Forex sentiment analysis tools sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with ahrefs author style and brimming with originality from the outset.

Understanding market sentiment is crucial in Forex trading, and having the right tools can make all the difference. In this guide, we’ll explore the world of Forex sentiment analysis tools, their importance, types, functionalities, and best practices.

Importance of Forex sentiment analysis tools

Forex sentiment analysis tools play a crucial role in helping traders make informed decisions in the foreign exchange market. By analyzing the collective sentiment of market participants, these tools provide valuable insights into market dynamics and trends.

Impact on Trading Decisions

- Sentiment analysis tools can help traders gauge market sentiment towards a particular currency pair, allowing them to anticipate potential price movements.

- By identifying overbought or oversold conditions based on sentiment data, traders can make more accurate entry and exit decisions.

- Tracking sentiment changes can alert traders to shifts in market sentiment, enabling them to adjust their trading strategies accordingly.

Benefits for Forex Traders

- Improved Decision-Making: Sentiment analysis tools provide traders with additional information beyond technical and fundamental analysis, enhancing their decision-making process.

- Risk Management: By incorporating sentiment analysis into their trading strategies, traders can better manage risks associated with market sentiment shifts.

- Enhanced Strategy Development: Understanding market sentiment can help traders develop more effective trading strategies tailored to prevailing market conditions.

Types of Forex sentiment analysis tools

When it comes to Forex trading, sentiment analysis tools play a crucial role in helping traders make informed decisions. There are different types of sentiment analysis tools available in the market, each offering unique features and functionalities. Let’s explore some of these types and compare automated tools with manual ones.

Automated sentiment analysis tools

Automated sentiment analysis tools utilize algorithms and machine learning to analyze vast amounts of data quickly. These tools can scan news articles, social media platforms, and other sources to gauge market sentiment accurately. Some popular automated sentiment analysis tools in the Forex market include:

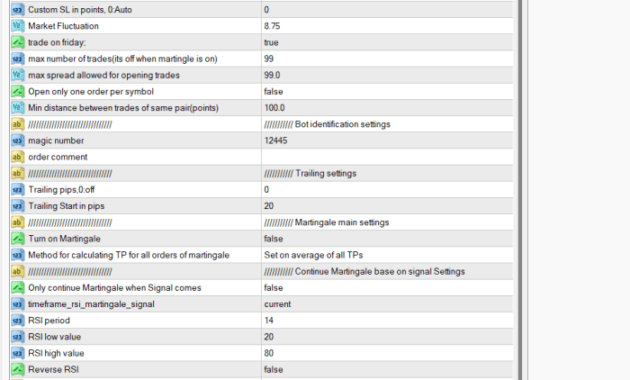

– MetaTrader 4/5: These platforms offer built-in sentiment analysis tools that provide traders with real-time market sentiment data.

– Forex Sentiment Indicator: This tool displays the sentiment of retail traders, helping traders gauge market sentiment.

Manual sentiment analysis tools

Manual sentiment analysis tools, on the other hand, rely on human judgment to interpret market sentiment. While they may be more time-consuming, manual tools allow traders to incorporate qualitative factors into their analysis. Some examples of manual sentiment analysis tools include:

– Trader Sentiment Surveys: Surveys conducted among traders to gather opinions on market sentiment.

– Expert Analysis: Market analysts who provide insights and opinions on market sentiment based on their experience and expertise.

By comparing automated and manual sentiment analysis tools, traders can choose the right tools that align with their trading strategies and preferences. Each type has its advantages and limitations, so it’s essential to understand how they work before making a decision.

How Forex sentiment analysis tools work

Forex sentiment analysis tools work by analyzing and interpreting market sentiment to help traders make informed decisions. These tools use a combination of data sources, algorithms, and indicators to gauge the overall feeling of market participants towards a particular currency pair or asset.

Role of AI and machine learning

AI and machine learning play a crucial role in developing advanced sentiment analysis tools for Forex trading. These technologies enable the tools to process vast amounts of data quickly and accurately, identify patterns, and make predictions based on historical data and real-time market conditions.

- AI algorithms can analyze social media posts, news articles, and other sources of information to determine the sentiment of market participants.

- Machine learning models can learn from past market behavior and adapt to changing market conditions to provide more accurate sentiment analysis.

- These technologies help sentiment analysis tools to filter out noise and focus on relevant information that can impact market sentiment.

Indicators used by sentiment analysis tools

Sentiment analysis tools use a variety of indicators to gauge market sentiment and provide traders with valuable insights. Some common indicators include:

- Social media sentiment: Monitoring social media platforms for mentions, hashtags, and sentiment towards a particular currency pair or asset.

- News sentiment: Analyzing news articles, headlines, and press releases to assess the overall sentiment of the market towards a specific asset.

- Market positioning: Looking at the positioning of traders in the market, such as long or short positions, to gauge sentiment and potential market movements.

Best practices for using Forex sentiment analysis tools

Utilizing Forex sentiment analysis tools effectively can significantly enhance a trader’s decision-making process. Below are some best practices to consider when using these tools:

Tip #1: Combine sentiment analysis with technical analysis

One of the best practices is to integrate sentiment analysis with technical analysis. By combining these two approaches, traders can gain a more comprehensive view of the market dynamics and make more informed trading decisions.

Tip #2: Use sentiment analysis as a confirmation tool, Forex sentiment analysis tools

Instead of relying solely on sentiment analysis, consider using it as a confirmation tool. Validate your trading decisions with sentiment data to reduce the risk of making impulsive trades based on emotions.

Tip #3: Monitor sentiment trends over time

It’s essential to track sentiment trends over time to identify any shifts in market sentiment. By monitoring sentiment data regularly, traders can adapt their strategies accordingly and stay ahead of potential market movements.

Common Mistakes to Avoid:

- Not considering other forms of analysis: Avoid relying solely on sentiment analysis without incorporating technical and fundamental analysis.

- Ignoring the context: Be cautious of interpreting sentiment data without considering the broader market context and news events.

- Overreacting to sentiment shifts: Avoid making sudden trading decisions based solely on short-term sentiment fluctuations.

Integrating sentiment analysis with technical and fundamental analysis

By combining sentiment analysis with technical and fundamental analysis, traders can develop a well-rounded trading strategy that considers market sentiment alongside other critical factors. This integration provides a more holistic view of the market and can lead to better trading decisions.

Final Conclusion

In conclusion, Forex sentiment analysis tools play a pivotal role in helping traders navigate the complexities of the Forex market by providing valuable insights into market sentiment. By leveraging these tools effectively, traders can make more informed decisions and enhance their trading strategies. Stay ahead of the game with the power of sentiment analysis tools in your trading arsenal.

When it comes to trading NZD/USD, efficiency is key. By utilizing the right strategies and tools, you can trade NZD/USD efficiently and maximize your profits. Keeping an eye on market trends, setting clear goals, and managing risk effectively are all essential components of successful trading in this currency pair.

When it comes to trading NZD/USD, efficiency is key to success in the forex market. By staying informed about market trends and using the right tools, you can trade NZD/USD efficiently and maximize your profits. Keep a close eye on economic indicators and geopolitical events that may impact the currency pair, and always have a solid risk management strategy in place.

With the right approach, you can navigate the volatility of the NZD/USD pair with confidence.