banks may adopt this policy when inflation is rising above target levels.

- Dovish Interest Rate Policy: Conversely, a dovish stance involves lowering interest rates to stimulate economic activity and boost inflation. This policy is usually implemented during periods of economic downturn or low inflation.

Implications of Interest Rate Policies on Forex Markets

The interest rate policies adopted by central banks have a significant impact on forex markets. When a central bank raises interest rates (hawkish policy), the currency of that country tends to appreciate as higher rates attract foreign investment. On the other hand, lowering interest rates (dovish policy) can lead to currency depreciation as investors seek higher returns elsewhere.

In addition, changes in interest rates can affect the yield differentials between currencies, influencing the direction of currency pairs in the forex market. Traders closely monitor central bank decisions and statements regarding interest rates to anticipate potential market movements.

Historical Impact of Interest Rate Policies on Currency Values

Analyzing historical data can provide insights into how interest rate policies have impacted currency values in the past. For example, when the Federal Reserve in the United States raised interest rates in 2018, the US dollar strengthened against other major currencies due to higher yields. Similarly, when the European Central Bank implemented a dovish policy in response to economic challenges, the euro depreciated against the US dollar.

Understanding the historical relationship between interest rate policies and currency values can help traders make informed decisions and assess potential risks in the forex market.

Final Review

Mastering the art of analyzing interest rates in Forex can give you a competitive edge in the dynamic world of currency trading. Stay ahead of the curve by delving deep into the nuances of interest rates and leveraging this knowledge to enhance your trading strategies.

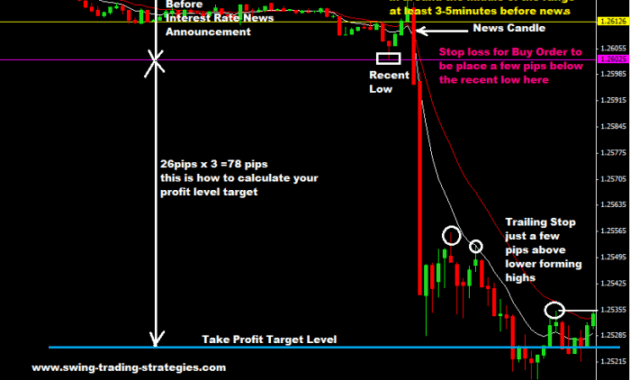

When it comes to Forex trading, one popular strategy that many traders use is swing trading. Swing trading strategies for Forex involve holding positions for several days to weeks to take advantage of short- to medium-term price moves. Traders typically look for trends and patterns in the market to make informed decisions on when to enter and exit trades.

By using technical analysis and risk management, traders can potentially profit from the volatility of the Forex market.

When it comes to Forex trading, one popular strategy that many traders use is swing trading. Swing trading strategies for Forex involve holding positions for multiple days or even weeks to take advantage of short to medium-term market movements. Traders often look for opportunities to enter and exit trades based on technical analysis and market trends.

By understanding key support and resistance levels, as well as using indicators like moving averages and Fibonacci retracements, traders can make informed decisions to potentially profit from price swings in the market.