Exploring the intricacies of How Compound interest works in DeFi, this introduction sets the stage for a deep dive into the world of decentralized finance, shedding light on the power of compounding returns.

As we unravel the mechanics of compound interest in DeFi platforms and uncover its benefits and risks, readers will gain a comprehensive understanding of this fundamental concept in the realm of decentralized finance.

Overview of Compound Interest in DeFi: How Compound Interest Works In DeFi

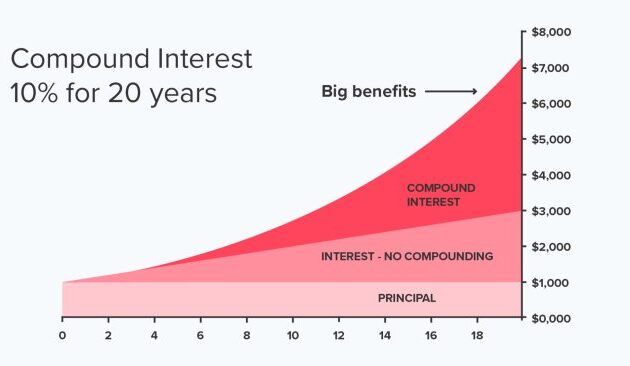

Compound interest is a concept where the interest that accrues on an initial principal amount also earns interest over time. This compounding effect allows for exponential growth of the investment.

As the cryptocurrency market continues to experience high levels of volatility, many investors are turning to stablecoins as a hedge against these fluctuations. Stablecoins are digital assets pegged to a stable asset, such as the US dollar, to minimize price volatility.

By holding stablecoins, investors can protect their investments during times of market uncertainty. To learn more about how stablecoins can serve as a hedge against volatility, check out this informative article on Stablecoins as a hedge against volatility.

Compound interest differs from simple interest in that with simple interest, the interest is calculated only on the principal amount, while with compound interest, the interest is calculated on the initial principal amount plus any previously earned interest. This leads to a higher overall return on investment.

Role of Compound Interest in Decentralized Finance (DeFi)

Compound interest plays a crucial role in decentralized finance (DeFi) by allowing users to earn interest on their assets without the need for traditional financial intermediaries like banks. In DeFi platforms, users can lend out their assets and earn interest on them through smart contracts.

Stablecoins play a crucial role in the cryptocurrency market as a hedge against volatility. These digital assets are pegged to stable assets like fiat currencies or commodities, providing a sense of stability for investors amidst the highly volatile nature of cryptocurrencies.

By holding stablecoins, traders can quickly move their funds out of volatile assets during market downturns, preserving their capital. To learn more about how stablecoins can help mitigate risks in the crypto market, check out this article on Stablecoins as a hedge against volatility.

- DeFi platforms leverage compound interest to provide users with opportunities to earn passive income on their holdings.

- Users can deposit their assets into DeFi protocols and earn interest that compounds over time, leading to the growth of their investment.

- Compound interest in DeFi is powered by blockchain technology, ensuring transparency and security in interest calculations and payouts.

Mechanics of Compound Interest in DeFi

Compound interest in DeFi platforms is calculated based on the principal amount invested, the interest rate, and the compounding frequency. Unlike simple interest, compound interest takes into account the interest earned on both the initial investment and the accumulated interest over time.

Calculation of Compound Interest in DeFi

In DeFi platforms, compound interest is calculated using the formula:

Final Amount = Principal Amount * (1 + Interest Rate)Number of Compounding Periods

This formula considers the compounding frequency, which determines how often the interest is added to the principal amount and reinvested to generate more interest.

Illustration of Compounding Process in DeFi

For example, let’s say you invest $1,000 in a DeFi platform with an annual interest rate of 10% compounded monthly. At the end of the first month, the interest earned would be $1,000 * (10%/12) = $8.33. This amount is added to the principal, making it $1,008.33 for the next month. The process continues, and the interest is calculated on the new total each month, leading to exponential growth of your investment.

Comparison of Compounding Frequency in Different DeFi Protocols

Different DeFi protocols offer varying compounding frequencies, such as daily, weekly, monthly, or annually. The more frequent the compounding, the faster your investment grows due to the reinvestment of earned interest. Investors can choose the compounding frequency that aligns with their investment goals and risk tolerance.

Benefits of Compound Interest in DeFi

Compound interest in DeFi offers several advantages that can significantly impact investment returns and wealth growth. By reinvesting the interest earned, investors can benefit from exponential growth over time.

Boosted Returns

- Compound interest allows for the reinvestment of earned interest, leading to accelerated growth of the investment.

- As interest is continuously added to the principal amount, the overall investment grows at an increasing rate, boosting returns over time.

- Higher returns can be achieved compared to simple interest investments, maximizing the potential gains in DeFi.

Wealth Growth Acceleration

- Through the compounding effect, wealth accumulation occurs at a faster pace, especially when investing for the long term.

- Investors can benefit from the snowball effect, where small gains accumulate and compound to generate substantial wealth over time.

- Compound interest enables investors to leverage time and the power of compounding to create significant wealth in DeFi investments.

Risks and Considerations with Compound Interest in DeFi

When engaging in DeFi platforms that offer compound interest, it’s essential to be aware of the potential risks involved. While compound interest can significantly increase your earnings over time, it can also expose you to certain vulnerabilities if not managed properly.

Market Volatility

One of the primary risks associated with compound interest in DeFi is market volatility. The value of the assets you have invested can fluctuate rapidly, leading to potential losses. For example, if the price of the underlying asset drops significantly, the compounded interest earned may not be enough to offset the losses incurred due to the price decrease.

Liquidation Risks

Another risk to consider is the possibility of liquidation. When borrowing against your assets to reinvest and compound interest, there is a chance that the value of your collateral may fall below the required threshold. In such cases, your collateral might be liquidated, resulting in a loss of your initial investment.

Smart Contract Risks

DeFi platforms operate on smart contracts, which are susceptible to bugs and vulnerabilities. In the event of a smart contract exploit or hack, your funds could be at risk. It’s crucial to conduct thorough research on the platform’s security measures and audit reports before committing your assets.

Strategies to Mitigate Risks, How Compound interest works in DeFi

To mitigate the risks associated with compound interest in DeFi, consider diversifying your investments across different platforms and assets. Additionally, set stop-loss orders to limit potential losses in case of market downturns. Stay informed about the latest developments in the DeFi space and be cautious when interacting with new or untested platforms.

Final Thoughts

In conclusion, mastering the art of compound interest in DeFi can lead to exponential growth in wealth and investments. By leveraging this powerful financial tool effectively and navigating the associated risks wisely, investors can unlock a world of opportunities in the decentralized finance space.