Delving into Contrarian stock market strategies, this introduction immerses readers in a unique and compelling narrative, with ahrefs author style that is both engaging and thought-provoking from the very first sentence.

Contrarian stock market strategies involve a distinct approach to investing that goes against the crowd, offering potential for lucrative opportunities in undervalued assets. As we explore the various types, identification methods, and risks associated with this strategy, readers will gain valuable insights into the world of contrarian investing.

Overview of Contrarian Stock Market Strategies

Contrarian stock market strategies involve going against the prevailing market sentiment and making investment decisions that are contrary to popular opinion. This approach often involves buying assets that are undervalued or selling assets that are overvalued, based on the belief that the market tends to overreact to news and events in the short term.

Basic Principles of Contrarian Investing

Contrarian investing is grounded in the belief that the market is not always efficient and that prices can deviate from their intrinsic value due to irrational behavior by investors. Contrarians typically look for opportunities where the market has mispriced assets, either undervaluing or overvaluing them, and take positions that go against the prevailing trend.

- Contrarians focus on buying assets that are undervalued and have the potential for long-term growth, even if they are currently out of favor with the market.

- Contrarians also look for opportunities to sell assets that are overvalued and likely to decline in value, based on the belief that markets tend to revert to their mean over time.

- Contrarian investors often have a long-term perspective and are willing to withstand short-term volatility in exchange for potential returns that may materialize in the future.

Benefits of Adopting a Contrarian Approach in the Stock Market, Contrarian stock market strategies

Contrarian investing can offer several benefits for investors who are willing to go against the crowd and take a different approach to the stock market.

- Opportunity to buy assets at a discount: Contrarians can capitalize on market overreactions by buying undervalued assets that have the potential for significant upside as their true value is recognized.

- Reduced risk of following the herd: By going against the prevailing market sentiment, contrarian investors can avoid the pitfalls of herd mentality and make decisions based on their own analysis and research.

- Potential for outsized returns: Contrarian strategies have the potential to deliver outsized returns when the market eventually recognizes the true value of undervalued assets, leading to significant price appreciation.

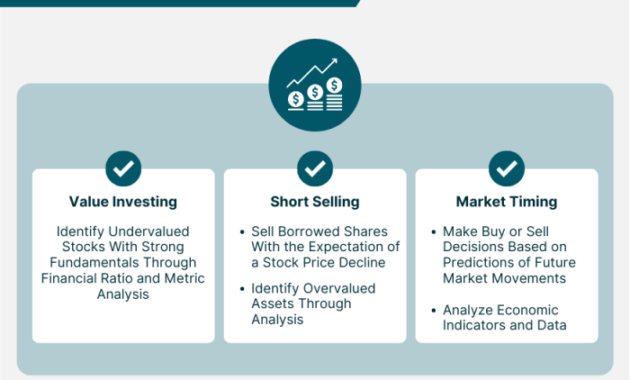

Types of Contrarian Strategies

Contrarian strategies in the stock market involve going against the crowd, often buying assets that are undervalued or selling those that are overvalued. There are several types of contrarian strategies that investors can utilize to capitalize on market inefficiencies.

Value Investing

Value investing is a contrarian strategy popularized by legendary investor Warren Buffett. This strategy involves identifying undervalued stocks that are trading below their intrinsic value. Value investors seek to buy these stocks and hold them for the long term, banking on the market eventually recognizing their true worth.

Bottom Fishing

Bottom fishing is another contrarian strategy that involves buying assets that have experienced a sharp decline in price. Investors employing this strategy believe that the market has overreacted to negative news or events, leading to an exaggerated drop in price. By buying at the bottom, investors hope to profit when the asset eventually rebounds.

Sentiment Analysis

Contrarian investors also use sentiment analysis to gauge market sentiment and make investment decisions based on the prevailing mood of other market participants. When sentiment is overly optimistic or pessimistic, contrarians may take the opposite stance, betting on a reversal in market sentiment.

Successful Contrarian Investors

Some successful contrarian investors who have made a name for themselves by following these strategies include David Dreman, Joel Greenblatt, and Seth Klarman. Each of these investors has their own unique approach to contrarian investing, but they all share a common belief in the importance of going against the crowd and being patient in their investment decisions.

Identifying Contrarian Opportunities

Investors looking to capitalize on contrarian opportunities in the stock market need to have a keen eye for undervalued or overlooked assets. By identifying stocks that are currently out of favor with the market but have strong fundamentals, investors can potentially benefit from future price appreciation.

Key Indicators of Undervalued Stocks

- Low Price-to-Earnings (P/E) Ratio: A low P/E ratio compared to industry peers may indicate that a stock is undervalued.

- High Dividend Yield: Stocks with a high dividend yield relative to their price may be undervalued.

- Price-to-Book (P/B) Ratio: A low P/B ratio can suggest that a stock is trading below its intrinsic value.

Signals of Overlooked Stocks

- Lack of Analyst Coverage: Stocks with limited analyst coverage may be overlooked by the market, presenting an opportunity for contrarian investors.

- Negative Sentiment: Stocks that are subject to negative sentiment or news flow may be unduly discounted, providing a contrarian buying opportunity.

- Contrarian News: Positive developments or improvements in a company that go unnoticed by the market can signal an opportunity for contrarian investors.

Research and Analysis Methods

- Financial Statement Analysis: Conduct a thorough review of a company’s financial statements to assess its financial health and performance.

- Industry Analysis: Compare a company’s performance and valuation metrics with industry peers to identify potential discrepancies.

- Market Sentiment Analysis: Monitor market sentiment, news, and social media to gauge the overall sentiment towards a stock.

Risks and Challenges of Contrarian Investing

Contrarian investing, like any other investment strategy, comes with its own set of risks and challenges that investors need to be aware of. Understanding these risks and challenges is crucial for successful implementation of contrarian stock market strategies.

Market Volatility

Market volatility is a significant risk associated with contrarian investing. Contrarian investors often go against the prevailing market sentiment, which can lead to increased volatility in their portfolios. Sudden market fluctuations can result in significant losses if the contrarian bet does not play out as expected. It is essential for contrarian investors to have a high tolerance for risk and be prepared for short-term fluctuations in the market.

Lack of Market Support

Another challenge that contrarian investors may face is the lack of market support for their investment decisions. Going against the crowd means that contrarian investors may not receive validation or support from other market participants. This lack of support can make it difficult to stay the course and stick to the contrarian strategy during periods of market uncertainty or negative sentiment.

Overcoming Challenges

To manage the risks and challenges associated with contrarian investing, investors can adopt several strategies. Diversification is key to mitigating risk in a contrarian portfolio. By spreading investments across different asset classes and sectors, investors can reduce the impact of any single contrarian bet gone wrong. Additionally, maintaining a long-term perspective and staying disciplined during times of market turbulence can help contrarian investors weather short-term fluctuations and stay focused on their investment goals.

Closure: Contrarian Stock Market Strategies

In conclusion, Contrarian stock market strategies provide a fresh perspective on investing, opening doors to overlooked opportunities and potential growth. By understanding the principles, strategies, and challenges of contrarian investing, individuals can navigate the stock market with a unique and informed approach.

When it comes to investing, one of the key decisions is choosing between small-cap and large-cap stocks. Small-cap stocks are known for their potential growth opportunities, while large-cap stocks offer stability and established track records. Understanding the differences between the two can help investors make informed decisions.

To learn more about the distinctions between small-cap and large-cap stocks, check out this detailed guide on Small-cap vs large-cap stocks.

When it comes to investing, one of the key decisions investors need to make is whether to focus on small-cap or large-cap stocks. Small-cap stocks are known for their potential for high growth but also come with higher risk. On the other hand, large-cap stocks are more stable and established companies with a lower growth potential.

Understanding the differences between small-cap and large-cap stocks can help investors make informed decisions based on their risk tolerance and investment goals.