Starting with EUR/USD analysis, we delve into the intricate world of forex trading, exploring the historical context, economic significance, and the impact of various factors on this popular currency pair.

As we navigate through the complexities of the EUR/USD market, we uncover key indicators, geopolitical events, technical analysis tools, trading strategies, and correlations with other assets that shape its movements.

Overview of EUR/USD

The EUR/USD pair is one of the most traded currency pairs in the forex market, representing the exchange rate between the Euro and the US Dollar. Let’s delve into the history and significance of this important pair.

Brief History of EUR/USD

The EUR/USD pair was introduced in 1999 when the Euro was officially adopted as the currency of the Eurozone. Initially, the exchange rate was set at 1.1686, and since then, it has experienced fluctuations driven by various economic factors.

Significance of EUR/USD

The EUR/USD pair is considered a major currency pair and is highly liquid, making it attractive to traders. As the most traded pair in the forex market, it often serves as a barometer for the overall health of the global economy. Movements in the EUR/USD pair can also impact other currency pairs and financial markets.

Impact of Economic Indicators on EUR/USD

Economic indicators such as GDP growth, inflation rates, interest rates, and employment data play a significant role in influencing the value of the EUR/USD pair. Positive economic data from the Eurozone or the US can strengthen the respective currency, leading to an appreciation of the pair. On the other hand, negative economic indicators can weaken the currencies and result in a depreciation of the pair.

Factors influencing EUR/USD

The EUR/USD exchange rate is influenced by a variety of factors, including economic indicators, geopolitical events, and interest rates. Understanding these key factors is crucial for traders and investors looking to predict and capitalize on movements in the currency pair.

Economic Indicators

Economic indicators play a significant role in determining the strength of the Euro and the US Dollar. Key indicators such as GDP growth, inflation rates, unemployment figures, and consumer confidence can impact the value of each currency. For example, a strong GDP growth in the Eurozone compared to the US could lead to a stronger Euro against the Dollar.

Geopolitical Events

Geopolitical events can have a major impact on the EUR/USD exchange rate. Events such as political instability, trade wars, and Brexit negotiations can create uncertainty in the market, leading to fluctuations in the currency pair. For instance, the outcome of trade negotiations between the US and the EU can significantly affect the value of the Euro.

Interest Rates

Interest rates set by central banks play a crucial role in determining the strength of a currency. Higher interest rates tend to attract foreign investment, leading to an appreciation of the currency. In the case of the EUR/USD pair, changes in the interest rates set by the European Central Bank (ECB) and the Federal Reserve can impact the exchange rate. For example, if the ECB raises interest rates while the Fed keeps rates unchanged, the Euro is likely to strengthen against the Dollar.

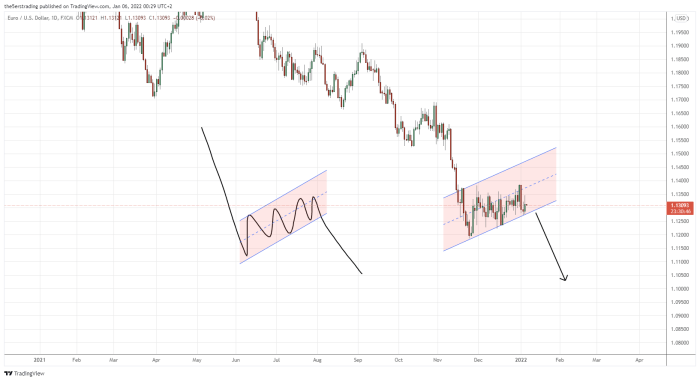

Technical analysis of EUR/USD

When it comes to analyzing the EUR/USD currency pair from a technical perspective, traders often rely on a combination of technical indicators, support and resistance levels, and chart patterns to make informed trading decisions.

Common Technical Indicators

Technical indicators are mathematical calculations based on historical price, volume, or open interest data. Some of the common technical indicators used to analyze the EUR/USD pair include:

- Simple Moving Average (SMA) – Helps identify trends by smoothing out price data over a specific period.

- Relative Strength Index (RSI) – Measures the speed and change of price movements to determine overbought or oversold conditions.

- Bollinger Bands – Consist of a simple moving average and two standard deviations bands to indicate volatility and potential price reversal points.

- MACD (Moving Average Convergence Divergence) – Shows the relationship between two moving averages to identify trend strength and potential reversals.

Support and Resistance Levels

Support and resistance levels play a crucial role in technical analysis as they represent key price levels where a currency pair is likely to experience buying or selling pressure. Traders often use these levels to identify potential entry and exit points for their trades. In the case of EUR/USD, support levels are price levels where buying interest is expected to be strong, preventing the price from falling further. On the other hand, resistance levels are price levels where selling interest is anticipated, capping further price increases.

Chart Patterns

Chart patterns are visual representations of price movements that traders use to predict future price direction. Some common chart patterns used in analyzing the EUR/USD pair include:

- Head and Shoulders – A reversal pattern that indicates a potential change in trend direction.

- Double Top/Bottom – Signals a potential reversal in the current trend.

- Ascending/Descending Triangle – Indicates a continuation pattern where the price is likely to break out in the direction of the previous trend.

- Flags and Pennants – Consolidation patterns that usually lead to a continuation of the existing trend.

Trading strategies for EUR/USD

When it comes to trading the EUR/USD pair, there are several popular strategies that traders can implement to maximize profits and minimize risks. It is important to have a clear understanding of the market dynamics and factors that influence the exchange rate between the Euro and the US Dollar in order to develop effective trading strategies.

Popular strategies for trading EUR/USD

- Breakout Trading: This strategy involves entering a trade when the price breaks out of a predefined range, either above resistance or below support levels. Traders can capitalize on the momentum of the breakout to make profitable trades.

- Trend Trading: Traders can follow the prevailing trend in the EUR/USD pair and enter trades in the direction of the trend. This strategy involves identifying higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend.

- Range Trading: Range-bound traders look to buy at support levels and sell at resistance levels within a defined price range. This strategy is ideal when the market is consolidating and not trending strongly in either direction.

Risk management techniques specific to EUR/USD trading

- Use Stop-Loss Orders: Implementing stop-loss orders can help limit potential losses by automatically closing a trade when the price reaches a predetermined level. This helps protect capital and manage risk effectively.

- Position Sizing: Properly sizing positions based on the account size and risk tolerance is crucial for managing risk in EUR/USD trading. Traders should not risk more than a small percentage of their capital on any single trade.

- Diversification: Avoid overexposure to the EUR/USD pair by diversifying the trading portfolio across different currency pairs or asset classes. This can help reduce overall risk and protect against sudden market movements.

Tips for beginners looking to trade the EUR/USD pair

- Educate Yourself: Before diving into trading the EUR/USD pair, beginners should take the time to educate themselves about fundamental and technical analysis, market trends, and risk management techniques.

- Start Small: Begin with a demo account or trade with a small amount of capital to gain experience and confidence in trading the EUR/USD pair. This allows beginners to practice their strategies without risking significant losses.

- Stay Informed: Keep up to date with economic indicators, geopolitical events, and central bank announcements that can impact the exchange rate between the Euro and the US Dollar. Staying informed helps traders make well-informed decisions.

EUR/USD correlation with other assets: EUR/USD Analysis

When analyzing the EUR/USD currency pair, it’s essential to consider its correlation with other assets, as these relationships can provide valuable insights into market dynamics and potential trading opportunities.

Correlation between EUR/USD and commodities, EUR/USD analysis

Commodities, such as gold, oil, and agricultural products, can have a significant impact on the EUR/USD exchange rate. For example, a rise in commodity prices could lead to an increase in inflation, which may weaken the value of the euro against the US dollar. Traders often monitor commodity prices as an indicator of potential movements in the EUR/USD pair.

Impact of equity markets on EUR/USD

Equity markets, including stock indices like the S&P 500 and the Dow Jones Industrial Average, can also influence the EUR/USD exchange rate. Positive performance in equity markets is generally associated with risk-on sentiment, which can lead to a stronger euro against the dollar. On the other hand, a downturn in equities may result in a flight to safety, boosting the value of the US dollar relative to the euro.

Relationship between EUR/USD and other major currency pairs

The EUR/USD is closely correlated with other major currency pairs, such as GBP/USD, USD/JPY, and AUD/USD. Changes in one currency pair can often impact the movements of others, especially when there are fundamental factors at play. For example, if the US Federal Reserve raises interest rates, this could lead to a stronger dollar against the euro and other currencies.

Last Recap

In conclusion, the EUR/USD analysis provides valuable insights into the multifaceted nature of this currency pair, offering traders a comprehensive understanding of the market dynamics to make informed decisions.