Emerging market stocks offer a unique blend of potential growth and risks, making them a compelling investment option for many. Exploring the intricacies of these stocks unveils a world of opportunities and challenges that investors need to navigate carefully.

Overview of Emerging Market Stocks

Emerging market stocks refer to stocks of companies located in countries that are considered to be at a stage of rapid economic development. These countries are often characterized by lower income levels, high growth potential, and higher risk compared to developed markets.

Characteristics of Emerging Market Stocks

- Higher growth potential: Emerging markets typically experience faster economic growth compared to developed markets, offering the potential for higher returns on investments.

- Higher volatility: Due to factors such as political instability, currency fluctuations, and regulatory changes, emerging market stocks tend to be more volatile than those in developed markets.

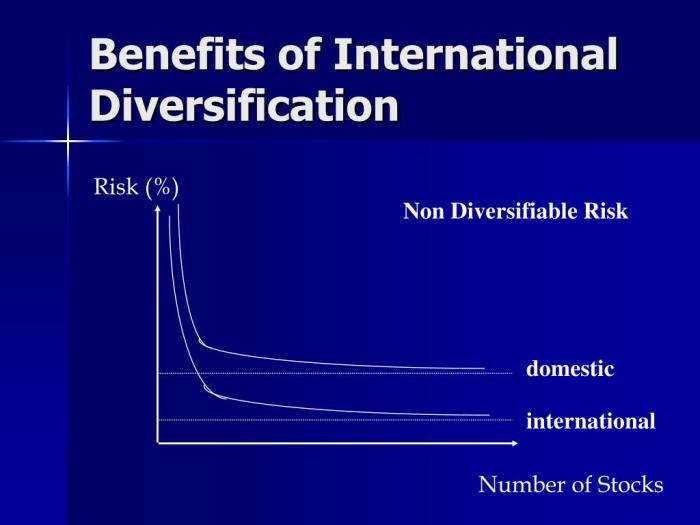

- Diversification benefits: Investing in emerging market stocks can provide diversification benefits to a portfolio, as their performance may not always be correlated with that of developed markets.

- Opportunity for early-stage investing: Emerging market stocks offer the opportunity to invest in companies that are in the early stages of growth, potentially providing significant returns over the long term.

Examples of Emerging Market Countries and Their Stock Markets

| Country | Stock Market |

|---|---|

| China | Shanghai Stock Exchange, Shenzhen Stock Exchange |

| India | Bombay Stock Exchange, National Stock Exchange of India |

| Brazil | B3 (Bovespa) Stock Exchange |

| Russia | Moscow Exchange |

| South Africa | Johannesburg Stock Exchange |

Factors Influencing Emerging Market Stocks

Emerging market stocks are influenced by a variety of factors, including political conditions, economic indicators, and global events. Understanding these factors is crucial for investors looking to navigate the dynamic landscape of emerging markets.

Are you looking for the best dividend stocks to buy? Look no further! Our latest research has identified some top-performing stocks that offer great dividends. Check out our detailed analysis and recommendations on Best dividend stocks to buy to make informed investment decisions.

Political Factors Affecting Emerging Market Stocks

Political stability, government policies, and regulatory changes can significantly impact emerging market stocks. Political unrest, corruption scandals, or changes in leadership can create uncertainty and lead to fluctuations in stock prices.

- Government stability is crucial for investor confidence in emerging markets.

- Regulatory changes, such as tax reforms or trade policies, can affect the profitability of companies operating in these markets.

- Political events like elections or geopolitical tensions can create volatility in stock prices.

Economic Indicators Impacting Emerging Market Stocks

Economic indicators play a vital role in determining the health of emerging market stocks. Factors such as GDP growth, inflation rates, and interest rates can influence investor sentiment and stock performance.

Looking for the best dividend stocks to buy? Check out our latest research on the top picks that offer great returns and stability in the market. Whether you’re a seasoned investor or just starting out, these stocks could be the perfect addition to your portfolio.

Click here to read more about best dividend stocks to buy.

- GDP growth rates reflect the overall economic performance of a country and can impact corporate earnings.

- Inflation rates can erode purchasing power and affect consumer spending, ultimately impacting company revenues.

- Interest rate changes by central banks can influence borrowing costs for businesses and consumer spending patterns.

Global Events Influence on Emerging Market Stocks

Global events, such as trade agreements, natural disasters, or pandemics, can have ripple effects on emerging market stocks. These events can create opportunities or challenges for companies operating in these markets.

- Trade agreements can open up new markets for emerging market companies, leading to growth opportunities.

- Natural disasters can disrupt supply chains and impact the production capabilities of companies, affecting stock prices.

- Pandemics, like the COVID-19 outbreak, can lead to economic downturns and market volatility in emerging economies.

Risks and Opportunities in Emerging Market Stocks

Investing in emerging market stocks can offer significant opportunities for growth, but it also comes with its fair share of risks. Understanding these risks and opportunities is crucial for investors looking to capitalize on the potential of emerging markets.

Common Risks Associated with Investing in Emerging Market Stocks

- Political instability: Emerging markets are often more prone to political upheavals, which can lead to sudden changes in policies and regulations affecting investments.

- Currency risk: Fluctuations in exchange rates can impact the value of investments in emerging market stocks, leading to potential losses for investors.

- Lack of liquidity: Some emerging market stocks may have lower trading volumes, making it difficult to buy or sell shares quickly at desired prices.

- Legal and regulatory risks: Emerging markets may have less developed legal systems, increasing the risk of fraudulent activities or inadequate investor protection.

Potential Opportunities for Growth in Emerging Market Stocks

- Rapid economic growth: Emerging markets often experience faster economic growth rates compared to developed markets, providing opportunities for companies to expand and increase profits.

- Youthful demographics: Many emerging markets have a young and growing population, creating a large consumer base for companies to target with their products and services.

- Untapped markets: Emerging markets offer opportunities for companies to enter new markets and establish a strong presence before competitors, leading to potential market dominance.

Strategies to Mitigate Risks When Investing in Emerging Market Stocks

- Diversification: Spread investments across different emerging markets and asset classes to reduce concentration risk.

- Research and due diligence: Conduct thorough research on companies and markets before investing to understand the risks involved and make informed decisions.

- Long-term perspective: Adopt a long-term investment horizon to ride out short-term volatility and benefit from the growth potential of emerging markets.

- Use of hedging instruments: Consider using options, futures, or currency hedging to mitigate currency and market risks associated with investing in emerging market stocks.

Performance Comparison with Developed Market Stocks

Emerging market stocks and developed market stocks are often compared in terms of performance to assess their risk and return characteristics. Let’s delve into the differences between the two and analyze historical data to understand how emerging market stocks have fared relative to developed markets.

Risk and Return Differences

In general, emerging market stocks tend to offer higher potential returns compared to developed market stocks. This higher return potential is often attributed to the higher risk associated with investing in emerging markets. Factors such as political instability, currency fluctuations, and less developed regulatory frameworks can contribute to higher volatility in emerging market stocks.

On the other hand, developed market stocks are considered more stable and less risky due to established regulatory environments, better infrastructure, and higher levels of investor protection. However, this stability often comes at the cost of lower potential returns compared to emerging markets.

Historical Performance Analysis

Analyzing historical data can provide insights into how emerging market stocks have performed relative to developed market stocks over time. While emerging market stocks have shown periods of high volatility, they have also delivered strong returns during certain periods of economic growth and market booms.

Developed market stocks, on the other hand, have demonstrated more stable performance with lower volatility. However, during certain economic downturns or market corrections, emerging market stocks have sometimes outperformed developed market stocks due to their higher growth potential.

Overall, the performance comparison between emerging market stocks and developed market stocks highlights the trade-off between risk and return that investors need to consider when making investment decisions in global equity markets.

Last Word

In conclusion, Emerging market stocks present investors with a dynamic landscape where risks and opportunities intertwine. Understanding the nuances of these stocks is key to making informed investment decisions in the ever-evolving global market.