Fibonacci retracement strategy takes center stage in the world of trading, offering a unique approach to analyzing market trends and making informed decisions. Dive into this comprehensive guide to unlock the potential of Fibonacci levels and enhance your trading skills.

Explore the intricacies of Fibonacci retracement and gain valuable insights into how you can leverage this strategy to navigate the complexities of the financial markets with confidence.

Definition of Fibonacci Retracement Strategy

Fibonacci retracement is a technical analysis tool used by traders to identify potential levels of support and resistance in a financial market. It is based on the Fibonacci sequence, where each number is the sum of the two preceding ones (0, 1, 1, 2, 3, 5, 8, 13, etc.). These numbers are then used to determine key levels where a price may reverse or continue its trend.

How Fibonacci Levels are Used in Technical Analysis, Fibonacci retracement strategy

Fibonacci retracement levels are horizontal lines drawn on a price chart indicating potential areas of support or resistance. These levels are derived from the ratios of the Fibonacci sequence, such as 23.6%, 38.2%, 50%, 61.8%, and 100%. Traders use these levels to anticipate where a price may retrace before continuing in the direction of the trend.

- Traders look for price retracements to these Fibonacci levels after a significant price move to identify potential entry points.

- The most commonly used Fibonacci retracement levels are 38.2%, 50%, and 61.8%, which are considered strong support or resistance areas.

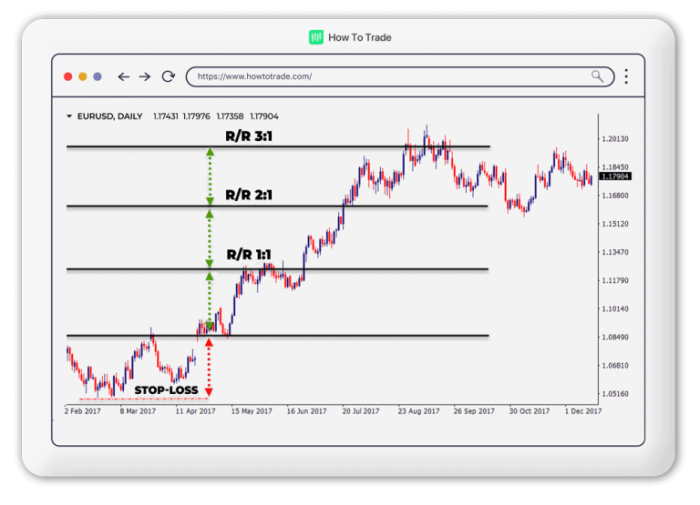

- These levels can help traders set stop-loss orders, target prices, and determine the overall risk/reward ratio of a trade.

Examples of Fibonacci Retracement Levels in a Price Chart

Fibonacci retracement levels can be seen on a price chart when connecting a significant low to a significant high or vice versa. The retracement levels then become potential areas where the price may reverse or continue its trend.

For example, if a stock price increases from $50 to $100 and then retraces back to $75, traders may use Fibonacci retracement levels to determine potential support levels for a buying opportunity.

How to Apply Fibonacci Retracement Strategy

Fibonacci retracement levels can be effectively used by traders to identify potential support and resistance levels in financial markets. By applying these key levels, traders can make informed decisions on entry and exit points for their trades.

Identifying Key Fibonacci Levels

- 23.6%: This level is often considered the shallowest retracement level and is commonly used to identify potential pullback levels in an ongoing trend.

- 38.2%: The 38.2% level is another important retracement level that signifies a deeper pullback in the price action, often used as a confirmation of a trend reversal.

- 50%: The 50% retracement level is not a traditional Fibonacci number but is widely used by traders to indicate a significant price level where a trend may continue or reverse.

- 61.8%: Known as the “Golden Ratio,” the 61.8% level is one of the most crucial Fibonacci retracement levels. It often acts as a strong support or resistance level in the market.

- 100%: While not a retracement level, the 100% level represents the starting point of the price movement and is often used as a reference point for measuring retracements.

Utilizing Fibonacci Retracement in Trading

Traders use Fibonacci retracement levels in various ways to make trading decisions. For example, when a price retraces to a key Fibonacci level, traders may look for potential entry points in the direction of the prevailing trend. Conversely, if the price approaches a Fibonacci level and shows signs of rejection, traders may consider exiting their positions or taking profits.

Overall, the Fibonacci retracement strategy provides traders with valuable insights into market dynamics and helps them anticipate potential price movements based on historical patterns and key support/resistance levels.

Common Mistakes to Avoid

When using Fibonacci retracement as part of your trading strategy, there are some common mistakes that traders often make. It is important to be aware of these pitfalls to maximize the effectiveness of this technical tool.

Avoid Relying Solely on Fibonacci Retracement

- One common mistake is relying solely on Fibonacci retracement levels without considering other technical indicators. While Fibonacci retracement can be a powerful tool, it is essential to combine it with other indicators for confirmation.

- Using Fibonacci retracement in isolation can lead to false signals and misinterpretations, potentially resulting in poor trading decisions.

Importance of Combining with Other Technical Indicators

- It is crucial to combine Fibonacci retracement with other technical indicators such as moving averages, trend lines, or oscillators to confirm potential reversal points.

- By using multiple indicators in conjunction with Fibonacci retracement, traders can reduce the risk of false signals and increase the accuracy of their trading decisions.

Tips to Avoid Misinterpreting Fibonacci Retracement Levels

- Ensure that you are using Fibonacci retracement correctly by identifying significant swing highs and lows to draw the retracement levels accurately.

- Avoid forcing Fibonacci retracement levels to fit a particular bias or preconceived notion, as this can lead to misinterpretations and incorrect trading decisions.

- Always consider the overall market context and use Fibonacci retracement as a supplementary tool rather than a standalone indicator.

Fibonacci Retracement Extensions

Fibonacci retracement extensions are levels that go beyond the typical retracement levels and are used by traders to set profit targets. These extension levels are based on the Fibonacci sequence and are used to identify potential areas where the price of an asset might reverse or continue its current trend.

How Fibonacci Extensions Differ from Retracement Levels

Fibonacci retracement levels are used to identify potential support and resistance levels based on the Fibonacci sequence. On the other hand, Fibonacci extensions are used to set profit targets beyond the typical retracement levels. While retracement levels are used to predict potential price reversals, extension levels are used to identify where the price might continue its existing trend.

- Fibonacci retracement levels typically include 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These levels are used to identify potential areas of support or resistance.

- Fibonacci extension levels go beyond 100% and include levels such as 127.2%, 161.8%, 200%, and even 261.8%. These levels are used to set profit targets for traders.

How Traders Use Fibonacci Extensions to Set Profit Targets

Traders use Fibonacci extensions to set profit targets by identifying key extension levels that align with the direction of the trend. For example, if a trader identifies an uptrend and wants to set a profit target, they may look to Fibonacci extension levels to determine where the price could potentially reach before reversing.

By setting profit targets using Fibonacci extensions, traders can have a clearer plan in place for when to exit a trade and take profits.

Examples of Fibonacci Extension Levels in a Trading Scenario

In a trading scenario, let’s say a trader identifies an uptrend in a stock and wants to set a profit target. They may use Fibonacci extension levels to determine potential target levels. If the stock price is moving up and the trader believes it will continue, they may look to levels such as 127.2% or 161.8% as potential profit targets.

- For instance, if the stock price is at $100 and the trader sets a profit target at the 161.8% Fibonacci extension level, the target price would be $161.80.

- Traders can use these extension levels to plan their trades and manage risk effectively by setting profit targets based on key Fibonacci extension levels.

Last Word

In conclusion, Fibonacci retracement strategy stands as a formidable tool for traders seeking to decode market movements and identify strategic entry and exit points. By mastering the art of Fibonacci levels, you can elevate your trading prowess and achieve greater success in the dynamic world of finance.

When diving into the world of Forex trading, beginners often find themselves overwhelmed with the plethora of strategies available. However, finding the best Forex trading strategies for beginners can make a significant difference in their trading journey. Whether it’s focusing on technical analysis, fundamental analysis, or a combination of both, having a solid strategy in place is crucial.

To help beginners navigate this complex market, here are some of the best Forex trading strategies for beginners to consider.

When it comes to diving into the world of Forex trading, beginners often find themselves overwhelmed with the multitude of strategies available. However, finding the best Forex trading strategies for beginners can significantly impact their success in this volatile market.

Whether it’s understanding technical analysis, mastering risk management, or developing a solid trading plan, having the right strategies in place is crucial. Check out this comprehensive guide on Best Forex trading strategies for beginners to kickstart your trading journey with confidence.