Delving into GBP/JPY trading tips, this introduction immerses readers in a unique and compelling narrative, with a focus on the strategies, trends, and psychology involved in trading this currency pair. From technical analysis methods to risk management techniques, this overview sets the stage for a comprehensive exploration of GBP/JPY trading.

As we delve deeper into the nuances of trading GBP/JPY, we will uncover key insights into market trends, forecasting strategies, and the psychological aspects that shape successful trading outcomes. Stay tuned for valuable tips and expert advice to enhance your trading experience in the GBP/JPY market.

Importance of GBP/JPY Trading: GBP/JPY Trading Tips

Trading in GBP/JPY holds significant importance in the forex market due to various factors that attract traders worldwide.

Factors Influencing GBP/JPY Exchange Rates

- The Strength of the UK and Japanese Economies: Economic indicators such as GDP growth, employment rates, and inflation can impact the exchange rates of GBP/JPY.

- Interest Rates: Central bank policies and interest rate differentials between the Bank of England and the Bank of Japan play a crucial role in determining GBP/JPY rates.

- Political Stability: Political events, elections, and government policies in the UK and Japan can influence investor sentiment and currency valuations.

- Market Sentiment: Global market trends, risk appetite, and geopolitical developments can also affect the demand for GBP/JPY.

Historical Performance of GBP/JPY

The GBP/JPY currency pair has shown significant volatility over the years, making it attractive for traders seeking opportunities for profit. The historical performance of GBP/JPY reflects the dynamic nature of the forex market and the impact of various economic and geopolitical factors on exchange rates.

Strategies for Trading GBP/JPY

When it comes to trading GBP/JPY, having a solid strategy is essential to navigate the volatility and fluctuations in this currency pair. Here are some key strategies to consider:

Technical Analysis Methods

Technical analysis plays a crucial role in GBP/JPY trading. Traders often use various technical indicators and chart patterns to identify potential entry and exit points. Some popular technical analysis methods specific to GBP/JPY trading include:

- Using moving averages to identify trends and potential reversal points.

- Utilizing Fibonacci retracement levels to determine potential support and resistance levels.

- Implementing oscillators like the Relative Strength Index (RSI) to gauge overbought or oversold conditions.

- Monitoring key levels such as round numbers or previous highs/lows for price reactions.

Fundamental Analysis Approaches

Fundamental analysis involves assessing economic indicators, geopolitical events, and central bank policies to make informed trading decisions. When trading GBP/JPY, traders should consider factors such as:

- Economic data releases from the UK and Japan, such as GDP growth, inflation rates, and employment figures.

- Market sentiment and risk appetite, which can impact the demand for safe-haven currencies like the Japanese Yen.

- Interest rate differentials between the Bank of England and the Bank of Japan, influencing the currency pair’s carry trade dynamics.

- Geopolitical developments that could affect the stability of the UK or Japan and impact investor confidence.

Risk Management Techniques

Effective risk management is crucial to preserve capital and minimize losses in GBP/JPY trading. Traders can employ various risk management techniques tailored to this currency pair, such as:

- Setting stop-loss orders to limit potential losses in case the trade moves against you.

- Using proper position sizing to ensure that each trade’s risk aligns with your overall risk tolerance.

- Diversifying your trading portfolio to reduce exposure to any single currency pair or market event.

- Regularly reviewing and adjusting your risk management strategy based on market conditions and trading performance.

Market Trends and Forecasting

In the world of trading GBP/JPY, understanding market trends and forecasting is crucial for making informed decisions and maximizing profits. By analyzing current market trends affecting GBP/JPY and utilizing the right tools and indicators, traders can better interpret market movements and anticipate potential shifts in the currency pair.

Analyzing Market Trends

- Market trends can be influenced by various factors such as economic indicators, geopolitical events, and central bank policies.

- Traders can use technical analysis tools like moving averages, MACD, and Fibonacci retracement levels to identify trends and potential entry/exit points.

- Fundamental analysis, including monitoring news releases and economic data, can also provide insights into market trends.

Tools and Indicators for Forecasting

- Popular tools for forecasting GBP/JPY movements include trend lines, support and resistance levels, and chart patterns like head and shoulders or double tops/bottoms.

- Indicators like the Relative Strength Index (RSI), Stochastic Oscillator, and Bollinger Bands can help traders gauge market momentum and overbought/oversold conditions.

- Combining multiple tools and indicators can provide a more comprehensive view of the market and improve forecasting accuracy.

Short-term vs. Long-term Forecasting Strategies

- Short-term forecasting strategies focus on capturing intraday or daily price movements, often relying on technical analysis and short-term indicators.

- Long-term forecasting strategies involve analyzing broader trends and economic factors to predict extended price movements, requiring a more fundamental approach.

- Traders can combine both short-term and long-term strategies to create a well-rounded forecasting approach that considers multiple timeframes.

Trading Psychology in GBP/JPY

-294408.jpg?w=700)

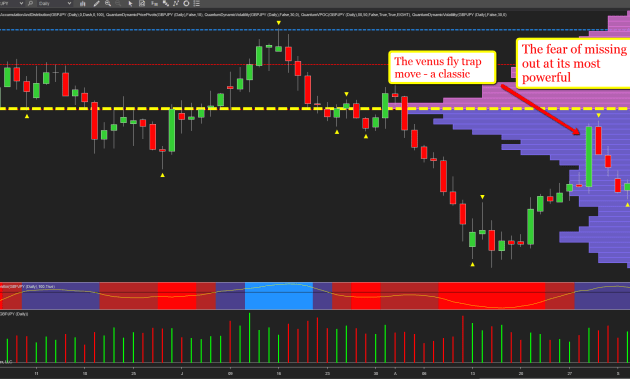

When it comes to trading GBP/JPY, it is essential to understand the unique psychological aspects that can impact your trading decisions. The volatile nature of this currency pair can trigger emotions like fear, greed, and anxiety, affecting your ability to make rational choices. Here are some tips to help you navigate the psychological challenges of trading GBP/JPY:

Managing Emotions

- Acknowledge your emotions: Recognize when emotions are influencing your trading decisions and take a step back to assess the situation objectively.

- Practice mindfulness: Stay focused on the present moment and avoid dwelling on past losses or future gains, which can cloud your judgment.

- Set realistic goals: Establish clear trading goals and adhere to a disciplined trading plan to avoid impulsive decisions driven by emotions.

- Take breaks: If you feel overwhelmed or stressed, take a break from trading to clear your mind and regain perspective.

Common Psychological Pitfalls to Avoid, GBP/JPY trading tips

- Overtrading: Resist the urge to trade excessively, as it can lead to poor decision-making and increased risk exposure.

- Fear of missing out (FOMO): Avoid making impulsive trades out of fear of missing out on potential profits, as this can result in losses.

- Confirmation bias: Be aware of seeking information that confirms your existing beliefs about the market, as it can lead to overlooking critical data that contradicts your views.

- Loss aversion: Accept that losses are a natural part of trading and avoid making irrational decisions to avoid losses at all costs, which can lead to missed opportunities.

End of Discussion

In conclusion, mastering the art of trading GBP/JPY requires a blend of technical expertise, market insight, and psychological resilience. By implementing the tips and strategies discussed, traders can navigate the complexities of this currency pair with confidence and precision. Whether you’re a novice or an experienced trader, integrating these GBP/JPY trading tips into your approach can lead to more informed and profitable trading decisions.