Compound (COMP) lending benefits immerse readers into the world of decentralized finance, offering a unique perspective on maximizing returns and liquidity in the cryptocurrency space.

Exploring the intricacies of Compound (COMP) lending, this article delves into its advantages, risks, and comparisons with other DeFi platforms, providing valuable insights for both novice and experienced investors.

Introduction to Compound (COMP) lending

Compound (COMP) lending is a key component of the decentralized finance (DeFi) ecosystem, offering a unique way for users to earn interest on their cryptocurrency holdings. In essence, Compound allows individuals to lend out their digital assets to others in exchange for interest payments. This peer-to-peer lending model operates without the need for traditional financial intermediaries, providing users with greater control over their funds.

How Compound (COMP) lending works and its significance in DeFi

Compound works by users depositing their cryptocurrency into smart contracts, which are then utilized to facilitate lending activities. These funds can be borrowed by other users who pledge collateral in the form of their own assets. The interest rates are algorithmically determined based on the supply and demand dynamics of each asset, ensuring a fair and efficient marketplace.

One of the main advantages of Compound lending is its decentralized nature, which eliminates the need for trust in third parties. Users retain ownership of their assets throughout the lending process, reducing counterparty risk and enhancing security. Additionally, the interest rates on Compound are typically higher than those offered by traditional banks, providing an attractive opportunity for users to earn passive income on their cryptocurrency holdings.

Benefits associated with Compound (COMP) lending

- Competitive interest rates: Compound offers competitive interest rates for both lenders and borrowers, making it an attractive option for individuals looking to maximize their returns.

- Instant access to funds: Users can withdraw their funds at any time without facing lengthy withdrawal periods or restrictions, providing flexibility and liquidity.

- Automatic interest accrual: Interest payments are automatically calculated and distributed to users based on their lending activities, streamlining the process and enhancing convenience.

- Diversification opportunities: Compound supports a wide range of cryptocurrencies, allowing users to diversify their holdings and minimize risk exposure.

Advantages of Compound (COMP) lending: Compound (COMP) Lending Benefits

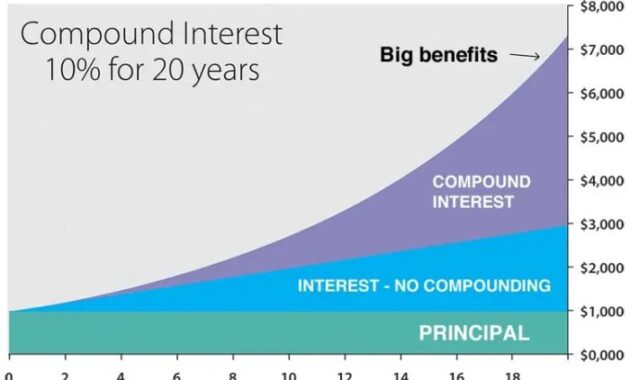

Compound (COMP) lending offers several advantages compared to traditional banking. One key benefit is the ability to earn interest on deposited assets, providing users with a passive income stream. This interest can often be higher than what traditional banks offer, allowing users to potentially earn more on their idle funds.

Potential for Higher Returns

One of the major advantages of Compound (COMP) lending is the potential for higher returns on investments. By utilizing decentralized finance platforms like Compound, users can access a wide range of lending and borrowing opportunities that may offer higher interest rates compared to traditional financial institutions. This can result in increased profits for investors looking to grow their wealth.

Liquidity for Users, Compound (COMP) lending benefits

Another advantage of Compound (COMP) lending is the liquidity it provides to users. Unlike traditional banking systems that may have restrictions on withdrawing funds or accessing assets, Compound allows users to easily deposit and withdraw funds as needed. This flexibility ensures that users have access to their assets when they need them, providing a level of financial freedom not typically found in traditional banking systems.

Risks and considerations in Compound (COMP) lending

When engaging in Compound (COMP) lending, it is crucial for users to be aware of the risks involved to make informed decisions. Understanding market volatility and smart contract risks is essential to mitigate potential losses and ensure the safety of your investments.

Market Volatility Risks

Market volatility can significantly impact the value of assets deposited in Compound (COMP) lending platforms. Sudden price fluctuations in cryptocurrencies or other digital assets can lead to liquidation events, resulting in the loss of deposited funds. It is important for users to monitor market trends closely and be prepared for potential risks associated with price volatility.

Smart Contract Risks

Smart contracts are the backbone of decentralized finance (DeFi) platforms like Compound (COMP). While smart contracts are designed to be secure and reliable, they are not immune to vulnerabilities or bugs. In the event of a smart contract exploit or hack, users may lose their deposited funds. It is crucial for users to conduct proper due diligence on the smart contracts used in Compound (COMP) lending and only engage with reputable platforms with a proven track record of security.

How to Mitigate Risks

To mitigate risks when engaging in Compound (COMP) lending, users can take several precautions. Diversifying their investments across different assets can help reduce exposure to a single asset’s volatility. Setting stop-loss orders and utilizing risk management strategies can also protect against unexpected market movements. Additionally, staying informed about the latest developments in the DeFi space and regularly auditing smart contracts can further enhance security and mitigate risks associated with smart contract vulnerabilities.

Comparison with other DeFi lending platforms

When comparing Compound (COMP) lending with other popular DeFi lending platforms like Aave or MakerDAO, several key differences come to light. These variations include interest rates, collateral requirements, and user experience. Let’s delve into the unique features that set Compound (COMP) lending apart from its competitors.

Interest Rates

Compound (COMP) lending offers dynamic interest rates that adjust based on the supply and demand within the platform. This feature provides users with the potential for higher or lower interest rates compared to fixed rates offered by other platforms like Aave or MakerDAO.

Collateral Requirements

One of the distinguishing factors of Compound (COMP) lending is its collateral requirements. Users can borrow funds by providing collateral in the form of various cryptocurrencies, allowing for greater flexibility compared to platforms with stricter collateral requirements like MakerDAO.

User Experience

Compound (COMP) lending is known for its user-friendly interface and seamless borrowing and lending processes. The platform’s intuitive design and transparent governance model contribute to a positive user experience, setting it apart from competitors like Aave or MakerDAO.

Final Review

In conclusion, Compound (COMP) lending stands out as a lucrative opportunity for those looking to explore the world of decentralized finance, offering a blend of high returns, liquidity, and unique features that set it apart from its competitors. Dive into the world of Compound (COMP) lending and seize the benefits it has to offer in the ever-evolving landscape of DeFi.

When it comes to blockchain technology, understanding the concept of oracles is crucial. One of the most popular oracle solutions is Chainlink. If you’re looking to delve deeper into the world of oracles, this article on Chainlink oracle integration explained will provide you with a comprehensive overview of how Chainlink integrates with various platforms and its impact on the blockchain ecosystem.

When it comes to decentralized finance (DeFi) projects, the integration of oracles plays a crucial role in ensuring the accuracy and reliability of data feeds. One of the most prominent oracle solutions in the market is Chainlink, known for its secure and decentralized data oracles.

To understand how Chainlink oracle integration works, check out this comprehensive guide on Chainlink oracle integration explained. Learn how Chainlink connects smart contracts with real-world data sources seamlessly.