Delving into Best strategies for trading news events, this introduction immerses readers in a unique and compelling narrative, with ahrefs author style that is both engaging and thought-provoking from the very first sentence.

In the world of trading, staying ahead of the game is crucial. To navigate the unpredictable waters of news events, traders need a solid strategy in place. This guide delves into the best practices for trading during news events, offering insightful tips and techniques for success.

Strategies for Preparing for News Events: Best Strategies For Trading News Events

When it comes to trading news events, preparation is key to success. By researching upcoming news events, understanding their potential impact on the market, and utilizing the right tools and resources, traders can make informed decisions and navigate the volatility that often accompanies such events.

Researching Upcoming News Events

- Stay informed about economic calendars that list important news releases and events.

- Follow financial news websites, such as Bloomberg or CNBC, for the latest updates on market-moving events.

- Monitor central bank announcements, economic data releases, and geopolitical developments that could influence market sentiment.

Understanding Potential Impact

- Recognize the significance of different news events and how they can impact various asset classes, such as currencies, stocks, and commodities.

- Learn how to interpret market reactions to news events and anticipate potential outcomes based on historical data and market trends.

- Consider the interplay between news events and market expectations to gauge the potential market impact accurately.

Tools and Resources

- Utilize trading platforms that offer real-time news feeds and market analysis to stay updated on breaking news.

- Explore financial data providers like Reuters or Bloomberg Terminal for comprehensive market news and analysis.

- Join online trading communities or forums to discuss news events with other traders and gain diverse perspectives on market trends.

Best Practices for Trading During News Events

When it comes to trading during news events, timing is crucial. Traders need to be quick to react to breaking news and understand how the market is likely to respond.

Significance of Timing in Trading News Events

Timing plays a critical role in trading news events. Traders must be prepared to enter and exit positions swiftly to capitalize on market movements triggered by breaking news. Being too slow to react can result in missed opportunities or significant losses.

- Monitor news sources constantly to stay informed about the latest developments.

- Use tools like economic calendars to track scheduled news releases and plan your trades accordingly.

- Practice executing trades quickly to take advantage of short-lived price movements during news events.

Tips for Managing Risk During Volatile Market Conditions

During news events, market volatility tends to increase, leading to higher risk levels for traders. It’s essential to implement risk management strategies to protect your capital and minimize potential losses.

- Set stop-loss orders to limit losses and protect your positions from sudden price fluctuations.

- Avoid overleveraging your trades, as increased volatility can amplify losses if the market moves against you.

- Diversify your portfolio to spread risk across different assets and reduce the impact of adverse market movements.

Understanding the ‘Buy the Rumor, Sell the News’ Strategy

The ‘buy the rumor, sell the news’ strategy is a common approach used by traders to capitalize on market sentiment surrounding upcoming news events. This strategy involves buying an asset based on rumors or speculation leading up to a significant announcement and selling once the news is officially released.

Traders often anticipate market reaction to news events, causing prices to rise or fall before the actual news is confirmed.

- Monitor market sentiment and rumors leading up to news events to gauge potential price movements.

- Be prepared to enter trades early based on rumors but remain cautious of sudden reversals once the news is announced.

- Consider taking profits before the news event if the asset has already experienced a significant price rally based on rumors.

Analyzing Market Sentiment and Reaction to News

Market sentiment plays a crucial role in determining how news events impact asset prices. Analyzing market sentiment before and after a news event can help traders anticipate market movements and make informed trading decisions. Understanding how different asset classes react to positive and negative news is essential for developing effective trading strategies. Additionally, technical analysis can provide valuable insights into market reactions to news events.

Methods for Analyzing Market Sentiment, Best strategies for trading news events

- Monitoring economic indicators: Keeping track of key economic indicators such as GDP growth, inflation rates, and employment data can provide valuable insights into market sentiment.

- Sentiment analysis: Utilizing sentiment analysis tools to gauge the overall sentiment of market participants can help traders understand prevailing market sentiment.

- Tracking institutional activity: Monitoring the trading activity of institutional investors can offer insights into market sentiment and potential market movements.

Examples of Asset Class Reactions

- Stocks: Positive news such as strong earnings reports or new product launches can lead to a rise in stock prices, while negative news like regulatory issues or poor financial results can cause stock prices to decline.

- Forex: Currency pairs can react differently to news events based on factors such as interest rate differentials, economic data releases, and geopolitical developments.

- Commodities: Commodities like gold and oil can be influenced by news events such as supply disruptions, geopolitical tensions, and economic reports.

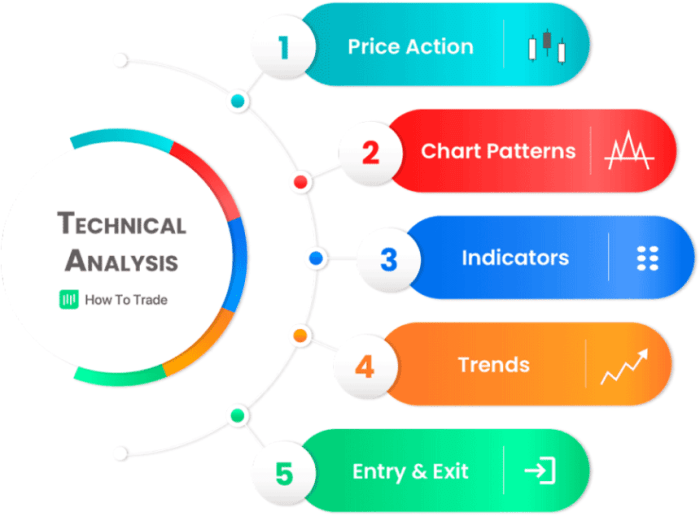

Role of Technical Analysis

- Identifying key support and resistance levels: Technical analysis can help traders identify important levels where asset prices are likely to reverse or continue their trend based on news events.

- Using technical indicators: Indicators such as moving averages, RSI, and MACD can help traders assess market momentum and potential entry/exit points following a news event.

- Chart patterns: Recognizing chart patterns like head and shoulders, triangles, and flags can provide valuable insights into market sentiment and potential price movements.

Incorporating Fundamental Analysis into News Trading

Fundamental analysis plays a crucial role in helping traders anticipate market movements post-news events. By understanding the underlying economic factors and data releases, traders can make more informed decisions and react strategically to news events.

Importance of Economic Indicators and Data Releases

- Economic indicators such as GDP growth, inflation rates, employment figures, and interest rates can provide valuable insights into the health of an economy.

- Traders often monitor data releases like Non-Farm Payrolls, Consumer Price Index, and Retail Sales to gauge the overall economic performance and sentiment.

- Understanding the impact of these indicators on currency, stock, and commodity markets can help traders anticipate market reactions to news events.

Examples of Geopolitical Events Impacting Market Sentiment

- Geopolitical events such as trade tensions, political instability, and global conflicts can significantly influence market sentiment and trading decisions.

- For instance, Brexit negotiations have had a profound impact on the value of the British Pound and European stock markets, reflecting the uncertainty and volatility surrounding the event.

- The escalating tensions between the US and China have also led to fluctuations in the stock market and currency valuations, showcasing the interconnectedness of geopolitical events and financial markets.

Last Point

As we wrap up our discussion on the best strategies for trading news events, it’s clear that preparation, timing, and analysis are key to success in the dynamic world of trading. By understanding market sentiment, managing risk effectively, and incorporating fundamental analysis, traders can navigate news events with confidence and skill.

When it comes to forex trading, understanding exotic currency pairs is essential for diversifying your portfolio. These pairs consist of one major currency and one currency from a developing economy, offering unique trading opportunities. By exploring exotic currency pairs , traders can potentially capitalize on market volatility and emerging trends, leading to profitable outcomes in the long run.

When it comes to forex trading, exotic currency pairs can offer unique opportunities for traders. These pairs involve currencies from developing or smaller economies, such as the Thai Baht or the South African Rand. While they may have lower liquidity compared to major pairs, they can provide diversification and potential for higher returns.

Understanding the characteristics and risks associated with exotic currency pairs is essential for any trader looking to expand their portfolio.