Binance Coin trading strategies are crucial for success in the crypto market. From understanding the basics to implementing advanced techniques, this guide will help you navigate the world of Binance Coin trading with confidence.

Explore the nuances of fundamental and technical analysis, learn how to manage risks effectively, and discover the winning strategies used by seasoned traders to stay ahead in this competitive landscape.

Binance Coin Trading Strategies

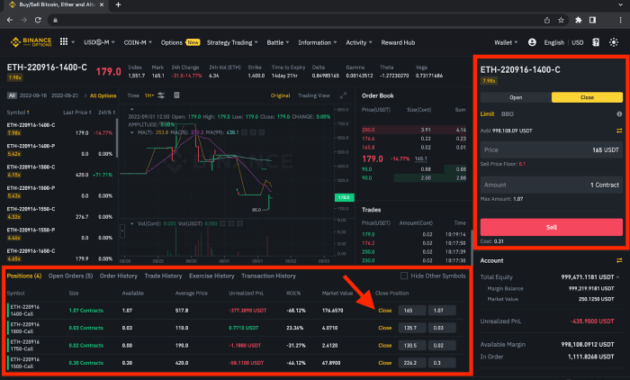

Binance Coin trading involves buying and selling Binance Coin (BNB) on various cryptocurrency exchanges, such as Binance. Traders aim to profit from the price movements of BNB by executing trades based on market analysis and trends.

Having a trading strategy is crucial when dealing with Binance Coin to maximize profits and minimize risks. A well-thought-out plan helps traders navigate the volatile cryptocurrency market and make informed decisions.

Importance of Having a Trading Strategy

Developing a trading strategy for Binance Coin is essential to achieve consistent success in trading. Traders need to consider factors such as market trends, technical analysis, risk management, and timing to create an effective strategy.

Successful Binance Coin trading strategies are influenced by various factors, including market conditions, news events, regulatory developments, and investor sentiment. Traders must stay informed about these factors to make timely and profitable trading decisions.

Examples of Successful Binance Coin Trading Strategies

Experienced traders utilize a combination of technical analysis, fundamental analysis, and market indicators to develop successful Binance Coin trading strategies. Some common strategies include:

- Swing Trading: Traders buy and hold Binance Coin for a short to medium-term period to capitalize on price fluctuations.

- Scalping: Traders make quick trades to profit from small price movements in Binance Coin.

- Trend Following: Traders follow the market trend and enter trades in the direction of the trend to maximize profits.

- Breakout Trading: Traders enter trades when Binance Coin breaks out of a key resistance or support level to capture significant price moves.

Fundamental Analysis for Binance Coin Trading

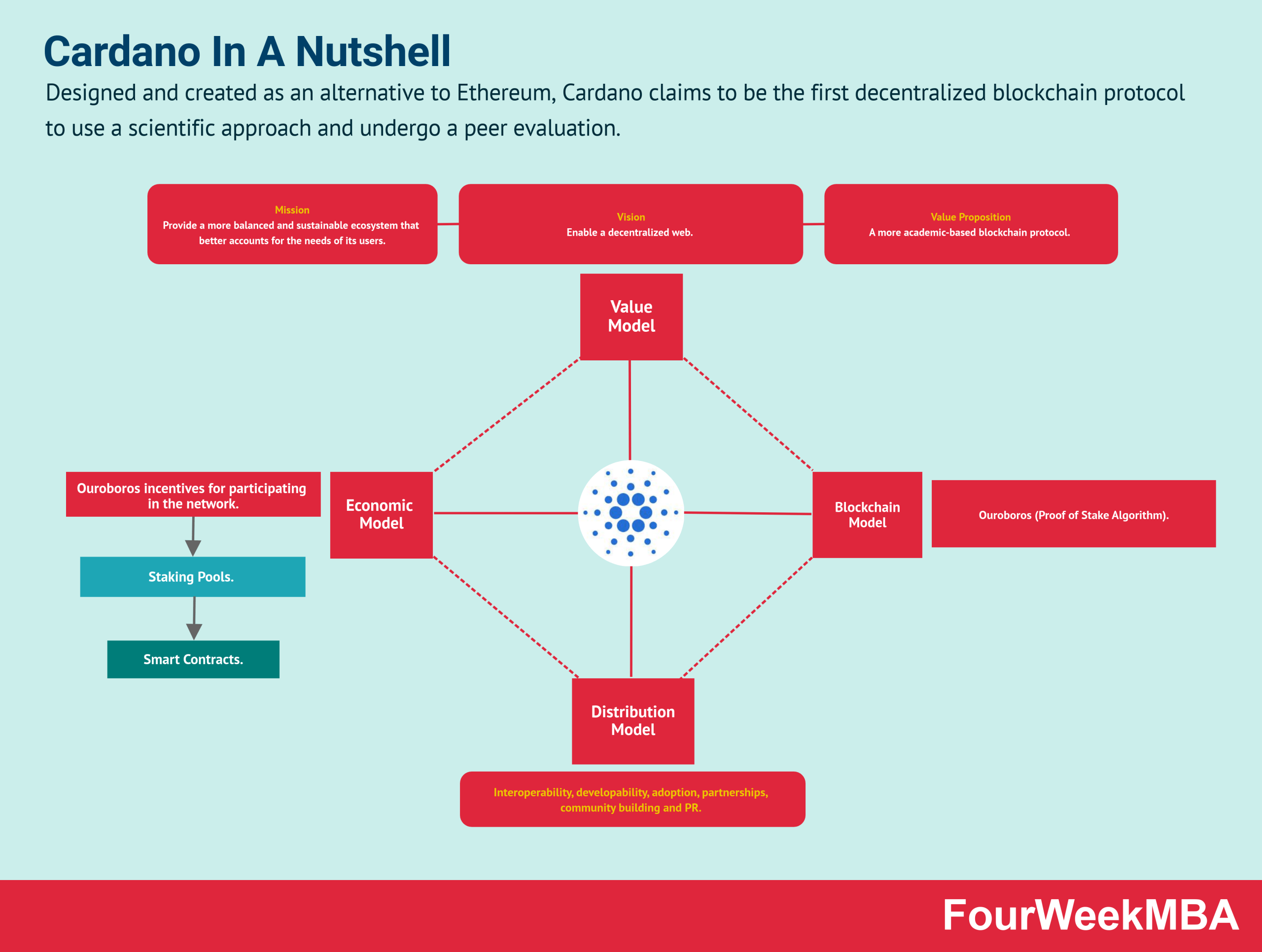

Fundamental analysis is a crucial approach for evaluating the intrinsic value of an asset, including cryptocurrencies like Binance Coin. By examining the underlying factors that drive the market, traders can make informed decisions based on the coin’s real value rather than just its market price fluctuations.

Key Metrics and Indicators, Binance Coin trading strategies

Fundamental analysis for Binance Coin involves assessing various metrics and indicators to gauge the coin’s potential for growth and profitability. Some key factors to consider include:

- Market Capitalization: The total value of all Binance Coins in circulation, which can indicate the coin’s overall worth in the market.

- Trading Volume: The amount of Binance Coin being traded on exchanges, reflecting the level of interest and liquidity in the market.

- Development Team: Evaluating the experience and expertise of the team behind Binance Coin, as well as their roadmap for future development.

- Partnerships and Integrations: Assessing the strategic partnerships and integrations that Binance Coin has with other projects or platforms, which can impact its adoption and value.

- Fundamental News: Keeping abreast of news and updates related to Binance Coin, such as regulatory developments, technological advancements, or market trends.

Comparison with Other Types of Analysis

While fundamental analysis focuses on intrinsic factors that drive the market, technical analysis relies on historical price data and chart patterns to predict future price movements. Fundamental analysis provides a deeper understanding of the asset’s value, while technical analysis offers insights into market sentiment and trends.

Step-by-Step Guide

- Evaluate the Market Capitalization and Trading Volume of Binance Coin.

- Research the Development Team and their background in the cryptocurrency industry.

- Analyze the Partnerships and Integrations of Binance Coin to assess its market reach and potential growth.

- Stay informed about Fundamental News related to Binance Coin to anticipate any market-moving events.

Technical Analysis for Binance Coin Trading

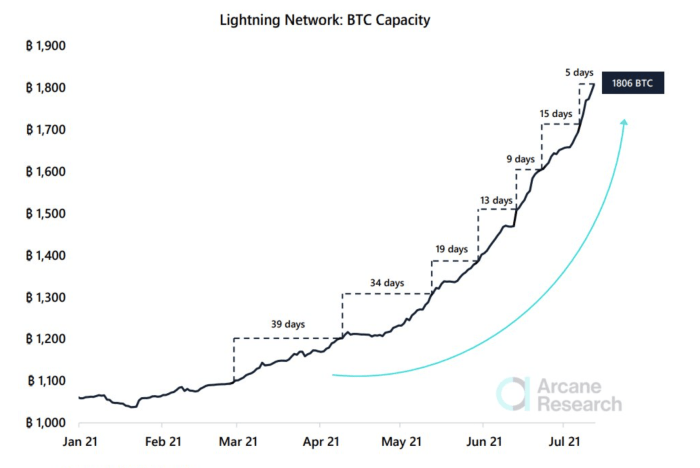

In Binance Coin trading, technical analysis plays a crucial role in helping traders make informed decisions based on historical price movements and market trends. By analyzing charts and using various technical indicators, traders aim to predict future price movements and identify potential entry and exit points for their trades.

Common Technical Analysis Tools and Techniques

- Moving Averages: Traders use moving averages to smooth out price data and identify trends over different time periods.

- Relative Strength Index (RSI): RSI is a momentum oscillator that measures the speed and change of price movements to determine overbought or oversold conditions.

- Bollinger Bands: Bollinger Bands consist of a simple moving average and two standard deviations above and below the moving average, helping traders identify volatility and potential price reversal points.

- Candlestick Patterns: Traders often use candlestick patterns to analyze price action and predict potential trend reversals or continuations.

Interpreting Chart Patterns and Trends

- Trend Identification: Traders look for patterns such as higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend, to identify the direction of the trend.

- Support and Resistance Levels: Support levels are where the price tends to find a bottom and bounce back up, while resistance levels are where the price struggles to move above. These levels help traders make decisions on entry and exit points.

- Chart Patterns: Patterns like head and shoulders, double tops, and triangles can provide insights into potential price movements based on historical price behavior.

Tips for Beginners on Using Technical Analysis

- Start with the Basics: Begin by understanding simple technical indicators and gradually expand your knowledge as you gain experience.

- Combine Indicators: Use a combination of different technical indicators to confirm signals and reduce the risk of false signals.

- Practice Patience: Avoid making impulsive decisions based on short-term price movements and take the time to analyze the charts thoroughly.

- Keep Learning: The world of technical analysis is vast and constantly evolving, so stay updated with new tools and techniques to improve your trading skills.

Risk Management Strategies for Binance Coin Trading: Binance Coin Trading Strategies

When it comes to trading Binance Coin, implementing effective risk management strategies is crucial to protect your capital and maximize your profits. By managing risks properly, traders can minimize potential losses and increase the chances of success in the volatile cryptocurrency market.

Importance of Risk Management in Binance Coin Trading

Effective risk management is essential in Binance Coin trading to safeguard your investment from unexpected market movements and mitigate potential losses. Without proper risk management, traders are prone to making emotional decisions, which can lead to significant financial setbacks.

Different Risk Management Strategies

- Diversification: Spread your investment across different assets to reduce risk exposure to a single cryptocurrency.

- Position Sizing: Determine the appropriate size of each trade based on your risk tolerance and account size.

- Setting Stop-Loss Orders: Establish predetermined price levels to automatically sell your Binance Coin holdings if the market moves against you.

- Use of Take-Profit Orders: Set profit targets to secure gains and avoid greed-driven decisions.

Stop-Loss Orders and Their Significance

Stop-loss orders are crucial tools in risk management as they allow traders to define the maximum amount of loss they are willing to bear on a trade. By setting stop-loss orders, traders can limit potential losses and protect their capital from excessive drawdowns.

Examples of Risk Management Plans

- Example 1: Trader A decides to allocate only 2% of their total capital to each Binance Coin trade and sets a stop-loss order at 5% below the entry price.

- Example 2: Trader B diversifies their portfolio by investing in multiple cryptocurrencies, reducing the impact of a single asset’s price movement on their overall investment.

Closing Notes

In conclusion, mastering Binance Coin trading strategies requires a blend of knowledge, skill, and adaptability. By incorporating the insights shared in this guide, you can enhance your trading prowess and strive towards achieving your financial goals in the dynamic world of cryptocurrency trading.