EUR/USD volatility sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with ahrefs author style and brimming with originality from the outset.

Volatility in the EUR/USD pair is a dynamic and complex phenomenon that is influenced by various factors, from economic indicators to central bank policies. In this comprehensive guide, we explore the intricacies of EUR/USD volatility, providing insights and strategies for traders and investors alike.

Understanding EUR/USD Volatility

When it comes to understanding EUR/USD volatility, it is important to consider the various factors that can impact the movement of this currency pair. Economic indicators, interest rates, and other external factors all play a role in determining the volatility of the EUR/USD pair.

Factors Contributing to EUR/USD Volatility

Economic indicators such as GDP growth, inflation rates, and employment data can have a significant impact on the volatility of the EUR/USD pair. Positive economic data from the Eurozone or the United States can lead to a strengthening of the respective currencies, causing the exchange rate to fluctuate. On the other hand, negative economic data can lead to increased volatility as investors react to the news.

Impact of Economic Indicators

Economic indicators are closely watched by traders and investors as they provide valuable insights into the health of the economy. Strong economic data can lead to increased confidence in a currency, driving up its value relative to others. This can result in higher volatility as market participants adjust their positions based on the new information.

Relationship Between Interest Rates and EUR/USD Volatility

Interest rates set by central banks also play a crucial role in determining the volatility of the EUR/USD pair. When interest rates in the Eurozone are higher than those in the United States, investors may flock to the Euro, leading to an increase in its value and higher volatility. Conversely, lower interest rates in the Eurozone compared to the US can lead to a weakening of the Euro and higher volatility in the currency pair.

Historical Analysis of EUR/USD Volatility

Understanding the historical context of EUR/USD volatility can provide valuable insights into the factors that influence this currency pair’s fluctuations.

Significant Events Impacting EUR/USD Volatility

Several significant events have caused high volatility in the EUR/USD pair. For example:

- The Global Financial Crisis in 2008 led to a surge in volatility as market participants reacted to the uncertainty and risk aversion.

- The Eurozone debt crisis in 2011 also contributed to heightened volatility as concerns about the stability of the eurozone countries affected the exchange rate.

- The Brexit referendum in 2016 caused a sharp increase in volatility as the outcome of the vote had profound implications for the future of the UK and the European Union.

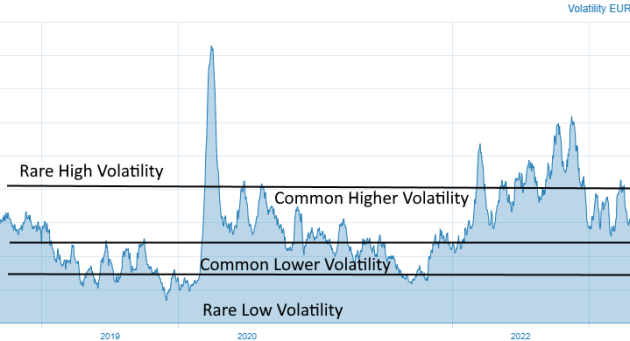

Comparing High and Low Volatility Periods

Periods of high and low volatility in the EUR/USD pair can be starkly different in terms of market behavior and sentiment:

- High volatility periods are often characterized by sharp price movements, increased trading volumes, and heightened uncertainty among market participants.

- Low volatility periods, on the other hand, may indicate a more stable market environment with less dramatic price fluctuations and reduced trading activity.

Geopolitical Events and EUR/USD Volatility

Geopolitical events play a crucial role in influencing EUR/USD volatility due to their impact on global economic conditions and market sentiment:

- Events such as elections, trade negotiations, geopolitical tensions, and policy decisions by central banks can all contribute to fluctuations in the EUR/USD exchange rate.

- Positive developments, such as trade agreements or political stability, may lead to a decrease in volatility, while negative events can trigger increased market uncertainty and higher levels of volatility.

Trading Strategies for EUR/USD Volatility

When trading the EUR/USD pair, volatility can present both opportunities and risks. Traders must have a solid understanding of different strategies to navigate the market effectively.

Common Trading Strategies

- Day Trading: Traders can take advantage of short-term price fluctuations by opening and closing positions within the same trading day.

- Swing Trading: This strategy involves holding positions for a few days to a few weeks to capitalize on medium-term price movements.

- Breakout Trading: Traders look for key levels of support and resistance and enter positions when the price breaks out of these levels, indicating potential momentum.

Using Technical Analysis

Technical analysis plays a crucial role in predicting EUR/USD volatility. Traders can use various indicators such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify trends, support/resistance levels, and overbought/oversold conditions. Additionally, chart patterns like head and shoulders, triangles, and flags can provide valuable insights into potential price movements.

Risk Management Techniques, EUR/USD volatility

- Setting Stop-Loss Orders: Traders should always have a predefined exit point to limit potential losses in case the trade goes against them.

- Position Sizing: Properly sizing positions based on risk tolerance and account size is essential to manage losses during volatile times.

- Diversification: Avoiding overexposure to a single trade or currency pair can help mitigate risks associated with sudden price movements.

Impact of Central Bank Policies on EUR/USD Volatility

Central banks play a crucial role in influencing the volatility of the EUR/USD currency pair through their monetary policy decisions. These decisions can have a significant impact on the exchange rate dynamics between the Euro and the US Dollar.

Role of Central Banks in Influencing EUR/USD Volatility

Central banks, such as the European Central Bank (ECB) and the Federal Reserve (Fed), have the power to set interest rates, implement quantitative easing programs, and intervene in the foreign exchange market. These actions can affect investor confidence, inflation rates, and economic growth, leading to fluctuations in the EUR/USD exchange rate.

- Interest Rate Decisions: Central banks adjust interest rates to control inflation and stimulate economic activity. Higher interest rates attract foreign capital, strengthening the local currency (Euro) and potentially causing the EUR/USD exchange rate to appreciate.

- Quantitative Easing (QE) Programs: Central banks may implement QE programs to inject liquidity into the financial system. This can lead to a depreciation of the local currency (Euro) as more money flows into the economy, potentially causing the EUR/USD exchange rate to depreciate.

- Foreign Exchange Interventions: Central banks can directly intervene in the foreign exchange market by buying or selling currencies to stabilize the exchange rate. These interventions can impact market sentiment and influence the direction of the EUR/USD exchange rate.

Effects of Central Bank Decisions on the EUR/USD Exchange Rate

Central bank decisions, such as interest rate changes or QE programs, can lead to immediate reactions in the currency markets. Traders and investors closely monitor central bank announcements and adjust their positions based on expectations of future policy actions. This can result in increased volatility in the EUR/USD exchange rate.

- Forward Guidance: Central banks provide forward guidance on future policy actions, which can influence market expectations and impact the EUR/USD exchange rate. Clarity and consistency in central bank communication are essential for market stability.

- Market Sentiment: Central bank decisions can affect market sentiment and investor confidence. Positive economic indicators or dovish policy statements may lead to a stronger Euro and a higher EUR/USD exchange rate, while negative news can have the opposite effect.

Quantitative Easing Programs and EUR/USD Volatility

Quantitative easing programs implemented by central banks can have a significant impact on EUR/USD volatility. When a central bank engages in QE by purchasing government bonds or other assets, it increases the money supply in the economy, leading to a potential depreciation of the local currency (Euro).

Quantitative easing can result in lower interest rates, reduced bond yields, and increased risk appetite among investors. This can lead to a weaker Euro and higher volatility in the EUR/USD exchange rate.

Ultimate Conclusion

In conclusion, EUR/USD volatility is a key aspect of the forex market that requires a deep understanding of its drivers and implications. By delving into the historical analysis, trading strategies, and central bank impact, one can navigate the turbulent waters of EUR/USD with confidence and knowledge. Stay informed, stay proactive, and embrace the opportunities that volatility presents.