Exploring the Best DeFi tokens to watch in 2024, this article dives into the most promising options that investors should keep an eye on. From potential growth opportunities to unique features, these tokens are positioned for success in the evolving cryptocurrency landscape.

As we delve deeper, we’ll uncover the critical factors driving the performance of DeFi tokens and how to select the best ones for your investment portfolio. Stay tuned to discover the top DeFi tokens set to shine in 2024.

Overview of DeFi Tokens

DeFi tokens, short for decentralized finance tokens, are digital assets that operate on blockchain technology and enable users to engage in various financial activities without the need for traditional intermediaries like banks or brokers. These tokens are typically used within decentralized applications (DApps) that offer services such as lending, borrowing, trading, and yield farming.

Significance of DeFi Tokens in the Cryptocurrency Market

DeFi tokens hold significant importance in the cryptocurrency market due to their ability to revolutionize the way financial transactions are conducted. By leveraging blockchain technology, these tokens provide users with greater control over their assets, lower fees, increased transparency, and enhanced security compared to traditional financial systems. The decentralized nature of DeFi tokens also promotes financial inclusion by allowing individuals worldwide to access financial services without the need for a central authority.

Benefits of Investing in DeFi Tokens

Investing in DeFi tokens offers several benefits to users looking to participate in the growing decentralized finance ecosystem. Some of the key advantages include the potential for higher returns through yield farming and staking, exposure to innovative financial products and services, diversification of investment portfolios, and the opportunity to support a more inclusive and transparent financial system. Additionally, as the popularity of DeFi continues to rise, investing in DeFi tokens may present early adopters with significant growth opportunities in the long term.

Factors Influencing DeFi Token Performance: Best DeFi Tokens To Watch In 2024

When it comes to the performance of DeFi tokens, several factors play a crucial role in determining their value and market dynamics. These factors can range from market trends and regulations to technological advancements and global events.

Market Trends, Best DeFi tokens to watch in 2024

Market trends have a significant impact on the performance of DeFi tokens. Positive market sentiment, such as increased adoption of DeFi platforms or new innovative projects, can drive up the prices of DeFi tokens. Conversely, negative market trends or fluctuations in the overall cryptocurrency market can lead to a decrease in DeFi token prices.

Regulations

Regulatory developments can heavily influence the performance of DeFi tokens. Changes in regulations, whether favorable or unfavorable, can affect investor confidence and the overall market sentiment towards DeFi projects. Compliance with regulations and legal frameworks is crucial for the sustained growth and stability of the DeFi ecosystem.

Technological Advancements

Technological advancements in the DeFi space can also impact the performance of DeFi tokens. Upgrades to existing protocols, the introduction of new features, or the integration of cutting-edge technologies can enhance the utility and value proposition of DeFi tokens, attracting more investors and users to the ecosystem.

Global Events

Global events, such as economic crises, geopolitical tensions, or health pandemics, can have a ripple effect on the cryptocurrency market, including DeFi tokens. Uncertainty and volatility stemming from these events can lead to fluctuations in DeFi token prices as investors react to changing market conditions and risk factors.

Criteria for Selecting the Best DeFi Tokens

When it comes to selecting the best DeFi tokens for your investment portfolio, it is crucial to consider a set of criteria that can help you evaluate the potential growth and sustainability of these tokens. By analyzing various factors, you can make informed decisions and maximize your chances of success in the DeFi market.

Market Demand and Use Case

One of the key criteria for selecting the best DeFi tokens is to assess the market demand for the token and its underlying use case. Tokens that solve real-world problems or offer innovative solutions are more likely to gain traction and achieve long-term success.

Team and Development

The team behind a DeFi project plays a crucial role in its success. Evaluate the experience and expertise of the team members, their track record in the blockchain industry, and the progress of the project’s development roadmap. A strong and dedicated team is essential for the sustainable growth of a DeFi token.

Security and Auditing

Security is paramount in the DeFi space, given the prevalence of hacks and vulnerabilities. Look for tokens that have undergone thorough security audits by reputable firms to ensure the safety of your investments. A robust security infrastructure is a non-negotiable criterion when selecting DeFi tokens.

Liquidity and Trading Volume

High liquidity and trading volume are indicators of a token’s market acceptance and stability. Tokens with a healthy trading volume are more likely to offer better price discovery and minimize slippage. Consider tokens that are listed on reputable exchanges and have a strong liquidity pool.

When it comes to Binance Coin trading strategies, it’s essential to have a solid plan in place. Whether you’re a beginner or an experienced trader, understanding the market trends and knowing when to buy or sell is crucial. One effective strategy is to set clear goals and stick to them, avoiding impulsive decisions that could lead to losses.

Additionally, keeping up with the latest news and developments in the cryptocurrency world can help you make informed decisions. For more insights on Binance Coin trading strategies, check out this Binance Coin trading strategies article.

Community and Governance

The strength of a token’s community and governance model can significantly impact its long-term viability. Look for tokens with active community engagement, transparent governance mechanisms, and a clear decision-making process. A supportive community can drive adoption and contribute to the token’s success.

When it comes to Binance Coin trading strategies, it’s crucial to stay informed and adapt to market trends. One effective approach is to diversify your portfolio and set clear goals for each trade. Additionally, keeping an eye on technical analysis indicators can help you make informed decisions.

To learn more about Binance Coin trading strategies, check out this comprehensive guide on Binance Coin trading strategies.

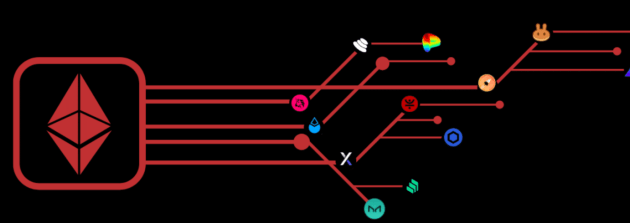

Top DeFi Tokens to Watch in 2024

In the rapidly evolving world of decentralized finance (DeFi), certain tokens have shown great potential for growth and innovation. Let’s take a closer look at some of the top DeFi tokens predicted to make waves in 2024.

1. Uniswap (UNI)

Uniswap is a decentralized exchange (DEX) that allows users to trade a wide range of tokens without the need for a central intermediary. UNI token holders have governance rights over the platform, making it a key player in the DeFi ecosystem.

2. Aave (AAVE)

Aave is a lending and borrowing protocol that enables users to earn interest on their crypto assets or borrow assets by providing collateral. AAVE token holders can participate in governance decisions and receive a share of the platform’s fees.

3. Chainlink (LINK)

Chainlink is a decentralized oracle network that connects smart contracts with real-world data. LINK token is used to pay for services on the Chainlink network, making it an essential component for ensuring data accuracy and reliability in DeFi applications.

4. Compound (COMP)

Compound is a decentralized lending protocol that allows users to lend and borrow various cryptocurrencies. COMP token holders can propose and vote on changes to the protocol, earning COMP rewards for participating in governance.

5. SushiSwap (SUSHI)

SushiSwap is a decentralized exchange that offers yield farming opportunities and incentivizes liquidity providers with SUSHI rewards. SUSHI token holders can stake their tokens to earn a share of the platform’s trading fees and participate in governance decisions.

These top DeFi tokens have garnered significant attention and adoption within the DeFi community due to their innovative features, strong use cases, and active development teams. As the DeFi space continues to expand and mature, these tokens are poised to play a crucial role in shaping the future of decentralized finance in 2024 and beyond.

Wrap-Up

In conclusion, the Best DeFi tokens to watch in 2024 offer exciting prospects for investors seeking to capitalize on the decentralized finance market. Keep track of these tokens for potential growth and innovation in the upcoming year.