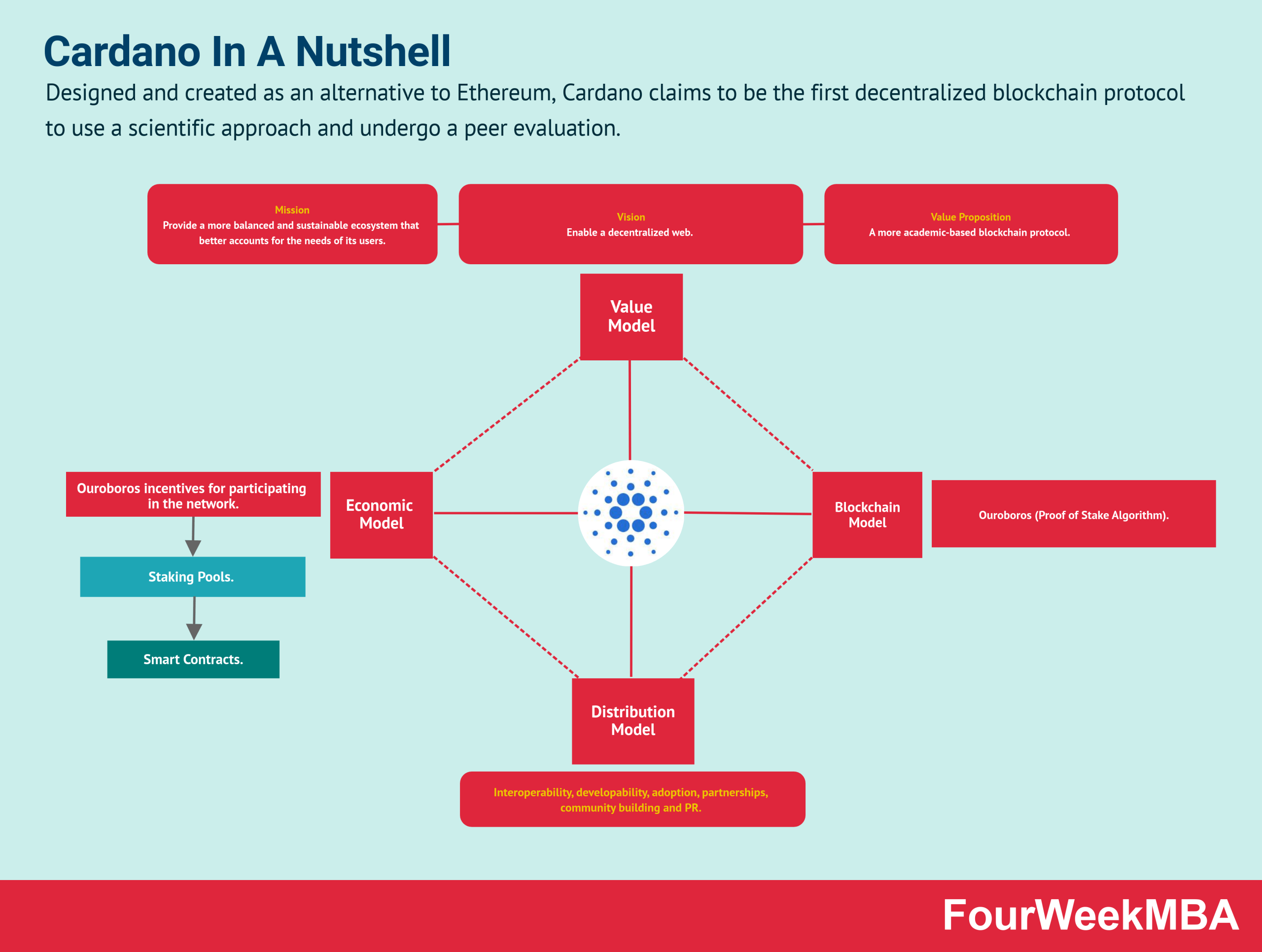

Cardano staking rewards offer a unique opportunity for crypto enthusiasts to earn passive income. By diving into the world of staking, participants can maximize their earnings while navigating potential risks. Let’s explore the ins and outs of Cardano staking rewards in this comprehensive guide.

What is Cardano staking rewards?

Cardano staking rewards refer to the incentives received by participants who hold and delegate their ADA cryptocurrency to help secure the Cardano network through a process known as staking. Staking rewards are a way for users to earn passive income by actively participating in the network’s operations.

How Cardano staking rewards work

Staking on the Cardano network involves delegating ADA coins to a stake pool, which is a group of validators responsible for processing transactions and creating new blocks. By delegating their coins to a stake pool, users contribute to the network’s security and decentralization.

- When users delegate their ADA to a stake pool, they receive staking rewards in the form of additional ADA coins.

- The amount of staking rewards earned is determined by various factors, including the amount of ADA staked, the duration of staking, and the performance of the chosen stake pool.

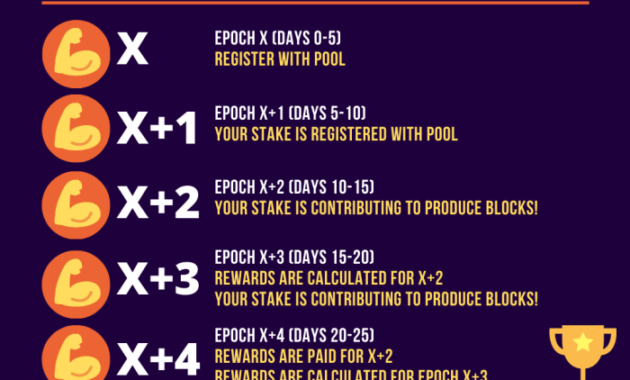

- Staking rewards are distributed periodically, usually every epoch (5 days), based on the pool’s performance and the amount of ADA delegated.

- Users can compound their staking rewards by reinvesting them back into the staking pool, allowing them to earn even more rewards over time.

Benefits of Cardano Staking Rewards

Earning staking rewards on the Cardano network comes with several advantages that contribute to the overall ecosystem and investor experience. Let’s explore the benefits of Cardano staking rewards in comparison to other blockchain networks.

1. Passive Income Generation

- Staking rewards provide investors with a passive income stream by simply holding their ADA tokens in a staking wallet.

- Cardano’s staking mechanism allows users to earn rewards without actively trading or participating in complex processes.

2. Secure and Decentralized Network, Cardano staking rewards

- By participating in staking, users help secure the Cardano network and contribute to its decentralization.

- Staking rewards incentivize holders to stake their ADA, which enhances network security and resilience against potential attacks.

3. Long-Term Investment Incentives

- Staking rewards encourage long-term holding of ADA tokens, fostering a more stable and sustainable investment environment.

- Investors are rewarded for their commitment to the Cardano ecosystem, promoting loyalty and continuous support for the network.

4. Competitive Rewards Structure

- Cardano offers competitive staking rewards compared to other blockchain networks, attracting more users to participate in staking.

- The transparent and fair reward distribution model of Cardano ensures that stakers receive their fair share of rewards based on their contributions.

How to maximize Cardano staking rewards

To maximize Cardano staking rewards, it’s essential to implement effective strategies that take into account various factors influencing the amount of rewards earned. By following best practices for staking ADA, you can optimize your rewards and enhance your overall staking experience.

Selecting a Reliable Pool

When staking ADA, one of the key factors that can impact your rewards is the pool you choose to delegate your stake to. It is crucial to select a reliable and trustworthy pool with a good track record of performance. Look for pools with a high pledge, consistent performance, and low fees to maximize your staking rewards.

Understanding Pool Performance Metrics

To maximize your staking rewards, it’s important to understand the various performance metrics associated with staking pools. Metrics such as return on stake, saturation level, and performance history can give you valuable insights into the potential rewards you can earn by delegating your stake to a particular pool. By analyzing these metrics, you can make informed decisions to optimize your staking rewards.

Regularly Reassessing Your Staking Strategy

As the Cardano network evolves and new pools emerge, it’s essential to regularly reassess your staking strategy to ensure you are maximizing your rewards. Keep track of pool performance, changes in fees, and saturation levels to make informed decisions about where to delegate your stake. By staying informed and adapting to changes in the network, you can optimize your staking rewards over time.

Diversifying Your Stake

Diversifying your stake across multiple pools can also help maximize your staking rewards. By spreading your ADA holdings across different pools, you can reduce the risk of downtime or underperformance in a single pool impacting your overall rewards. Diversification can help you maintain a more stable and consistent source of staking rewards.

Staying Informed and Engaged

Finally, staying informed and engaged with the Cardano community can also help you maximize your staking rewards. By actively participating in discussions, staying up to date on network developments, and sharing insights with other stakers, you can gain valuable knowledge that can enhance your staking strategy. Being an engaged member of the community can provide you with valuable insights and opportunities to optimize your staking rewards effectively.

Risks and considerations of Cardano staking rewards

When considering staking ADA on the Cardano network, it is essential to be aware of the potential risks and factors that could impact your staking rewards. Understanding these risks and considerations can help stakers make informed decisions and manage their investments effectively.

Security Risks

One of the main risks associated with staking on the Cardano network is the potential for security breaches or attacks. While Cardano is known for its robust security measures, no system is completely immune to cyber threats. Stakers should be cautious and take necessary precautions to safeguard their staked ADA.

Volatility in Staking Rewards

Another consideration for stakers is the volatility in staking rewards. The amount of rewards earned through staking can fluctuate based on various factors such as network activity, market conditions, and staking pool performance. Stakers should be prepared for fluctuations in their rewards and have a long-term investment perspective.

Regulatory Risks

Regulatory changes and compliance requirements can also pose risks to Cardano staking rewards. Stakers should stay informed about regulatory developments in the cryptocurrency space and ensure that they are in compliance with relevant laws and regulations. Non-compliance could result in penalties or loss of staking rewards.

External Factors Impacting Rewards

External factors such as technological advancements, competition from other blockchain networks, and changes in user behavior can also impact Cardano staking rewards. Stakers should stay updated on industry trends and developments to adapt their staking strategies accordingly and mitigate potential risks.

Closing Notes

In conclusion, Cardano staking rewards present a promising avenue for investors looking to grow their digital assets. By understanding the benefits, strategies, and risks involved, individuals can make informed decisions to enhance their staking experience on the Cardano network.