With Buy and hold strategy for stocks at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling ahrefs author style filled with unexpected twists and insights.

The buy and hold strategy for stocks involves a patient and disciplined approach to investing in the stock market for the long term. By understanding the key principles and benefits of this strategy, investors can potentially achieve financial success and growth over time.

Introduction to Buy and Hold Strategy

The buy and hold strategy in stock investment involves purchasing stocks and holding onto them for an extended period, regardless of short-term market fluctuations. This strategy is based on the belief that over the long term, the stock market tends to increase in value, allowing investors to benefit from capital appreciation and dividends.

During market downturns, investors often seek refuge in defensive stocks. These stocks are known for their stability and ability to weather economic storms. Companies in industries like utilities, healthcare, and consumer staples are popular choices for investors during turbulent times.

Understanding the characteristics of defensive stocks can help investors protect their portfolios from excessive losses. To learn more about defensive stocks during market downturns, check out this informative article: Defensive stocks during market downturns.

There are several benefits to adopting a buy and hold strategy for stocks. Firstly, it helps investors avoid making impulsive decisions based on short-term market movements, reducing the impact of market volatility on their investment portfolio. Additionally, by holding onto stocks for the long term, investors can benefit from compounding returns and potentially outperform market benchmarks.

Historical Success of Buy and Hold Strategy

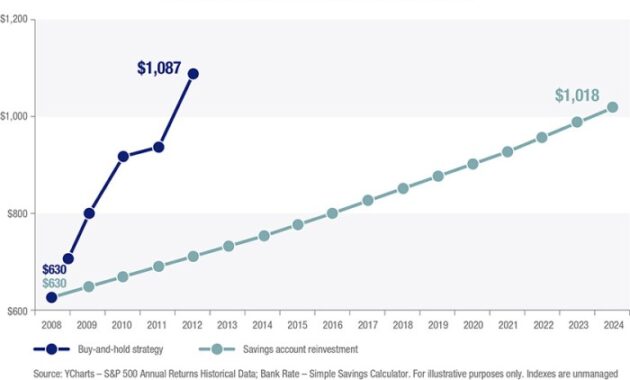

The buy and hold strategy has a long history of success in the stock market. Numerous studies and analyses have shown that over extended periods, stock market returns have tended to be positive, despite occasional downturns and market corrections. By staying invested in quality companies and riding out market fluctuations, investors following the buy and hold strategy have been able to achieve significant wealth accumulation over time.

Implementing the Buy and Hold Strategy

Implementing the buy and hold strategy involves carefully selecting suitable stocks, conducting thorough research before making any purchases, and creating a diversified portfolio to mitigate risk.

Steps to Select Suitable Stocks for a Buy and Hold Strategy

- Look for companies with strong fundamentals, such as solid revenue growth, low debt levels, and consistent profitability.

- Consider the company’s competitive advantage or moat, which can help sustain its growth over the long term.

- Evaluate the industry trends and future growth potential of the company to ensure it aligns with your investment goals.

- Review the company’s management team and corporate governance practices to assess whether they are shareholder-friendly.

The Importance of Thorough Research Before Buying Stocks, Buy and hold strategy for stocks

Before investing in any stock for a buy and hold strategy, it is crucial to conduct thorough research to understand the company’s business model, financial health, market position, and growth prospects. This research helps investors make informed decisions and reduces the risk of making poor investment choices.

During market downturns, investors often turn to defensive stocks as a safe haven for their portfolios. These stocks are known for their stability and ability to weather economic storms. Companies in sectors such as healthcare, utilities, and consumer staples are popular choices for defensive stocks.

To learn more about defensive stocks during market downturns, check out this informative article on Defensive stocks during market downturns.

Creating a Diversified Portfolio for a Buy and Hold Strategy

- Diversification is key to reducing risk in a buy and hold strategy. Allocate your investments across different sectors, industries, and asset classes to minimize the impact of any single company or market downturn.

- Consider investing in a mix of large-cap, mid-cap, and small-cap stocks to spread out risk and capture opportunities across the market spectrum.

- Include other asset classes like bonds, real estate, or commodities to further diversify your portfolio and protect against market volatility.

- Regularly review and rebalance your portfolio to ensure it remains aligned with your investment objectives and risk tolerance.

Managing a Buy and Hold Portfolio: Buy And Hold Strategy For Stocks

Effectively monitoring and managing a buy and hold portfolio is essential for long-term investment success. This strategy involves carefully selecting quality stocks and holding onto them for an extended period to benefit from their growth potential.

Rebalancing a Buy and Hold Portfolio

Rebalancing a buy and hold portfolio should be considered when the original investment thesis no longer holds true, or when there are significant changes in the market or the company’s fundamentals. It helps maintain the desired asset allocation and risk levels.

- Review your portfolio regularly to ensure it aligns with your investment goals and risk tolerance.

- Consider rebalancing if a particular stock becomes too dominant in your portfolio, exposing you to undue risk.

- Reevaluate your investments if there are major economic shifts or changes in the industry that may impact your holdings.

The Role of Dividends in a Buy and Hold Strategy

Dividends play a crucial role in a buy and hold strategy as they provide a steady income stream and can enhance total returns over time.

- Reinvesting dividends can accelerate the growth of your portfolio through compounding.

- High dividend-paying stocks can offer stability and income during market downturns.

- Monitor dividend payouts and company performance to ensure the sustainability of dividends over the long term.

Risks and Challenges of Buy and Hold Strategy

When implementing a buy and hold strategy for investing in stocks, it is crucial to be aware of the potential risks and challenges that may arise. Understanding these risks and knowing how to mitigate them is essential for long-term success in this investment approach.

Market Volatility

One of the key risks associated with a buy and hold strategy is market volatility. Stock prices can fluctuate significantly in the short term due to various factors such as economic conditions, geopolitical events, and company-specific news. This volatility can lead to periods of sharp declines in the value of your portfolio.

- Stay focused on the long-term: By maintaining a long-term perspective, investors can ride out short-term market fluctuations and benefit from the overall growth of the market over time.

- Diversification: Building a diversified portfolio can help mitigate the impact of market volatility on your investments. By spreading your investments across different asset classes and industries, you can reduce the risk of significant losses from a downturn in any single stock or sector.

- Regular monitoring: While the buy and hold strategy emphasizes long-term holding periods, it is still important to regularly review your portfolio to ensure it remains aligned with your investment goals and risk tolerance.

Company-specific Risks

Another risk to consider when following a buy and hold strategy is company-specific risks. These risks can include poor financial performance, management issues, or changes in industry dynamics that negatively impact the stock price of a particular company.

- Thorough research: Conducting thorough research before investing in a company can help you identify potential risks and make informed decisions about whether to include the stock in your portfolio.

- Regular updates: Stay informed about the companies you have invested in by keeping up with their quarterly earnings reports, company announcements, and industry trends. This will help you identify any changes in the company’s outlook that may warrant a reassessment of your investment.

Last Recap

In conclusion, the buy and hold strategy for stocks offers a reliable way to build wealth and navigate the ups and downs of the market with a focus on long-term growth and stability. By following the steps Artikeld and staying committed to the strategy, investors can position themselves for a successful investment journey.