Calculating risk-to-reward ratio takes center stage in the world of finance, influencing crucial decision-making processes. Dive into the realm of investment strategies with this comprehensive guide.

Explore the significance of accurately calculating risk-to-reward ratio and learn how to apply it effectively in your investment endeavors.

Understanding Risk-to-Reward Ratio

In the world of finance and investing, the risk-to-reward ratio is a crucial concept that helps investors assess the potential return on investment relative to the risk involved. It is a calculation that allows investors to weigh the potential profit against the potential loss of an investment.

The risk-to-reward ratio influences decision-making in finance by providing a clear framework for evaluating investment opportunities. By comparing the potential reward of an investment to the amount of risk involved, investors can make more informed decisions and manage their portfolio effectively.

High Risk-to-Reward Ratio Scenario

A high risk-to-reward ratio scenario typically involves an investment with a high potential return but also a significant amount of risk. For example, investing in a speculative startup company with the potential for exponential growth but a high likelihood of failure would be considered a high risk-to-reward ratio scenario. While the potential reward is substantial, the risk of losing the entire investment is equally high.

Low Risk-to-Reward Ratio Scenario, Calculating risk-to-reward ratio

Conversely, a low risk-to-reward ratio scenario involves an investment with a lower potential return but also lower risk. Investing in a stable, blue-chip company with steady growth and consistent dividends would be an example of a low risk-to-reward ratio scenario. While the potential reward may not be as high, the risk of significant loss is also minimized.

Calculating Risk-to-Reward Ratio

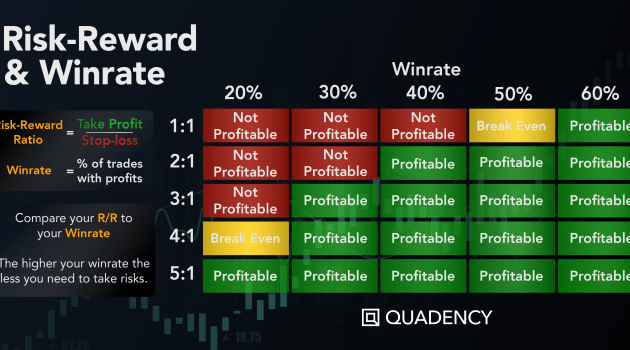

When it comes to investing, calculating the risk-to-reward ratio is a crucial step in determining the potential profitability of an investment. This ratio helps investors assess the amount of risk they are taking on compared to the potential reward they could gain.

Formula for Calculating Risk-to-Reward Ratio

Risk-to-Reward Ratio = (Entry Price – Stop Loss Price) / (Take Profit Price – Entry Price)

The formula for calculating the risk-to-reward ratio involves comparing the distance between the entry price and the stop-loss price to the distance between the entry price and the take-profit price.

Significance of Accurately Calculating Risk-to-Reward Ratio

- Helps investors make informed decisions: By calculating the risk-to-reward ratio, investors can weigh the potential risks against the rewards of an investment, allowing them to make more informed decisions.

- Manages risk effectively: A good risk-to-reward ratio can help investors manage their risk exposure and avoid potential losses.

- Improves profitability: By accurately calculating the risk-to-reward ratio, investors can increase their chances of profitability by ensuring that the potential reward justifies the risk taken.

Step-by-Step Guide to Calculating Risk-to-Reward Ratio

- Determine the entry price, stop-loss price, and take-profit price for the investment.

- Substitute these values into the risk-to-reward ratio formula: Risk-to-Reward Ratio = (Entry Price – Stop Loss Price) / (Take Profit Price – Entry Price).

- Calculate the values in the formula to get the risk-to-reward ratio.

- Interpret the ratio: A ratio greater than 1 indicates that the potential reward outweighs the risk, while a ratio less than 1 suggests that the risk is greater than the potential reward.

Importance in Investment Analysis

Risk-to-reward ratio plays a crucial role in investment analysis as it helps investors make informed decisions by assessing the potential returns and risks associated with a particular investment opportunity.

Impact on Portfolio Diversification

When it comes to portfolio diversification, the risk-to-reward ratio is a key factor to consider. By analyzing this ratio, investors can determine how the potential returns of an asset or security stack up against the risks involved. This information allows investors to make strategic decisions about including different types of assets in their portfolios to achieve a balance between risk and reward.

- Portfolio diversification helps spread risk across various assets, reducing the overall risk exposure of the portfolio.

- Investors can use the risk-to-reward ratio to evaluate the risk-return profile of each asset class and make adjustments to their portfolio accordingly.

- By maintaining a well-diversified portfolio based on the risk-to-reward ratio, investors can optimize their chances of achieving their financial goals while minimizing potential losses.

Assessment of Potential Returns and Risks

Investors rely on the risk-to-reward ratio to assess the potential returns and risks associated with an investment. This ratio provides a clear picture of how much an investor stands to gain compared to the potential losses they may incur. By evaluating this ratio, investors can make informed decisions about whether an investment opportunity aligns with their risk tolerance and financial objectives.

Calculating the risk-to-reward ratio allows investors to quantify the relationship between risk and potential reward, enabling them to make rational investment choices.

Successful Investment Decisions

Real-life examples abound where considering the risk-to-reward ratio has led to successful investment decisions. For instance, a savvy investor might choose to invest in a high-risk, high-reward opportunity only if the potential returns outweigh the associated risks. By carefully analyzing the risk-to-reward ratio, investors can identify opportunities that offer an optimal balance between risk and reward, leading to profitable outcomes.

- Warren Buffett’s investment strategy is often cited as a prime example of successful risk-to-reward ratio analysis, where he seeks out undervalued companies with strong fundamentals and favorable risk profiles.

- In the cryptocurrency market, investors who evaluate the risk-to-reward ratio before making investment decisions are better equipped to navigate the volatile nature of digital assets and capitalize on lucrative opportunities.

Managing Risk-to-Reward Ratio: Calculating Risk-to-reward Ratio

When it comes to managing risk-to-reward ratio, it is essential to align this ratio with your investment goals to ensure a balanced approach to risk management. By adjusting the risk-to-reward ratio effectively, investors can optimize their portfolio’s performance while minimizing potential losses.

Adjusting Risk-to-Reward Ratio

- One strategy for adjusting the risk-to-reward ratio is to diversify your portfolio. By spreading your investments across different asset classes and industries, you can reduce the overall risk exposure while maintaining the potential for rewards.

- Another approach is to set stop-loss orders to limit potential losses. This strategy helps to control risk by automatically selling an asset if it reaches a predetermined price, preventing further losses.

- Regularly reviewing and rebalancing your portfolio is also crucial in managing risk-to-reward ratio. This involves assessing the performance of your investments and making adjustments to maintain the desired risk levels.

Risk Management and Risk-to-Reward Ratio

Risk management is the process of identifying, assessing, and prioritizing risks followed by coordinating and applying resources to minimize, monitor, and control the probability or impact of unfortunate events or to maximize the realization of opportunities.

- When it comes to risk-to-reward ratio, effective risk management involves evaluating the potential risks associated with each investment and determining whether the potential rewards justify taking on those risks.

- By implementing risk management practices, investors can protect their capital and ensure that their portfolio remains aligned with their risk tolerance and investment objectives.

Maintaining a Balanced Risk-to-Reward Ratio

- Regularly assess your risk tolerance and investment goals to ensure that your risk-to-reward ratio remains in line with your overall strategy.

- Consider using position sizing techniques to control the amount of capital allocated to each investment based on its risk profile.

- Stay informed about market trends and developments to make informed decisions about adjusting your risk exposure as needed.

Final Review

Mastering the art of managing risk-to-reward ratio is essential for achieving success in the realm of investments. With the right strategies and insights, you can navigate the complexities of financial decision-making with confidence.

When it comes to analyzing the Forex market, having access to the best resources is crucial for making informed decisions. From comprehensive market reports to expert analysis, the best resources for Forex market analysis can provide valuable insights for traders of all levels.

Whether you’re a beginner looking to learn the basics or an experienced trader seeking advanced strategies, these resources offer a wealth of information to help you navigate the complexities of the currency market.

When it comes to Forex market analysis, having access to the best resources is crucial for making informed decisions. Whether you are a beginner or an experienced trader, staying updated with the latest trends and data can significantly impact your trading success.

One of the best resources for Forex market analysis is Best resources for Forex market analysis , where you can find comprehensive tools, news, and insights to help you navigate the complexities of the market.