With Fundamental analysis for stocks at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Embark on a journey to unravel the intricacies of fundamental analysis for stocks, exploring its vital role in assessing investments and making informed decisions in the stock market.

Importance of Fundamental Analysis

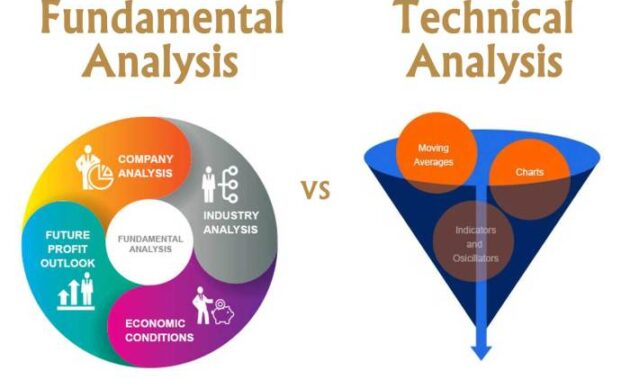

When it comes to evaluating stocks, fundamental analysis plays a crucial role in helping investors make informed decisions based on the financial health and performance of a company. Unlike technical analysis, which focuses on price movements and historical data, fundamental analysis looks at the underlying factors that drive a company’s value.

Key Components of Fundamental Analysis

- Financial Statements: Fundamental analysis involves examining a company’s financial statements, including the income statement, balance sheet, and cash flow statement. These documents provide valuable insights into the company’s revenues, expenses, assets, and liabilities.

- Ratio Analysis: Ratios such as price-to-earnings (P/E), debt-to-equity (D/E), and return on equity (ROE) are commonly used in fundamental analysis to assess a company’s financial health and performance relative to its industry peers.

- Business Operations: Understanding a company’s business model, competitive advantages, and industry trends is essential in fundamental analysis. This helps investors evaluate the company’s growth potential and sustainability.

- Economic Indicators: External factors such as interest rates, inflation, and GDP growth can impact a company’s performance. Fundamental analysis considers these macroeconomic indicators to gauge the overall market conditions.

Financial Statements Analysis

Financial statements are crucial documents that provide valuable insights into a company’s financial health and performance. Fundamental analysis heavily relies on the analysis of these financial statements to make informed investment decisions.

Types of Financial Statements

- Balance Sheet: A snapshot of a company’s financial position at a specific point in time, showing assets, liabilities, and equity.

- Income Statement: Summarizes a company’s revenues, expenses, and profits over a specific period.

- Cash Flow Statement: Tracks the flow of cash in and out of a company, detailing operating, investing, and financing activities.

Interpreting Financial Statements

- Balance Sheets: Analyze the company’s liquidity, solvency, and financial stability by comparing assets to liabilities.

- Income Statements: Evaluate the company’s profitability and performance by assessing revenue, expenses, and net income.

- Cash Flow Statements: Review the company’s ability to generate cash and manage its operations efficiently.

Key Financial Ratios

- Profitability Ratios: Measure a company’s ability to generate profit, including Return on Equity (ROE) and Gross Margin.

- Liquidity Ratios: Assess a company’s short-term financial health, such as Current Ratio and Quick Ratio.

- Debt Ratios: Determine the level of debt a company carries, like Debt-to-Equity Ratio and Interest Coverage Ratio.

- Efficiency Ratios: Evaluate how well a company utilizes its assets and resources, including Inventory Turnover and Asset Turnover Ratios.

Economic Indicators and Market Trends

Understanding economic indicators and market trends is crucial in fundamental analysis as they play a significant role in influencing stock prices and valuations.

When it comes to managing a stock portfolio, it’s crucial to have the best strategies in place. From diversification to risk management, having a solid plan can make all the difference in your investment success. To learn more about the best strategies for stock portfolio management , click here.

Impact of Economic Indicators on Stock Prices

Economic indicators such as GDP growth rate, inflation rate, employment data, and interest rates can have a direct impact on stock prices. For example, a strong GDP growth rate is usually associated with higher corporate profits, leading to an increase in stock prices. On the other hand, rising inflation or interest rates may negatively affect stock prices as they can erode company earnings and reduce consumer spending.

When it comes to managing your stock portfolio, it’s crucial to have the best strategies in place. From diversification to risk management, having a solid plan can make all the difference in your investment success. Check out this resource on best strategies for stock portfolio management to learn more about how you can optimize your portfolio for maximum returns.

Market Trends Influence on Fundamental Analysis

Market trends, such as bull and bear markets, can significantly influence fundamental analysis. During a bull market, where stock prices are rising, companies tend to perform better due to increased investor confidence and economic growth. This can lead to higher stock valuations based on positive earnings forecasts and growth prospects. Conversely, in a bear market, where stock prices are falling, companies may struggle to meet earnings expectations, leading to lower stock valuations.

Examples of Macroeconomic Factors Affecting Stock Valuations

- Political Stability: Uncertainty in the political landscape can lead to market volatility and impact stock prices.

- Consumer Confidence: High consumer confidence usually translates to increased spending, benefiting companies and boosting stock valuations.

- Global Economic Conditions: Factors such as trade agreements, currency fluctuations, and economic growth in other countries can affect stock valuations of multinational companies.

Company Valuation Methods

:max_bytes(150000):strip_icc()/FundamentalAnalysis_Final_4195918-eea2436ba2374e23930b0a482adbea2f.jpg?w=700)

When it comes to valuing a company, there are several methods that investors can use to determine the intrinsic value of a stock. Some of the most common valuation methods include discounted cash flow (DCF), price-to-earnings (P/E) ratio, and price-to-book (P/B) ratio.

Discounted Cash Flow (DCF)

Discounted Cash Flow analysis is a valuation method that estimates the value of an investment based on its expected future cash flows. Investors calculate the present value of these cash flows to determine the intrinsic value of a company. The formula for DCF is as follows:

DCF = CF1 / (1+r)^1 + CF2 / (1+r)^2 + … + CFn / (1+r)^n

Where CF represents the cash flow for each period, r is the discount rate, and n is the number of periods.

Price-to-Earnings (P/E) Ratio

The Price-to-Earnings ratio is a popular valuation metric that compares a company’s current stock price to its earnings per share (EPS). It provides investors with an indication of how much they are willing to pay for each dollar of earnings generated by the company. The formula for P/E ratio is:

P/E Ratio = Price per Share / Earnings per Share

Price-to-Book (P/B) Ratio

The Price-to-Book ratio compares a company’s market value to its book value, which is the value of its assets minus its liabilities. This ratio helps investors assess whether a stock is undervalued or overvalued relative to its accounting value. The formula for P/B ratio is:

P/B Ratio = Price per Share / Book Value per Share

Importance of Considering Qualitative Factors in Company Valuation

In addition to quantitative metrics like DCF, P/E ratio, and P/B ratio, it is crucial for investors to consider qualitative factors when valuing a company. Qualitative factors can provide valuable insights into a company’s management team, competitive advantages, brand reputation, industry trends, and overall business strategy. By combining both quantitative and qualitative analysis, investors can make more informed decisions when determining the intrinsic value of a stock.

Industry Analysis

Industry analysis is a crucial component of fundamental analysis when evaluating potential investment opportunities in the stock market. By understanding the dynamics of a particular industry, investors can make more informed decisions regarding which companies to invest in.

Conducting Industry Analysis

When conducting industry analysis, investors typically consider various factors to assess the overall health and future prospects of a specific industry. This process involves examining market trends, competitive landscape, regulatory environment, and technological advancements that could impact the industry’s growth potential.

Key Factors to Consider

- Market Size and Growth: Analyzing the size of the market and its growth prospects can provide insights into the potential opportunities for companies operating within the industry.

- Competitive Landscape: Understanding the competitive dynamics within an industry, including the market share of key players and barriers to entry, is essential for evaluating the profitability of investments.

- Regulatory Environment: Changes in regulations or government policies can significantly impact the operations and profitability of companies within a particular industry.

- Technological Trends: Assessing technological advancements and innovations within an industry can help investors identify companies that are well-positioned to capitalize on emerging trends.

Benefits of Industry Analysis

Industry analysis plays a crucial role in helping investors make informed investment decisions by providing a comprehensive understanding of the external factors that could impact a company’s performance. By conducting thorough industry analysis, investors can identify potential risks and opportunities within a specific industry, allowing them to allocate their capital more effectively.

Risks and Limitations of Fundamental Analysis

When using fundamental analysis to evaluate stocks, it is important to be aware of the risks and limitations associated with this approach. Understanding these factors can help investors make more informed decisions and mitigate potential downsides.

Limitations of Fundamental Analysis

While fundamental analysis is a valuable tool for evaluating stocks, it may not be suitable for certain types of investments. For example, companies in emerging industries or those with high volatility may not have historical data that is reliable for analysis. In such cases, fundamental analysis may provide limited insights into the true value of the stock.

Common Risks Associated with Fundamental Analysis

- Market Sentiment: Fundamental analysis does not account for market sentiment or investor emotions, which can have a significant impact on stock prices.

- External Factors: Changes in government regulations, economic conditions, or industry trends can affect a company’s performance, making it challenging to predict future outcomes based solely on historical data.

- Accounting Practices: Companies may use creative accounting techniques to manipulate financial statements, leading to inaccurate valuation based on fundamental analysis.

- Unexpected Events: Unforeseen events such as natural disasters, geopolitical conflicts, or global pandemics can disrupt the market and company operations, making fundamental analysis less reliable.

Strategies to Mitigate Risks in Fundamental Analysis, Fundamental analysis for stocks

- Diversification: Spreading investments across different industries and asset classes can help reduce the impact of individual stock analysis errors.

- Combining Analysis Methods: Integrating technical analysis or qualitative factors with fundamental analysis can provide a more comprehensive view of stock valuation.

- Continuous Monitoring: Regularly reviewing financial statements, economic indicators, and market trends can help investors stay informed and adjust their strategies accordingly.

- Consulting Experts: Seeking advice from financial advisors or industry professionals can offer additional insights and perspectives to complement fundamental analysis.

Wrap-Up: Fundamental Analysis For Stocks

In conclusion, mastering the art of fundamental analysis for stocks is key to navigating the complex world of stock evaluation with confidence and precision. Armed with the insights and strategies discussed, you are now better equipped to uncover hidden opportunities and mitigate risks effectively.