Diversification in Forex portfolio is a critical strategy that can enhance performance and reduce risks. By exploring various methods and techniques, investors can achieve a well-rounded approach to trading in the forex market.

Understanding the importance of diversification, implementing effective risk management techniques, and knowing how to monitor and rebalance a diversified portfolio are key components to success in forex trading.

Importance of Diversification in Forex Portfolio

Diversification is a crucial strategy in a forex portfolio as it helps spread risk across different assets, which can help protect against large losses from any single trade or currency pair. By diversifying, traders can potentially reduce the impact of unexpected market movements and increase the chances of overall portfolio stability.

Mitigating Risks through Diversification

- Diversifying across multiple currency pairs: By trading different currency pairs, traders can minimize the impact of adverse movements in a single pair. For example, if one currency pair experiences a sharp decline, gains in another pair can help offset the losses.

- Combining different trading strategies: Utilizing a mix of trading strategies, such as trend following, range trading, and breakout trading, can help diversify risk and capture opportunities in various market conditions. This approach can reduce the reliance on a single strategy that may underperform in certain market environments.

- Including non-correlated assets: In addition to forex trades, incorporating other asset classes like stocks, commodities, or bonds can further diversify a portfolio. These assets may have different risk-return profiles compared to currencies, providing additional protection against market fluctuations.

Improving Portfolio Performance through Diversification

- Enhancing risk-adjusted returns: Diversification can potentially improve the risk-adjusted returns of a forex portfolio by reducing volatility and enhancing consistency in performance. By spreading risk across different assets, traders can achieve a more stable growth trajectory over time.

- Expanding opportunities for profit: By diversifying across multiple instruments and strategies, traders can increase the chances of capturing profitable opportunities in various market conditions. This approach allows for a more balanced exposure to different market dynamics, leading to a more robust portfolio performance.

- Reducing dependency on single trades: Relying on a single trade or currency pair can expose traders to significant risks if that position turns unfavorable. Diversification helps mitigate this risk by distributing capital across multiple assets, reducing the impact of any individual trade on overall portfolio performance.

Strategies for Diversifying a Forex Portfolio

Diversifying a forex portfolio is crucial for managing risk and maximizing potential returns. There are different methods for diversifying a forex portfolio, including investing in various asset classes and currency pairs.

Comparing Asset Classes

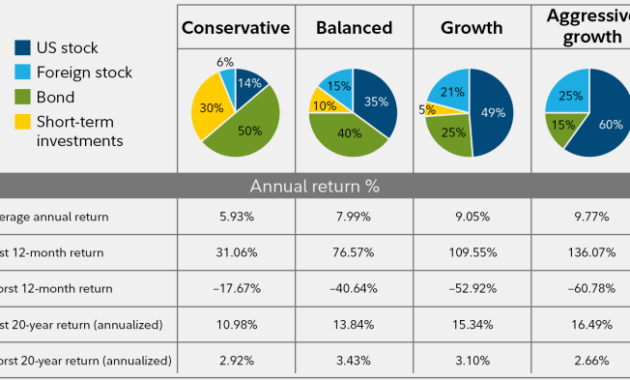

When diversifying a forex portfolio, investors can include different asset classes such as currencies, commodities, stocks, and bonds. Each asset class has its own risk and return characteristics, so combining them in a portfolio can help spread risk and enhance overall performance. For example, while currencies are highly liquid and offer opportunities for profit through volatility, commodities like gold can act as a hedge against inflation and geopolitical risks.

Diversifying Currency Pairs, Diversification in Forex portfolio

Another effective strategy for diversifying a forex portfolio is to trade across different currency pairs. By spreading investments across various currency pairs, investors can reduce the impact of adverse movements in a single currency. This can help mitigate risk and improve the overall risk-adjusted returns of the portfolio. For instance, pairing major currencies like EUR/USD with exotic currencies like USD/TRY can provide a balance between liquidity and volatility.

Benefits of Diversification

Diversifying across different currency pairs can offer several benefits, including:

- Reduced risk through exposure to multiple markets

- Enhanced potential for profit by capturing opportunities in various currency pairs

- Improved risk-adjusted returns by balancing out the impact of individual currency movements

Overall, diversification in a forex portfolio is essential for managing risk and optimizing returns in the dynamic and volatile foreign exchange market.

Risk Management Techniques in Diversified Forex Portfolios: Diversification In Forex Portfolio

Effective risk management is crucial in maintaining a diversified forex portfolio to protect against potential losses and ensure long-term success. By implementing a well-thought-out risk management plan, traders can mitigate risks and optimize their trading strategies for better overall performance.

Designing a Risk Management Plan

- Set Risk Tolerance Levels: Determine the maximum amount of risk you are willing to take on each trade or overall in the portfolio.

- Implement Stop-Loss Orders: Utilize stop-loss orders to automatically close positions at a predetermined price level to limit potential losses.

- Diversify Across Currency Pairs: Spread risk by trading multiple currency pairs to reduce exposure to any single currency’s fluctuations.

- Use Proper Position Sizing: Calculate the appropriate position size based on your risk tolerance and stop-loss levels to manage risk effectively.

Importance of Stop-Loss Orders and Position Sizing

- Stop-Loss Orders: These orders help traders control risk by defining a predetermined exit point for a trade, preventing emotional decision-making and limiting potential losses.

- Position Sizing: Proper position sizing ensures that each trade’s risk is proportionate to the overall portfolio size, helping traders avoid overexposure and maintain a balanced risk-reward ratio.

Monitoring and Rebalancing a Diversified Forex Portfolio

Monitoring and rebalancing a diversified forex portfolio is crucial to ensure optimal performance and risk management. By regularly assessing the portfolio’s performance and making necessary adjustments, investors can maintain a balanced and profitable investment strategy.

Best Practices for Monitoring a Diversified Forex Portfolio

- Regularly review the performance of each asset in the portfolio to identify strengths and weaknesses.

- Utilize technical analysis tools and indicators to track market trends and potential opportunities for adjustment.

- Stay informed about global economic events and news that may impact currency values and market dynamics.

Key Indicators for Rebalancing a Diversified Forex Portfolio

- Significant changes in currency exchange rates that deviate from the expected patterns.

- Increased volatility in the forex market, signaling potential risks to the portfolio’s stability.

- Shifts in global economic conditions or geopolitical events that may affect currency values.

Adjusting Asset Allocation based on Market Conditions

- Consider reallocating assets to reduce exposure to high-risk currencies or regions experiencing instability.

- Diversify across different currency pairs to spread risk and take advantage of various market opportunities.

- Implement stop-loss orders and profit targets to manage risks and protect gains in a volatile market.

Ending Remarks

In conclusion, Diversification in Forex portfolio is not just a recommendation, but a necessity for traders looking to thrive in the dynamic forex market. By diversifying intelligently and managing risks effectively, investors can position themselves for long-term success and growth.

When it comes to trading in the forex market, having access to reliable Forex sentiment analysis tools can make a huge difference in your decision-making process. These tools provide valuable insights into the market sentiment, helping traders make more informed choices.

By utilizing these tools effectively, traders can better predict market movements and adjust their strategies accordingly.

When it comes to analyzing forex sentiment, having the right tools is crucial. One of the most effective tools in the market is the Forex sentiment analysis tools which provides valuable insights into market trends and trader behavior. By utilizing these tools, traders can make more informed decisions and improve their overall trading strategy.