With Diversifying your stock portfolio for less risk at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling filled with unexpected twists and insights.

Diversifying your stock portfolio is a critical strategy for minimizing risk and maximizing returns in the ever-changing world of investing. By spreading your investments across various asset classes, you can shield yourself from market volatility and potentially achieve more stable long-term growth. This guide explores the importance of diversification, different types of investments to consider, risk management techniques, and the advantages of international diversification. Let’s delve into the world of diversifying your stock portfolio for less risk.

Importance of Diversification: Diversifying Your Stock Portfolio For Less Risk

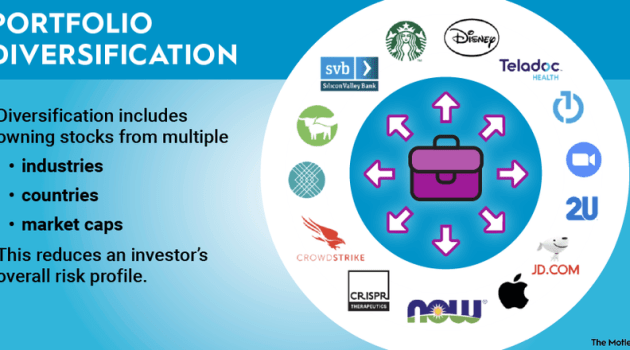

Diversifying a stock portfolio is crucial for reducing risk in investments. By spreading investments across different asset classes, sectors, and geographical regions, investors can minimize the impact of any one investment underperforming.

Protection Against Market Volatility

Diversification can protect against market volatility by ensuring that a decline in one asset class is offset by gains in another. For example, during times of economic downturn, defensive stocks like utilities and consumer staples may outperform while other sectors struggle.

Stable Returns Over Time

Diversification helps achieve more stable returns over time by smoothing out the fluctuations in the overall portfolio. By including a mix of low-risk and high-risk investments, investors can potentially reduce the overall volatility of their portfolio and improve the chances of consistent returns.

Types of Investments for Diversification

When diversifying your stock portfolio, it is essential to consider various asset classes to spread out risk and optimize returns. Different types of investments offer varying levels of risk and return potential, making it crucial to understand the characteristics of each asset class.

Stocks

Stocks represent ownership in a company and are known for their potential high returns but also high volatility. Investing in a diverse range of stocks across industries and market capitalizations can help mitigate risk.

Bonds

Bonds are debt securities issued by governments or corporations, offering fixed interest payments over a specified period. Bonds are generally considered less risky than stocks but provide lower returns. Including bonds in your portfolio can add stability and income generation.

Real Estate

Real estate investments involve purchasing properties directly or through real estate investment trusts (REITs). Real estate can provide a hedge against inflation and offer a steady income stream through rental payments or property appreciation.

Commodities

Commodities include physical goods such as gold, oil, and agricultural products. Investing in commodities can help diversify your portfolio and protect against inflation or economic downturns. However, commodity prices can be volatile.

Alternative Investments

Alternative investments like hedge funds, private equity, and venture capital offer unique investment opportunities with potentially higher returns. These investments are less correlated with traditional asset classes, providing further diversification benefits.

Strategies for Allocation, Diversifying your stock portfolio for less risk

To optimize diversification, consider allocating funds across different asset classes based on your investment goals, risk tolerance, and time horizon. One common strategy is the “60-40” rule, allocating 60% of your portfolio to stocks and 40% to bonds. Regularly rebalancing your portfolio can help maintain your desired asset allocation and manage risk effectively.

Risk Management Techniques

When it comes to managing risks in a diversified stock portfolio, there are several techniques that investors can employ to help protect their investments and minimize potential losses.

One effective method is dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy can help reduce the impact of market volatility on your portfolio, as you are consistently buying shares at different price points.

Role of Rebalancing

Rebalancing is another crucial risk management technique that helps investors maintain the desired level of diversification in their portfolio. Over time, the value of different assets in your portfolio may fluctuate, leading to an imbalance in your original asset allocation. By periodically rebalancing your portfolio, you can realign your investments to ensure they are in line with your risk tolerance and financial goals.

- Rebalancing involves selling assets that have performed well and buying assets that have underperformed to bring your portfolio back to its target allocation.

- It helps prevent your portfolio from becoming too concentrated in a particular asset class, reducing the overall risk exposure.

- Regular rebalancing ensures that you are not overly exposed to the risks associated with a single investment, sector, or market condition.

By regularly rebalancing your portfolio, you can maintain the desired level of diversification and reduce the impact of market fluctuations on your investments.

Setting Stop-loss Orders

In addition to dollar-cost averaging and rebalancing, setting stop-loss orders can be a valuable risk management tool for investors with a diversified portfolio. A stop-loss order is a preset instruction to sell a security when it reaches a certain price, helping limit potential losses in case of a market downturn.

- Stop-loss orders allow investors to establish an exit strategy before emotions take over during market fluctuations.

- They help protect gains and limit losses by automatically triggering a sale when a security’s price falls to a specified level.

- Setting stop-loss orders can help investors control risk and prevent significant portfolio losses in volatile market conditions.

By using stop-loss orders in conjunction with other risk management techniques, investors can safeguard their diversified portfolio against unexpected market events and minimize potential downside risks.

International Diversification

International diversification involves including stocks from different countries in your portfolio to reduce risk and potentially increase returns. By investing in international markets, you can benefit from the growth of economies outside your home country and gain exposure to different industries and currencies.

Benefits of International Diversification

- Diversification of Political and Economic Risks: Investing in multiple countries can help mitigate the impact of political instability or economic downturns in any single country.

- Access to Emerging Markets: Including developing countries in your portfolio can provide opportunities for high growth potential that may not be available domestically.

- Currency Diversification: Holding assets denominated in different currencies can protect your portfolio from fluctuations in exchange rates.

Risks of International Investing and Risk Management

- Foreign Exchange Risk: Changes in currency values can impact the returns of international investments. Hedging strategies or investing in currency-hedged funds can help manage this risk.

- Political and Regulatory Risks: Different countries have varying levels of political stability and regulatory environments. Conducting thorough research and staying informed can help mitigate these risks.

- Market Volatility: International markets may experience higher levels of volatility compared to domestic markets. Diversifying across countries and regions can help spread this risk.

Impact of Global Economic Trends on International Diversification

- Trade Policies: Changes in trade agreements or tariffs can affect international investments, especially in sectors that rely heavily on global trade.

- Interest Rates: Variations in interest rates across countries can impact the performance of international investments, particularly in fixed-income securities.

- Global Economic Growth: Shifts in global economic growth rates can influence the performance of international stocks, as companies may derive a significant portion of their revenue from overseas markets.

Last Point

In conclusion, diversifying your stock portfolio is not just a smart move but a necessary one to navigate the unpredictable nature of the market. By incorporating a mix of assets, managing risks effectively, and exploring international markets, you can build a more resilient investment portfolio. Embrace diversification as your ally in the journey towards financial stability and growth.

When it comes to navigating the unpredictable world of investments, having solid Stock Market Strategies is crucial. Whether you’re a seasoned investor or just starting out, understanding different approaches like value investing, growth investing, or day trading can help you make informed decisions.

It’s essential to diversify your portfolio, stay updated on market trends, and never invest more than you can afford to lose. By following proven strategies and staying disciplined, you can increase your chances of success in the stock market.

When it comes to navigating the unpredictable world of investments, having solid Stock Market Strategies is crucial. Whether you’re a seasoned investor or just starting out, understanding the ins and outs of the stock market can make a significant difference in your portfolio.

From long-term investments to day trading, having a clear strategy can help you mitigate risks and maximize returns. It’s essential to stay informed about market trends and economic indicators to make well-informed decisions.