Kicking off with Bitcoin vs Ethereum comparison, this opening paragraph is designed to captivate and engage the readers, setting the tone for a detailed exploration of the two major cryptocurrencies dominating the market. Bitcoin and Ethereum have been at the forefront of the cryptocurrency revolution, each with its unique features and capabilities that set them apart from each other. Let’s delve into a comprehensive comparison to understand the key differences and similarities between these two giants of the digital currency world.

Introduction

Bitcoin and Ethereum are two of the most well-known cryptocurrencies in the market. Bitcoin, created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto, is considered the original cryptocurrency and operates on a decentralized peer-to-peer network. Ethereum, on the other hand, was proposed by Vitalik Buterin in late 2013 and went live in 2015. Ethereum is not just a digital currency, but also a platform for creating smart contracts and decentralized applications (DApps).

Comparing Bitcoin and Ethereum is significant in the cryptocurrency market as they represent the two largest cryptocurrencies by market capitalization and have different use cases and functionalities. While Bitcoin is primarily used as a store of value and a medium of exchange, Ethereum’s blockchain technology allows for more complex transactions and applications beyond just currency.

In terms of popularity, Bitcoin is often referred to as digital gold and is considered a safe-haven asset by many investors. Ethereum, on the other hand, is known for its smart contract capabilities and has gained popularity for powering a wide range of decentralized applications.

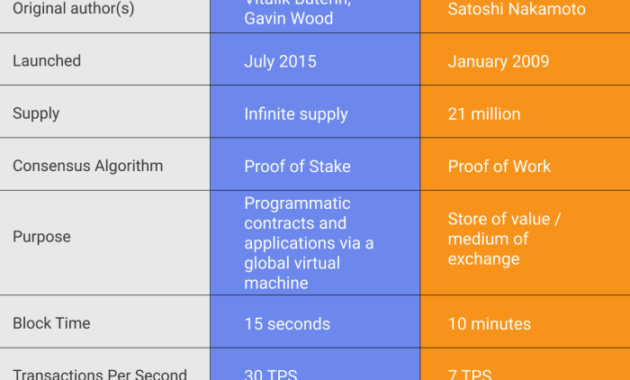

General Differences

- Bitcoin is primarily a digital currency used for peer-to-peer transactions, while Ethereum is a platform that enables developers to build decentralized applications.

- Bitcoin has a fixed supply cap of 21 million coins, while Ethereum has no supply cap and is inflationary.

- Bitcoin uses the proof-of-work consensus algorithm, while Ethereum is transitioning to a proof-of-stake algorithm with Ethereum 2.0.

- Bitcoin transactions are generally slower and more costly compared to Ethereum transactions due to differences in blockchain technology.

- Bitcoin is considered a more stable and established cryptocurrency, while Ethereum is known for its innovation and flexibility in the blockchain space.

Technology Comparison

Bitcoin and Ethereum are two of the most well-known cryptocurrencies, each with its own unique underlying technology based on blockchain. Let’s delve deeper into the technology comparison between these two digital assets.

Consensus Mechanisms

- Bitcoin: Bitcoin uses the Proof of Work (PoW) consensus mechanism, where miners compete to solve complex mathematical puzzles to validate transactions and create new blocks on the blockchain. This process requires significant computational power and energy consumption.

- Ethereum: Ethereum is in the process of transitioning from PoW to Proof of Stake (PoS) consensus mechanism with the Ethereum 2.0 upgrade. PoS relies on validators who are chosen to create new blocks based on the number of coins they hold and are willing to “stake” as collateral.

Scalability Solutions

- Bitcoin: Bitcoin has faced challenges with scalability due to its limited block size and block time, resulting in slower transaction speeds and higher fees during peak times. Solutions like the Lightning Network have been developed to enable faster and cheaper off-chain transactions.

- Ethereum: Ethereum has also encountered scalability issues, particularly with network congestion and high gas fees. To address this, Ethereum is implementing upgrades like Ethereum 2.0, which aims to improve scalability through sharding and the transition to PoS consensus.

Transaction Speed and Fees: Bitcoin Vs Ethereum Comparison

When comparing Bitcoin and Ethereum, one crucial aspect to consider is their transaction speed and fees. Let’s delve into the differences between the two cryptocurrencies in this regard.

Transaction Speed

Bitcoin transactions typically take around 10 minutes to be confirmed on the blockchain. This is due to the proof-of-work consensus mechanism that Bitcoin employs, which requires miners to solve complex mathematical puzzles to validate transactions.

Ethereum, on the other hand, usually has faster transaction speeds, with transactions being confirmed in around 10 to 20 seconds. Ethereum uses a proof-of-stake consensus mechanism, which is generally faster and more energy-efficient compared to Bitcoin’s proof-of-work.

When it comes to predicting the price of Bitcoin, experts use various methods and analysis to make educated guesses. Factors such as market trends, investor sentiment, and regulatory news all play a role in determining the future value of this popular cryptocurrency.

If you’re interested in learning more about Bitcoin price prediction, you can check out this informative article on Bitcoin price prediction.

Transaction Fees

Transaction fees in Bitcoin can vary depending on network congestion, but they have been known to spike during times of high demand. These fees are paid to miners to prioritize transactions and ensure their inclusion in the blockchain.

When it comes to predicting the future of Bitcoin price, there are various factors at play. From market trends to regulatory changes, experts use a combination of technical analysis and fundamental data to make their forecasts. If you’re curious about the latest Bitcoin price prediction, you can check out this insightful article on Bitcoin price prediction to stay informed and make informed decisions.

On the Ethereum network, transaction fees are known as gas fees and are also influenced by network congestion. Gas fees can fluctuate based on the computational resources required to process a transaction, such as executing smart contracts.

Factors Influencing Transaction Speed and Fees

- Network Congestion: Both Bitcoin and Ethereum can experience delays in transactions when the network is congested with a high volume of transactions.

- Consensus Mechanism: The consensus mechanism used by each cryptocurrency plays a significant role in determining transaction speed. Proof-of-work systems like Bitcoin tend to be slower compared to proof-of-stake systems like Ethereum.

- Transaction Complexity: Transactions involving smart contracts or complex operations may require more computational resources, leading to higher fees on the Ethereum network.

Smart Contracts and Decentralized Applications (DApps)

Smart contracts are self-executing contracts with the terms directly written into code. They automatically enforce and facilitate the negotiation or performance of agreements without the need for intermediaries. In the context of blockchain technology, Ethereum is known for popularizing smart contracts through its platform.

Smart Contracts on Ethereum

Smart contracts on the Ethereum network are written using Solidity, a programming language specifically designed for creating smart contracts. These contracts are deployed on the Ethereum Virtual Machine (EVM) and are executed autonomously once certain conditions are met. Ethereum’s flexibility and support for smart contracts have made it a preferred platform for developers looking to create decentralized applications (DApps).

Comparison of Smart Contracts Usage

While Ethereum is widely recognized for its robust smart contract capabilities, Bitcoin also allows for the implementation of simple smart contracts through its scripting language. However, the functionality and complexity of smart contracts on Bitcoin are more limited compared to Ethereum. Ethereum’s Turing-complete programming language enables developers to create a wide range of sophisticated smart contracts.

Decentralized Applications (DApps) Development, Bitcoin vs Ethereum comparison

Both Bitcoin and Ethereum support the development of decentralized applications (DApps), but Ethereum is considered the go-to platform for building DApps due to its smart contract functionality. Ethereum’s ecosystem provides developers with a wide array of tools, libraries, and resources to create decentralized applications across various industries such as finance, gaming, and decentralized finance (DeFi).

Market Capitalization and Price Volatility

When comparing Bitcoin and Ethereum, it is essential to look at their market capitalization and price volatility to understand their position in the cryptocurrency market.

Market Capitalization

- As of [current date], Bitcoin holds the highest market capitalization among all cryptocurrencies, with a value of [current market cap in USD].

- Ethereum follows closely behind, with a market capitalization of [current market cap in USD].

- The market capitalization of both Bitcoin and Ethereum fluctuates based on market demand, adoption, and investor sentiment.

Price Volatility

- Historically, Bitcoin has been known for its price volatility, experiencing major price swings within short periods of time.

- Ethereum has also shown significant price volatility, influenced by market trends, regulatory developments, and technological advancements.

- Factors influencing price volatility include market speculation, macroeconomic events, regulatory changes, and technological upgrades within the respective blockchain networks.

Community and Ecosystem

When it comes to the community and ecosystem surrounding Bitcoin and Ethereum, both cryptocurrencies have vibrant and active communities that play a crucial role in their development and growth. These communities consist of developers, investors, miners, and enthusiasts who contribute to the overall ecosystem in various ways.

Community Support and Developer Ecosystem

- Bitcoin: The Bitcoin community is one of the oldest and most established in the cryptocurrency space. It has a large following of supporters who are dedicated to promoting and improving the Bitcoin network. The developer ecosystem for Bitcoin is also robust, with developers constantly working on enhancing the protocol and addressing any issues that may arise.

- Ethereum: Ethereum also has a strong and active community that is known for its innovation and willingness to experiment with new technologies. The developer ecosystem for Ethereum is particularly vibrant, with a large number of developers building decentralized applications (DApps) on the Ethereum blockchain.

Governance Models

- Bitcoin: Bitcoin operates on a more decentralized governance model, where decisions regarding the network’s development are typically made through rough consensus among the community. Changes to the Bitcoin protocol require broad community support and are implemented through a process known as a “soft fork” or “hard fork.”

- Ethereum: Ethereum has a slightly more centralized governance model compared to Bitcoin, with decisions being made by the Ethereum Foundation and core developers. However, the Ethereum community still plays a significant role in proposing and implementing changes to the network.

Impact on Growth

- The community and ecosystem surrounding Bitcoin and Ethereum have been instrumental in driving the growth and adoption of both cryptocurrencies. Community support helps to build trust and credibility in the networks, attracting more users and developers to participate in the ecosystem.

- Both cryptocurrencies have benefited from a strong community that is passionate about the technology and its potential impact on the financial industry. This support has led to increased awareness and interest in Bitcoin and Ethereum, contributing to their success in the cryptocurrency market.

Final Summary

In conclusion, the comparison between Bitcoin and Ethereum reveals the intricate dynamics of the cryptocurrency market. While Bitcoin remains the pioneer and most widely recognized digital currency, Ethereum’s innovative smart contract capabilities have solidified its position as a powerhouse in the decentralized finance ecosystem. Understanding the nuances of these two cryptocurrencies is crucial for investors and enthusiasts alike to navigate the ever-evolving landscape of digital assets.