Balancing risk and reward in stock trading sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Understanding the delicate equilibrium between risk and reward is essential for navigating the complex world of stock trading.

Understanding Risk and Reward: Balancing Risk And Reward In Stock Trading

Risk and reward are two crucial components of stock trading that investors must carefully consider to make informed decisions. Let’s delve into the definitions and differences between these two concepts.

Risk in Stock Trading

Risk in stock trading refers to the uncertainty or probability of losing money on an investment. It is the potential for an investment to generate lower returns or incur losses due to various factors such as market volatility, economic conditions, company performance, or external events. Investors face different types of risks, including market risk, liquidity risk, credit risk, and operational risk. Understanding and managing these risks are essential to protect capital and achieve investment goals.

Reward in Stock Trading

On the other hand, reward in stock trading represents the potential return or profit that investors can earn from their investments. It is the compensation or gain investors expect to receive for taking on risk. The reward can come in the form of capital appreciation, dividends, interest payments, or other financial benefits. Investors seek to maximize their rewards while managing risks effectively to achieve their financial objectives.

Comparing Risk and Reward

Risk and reward in stock trading are interconnected, with higher potential rewards often associated with higher levels of risk. Investors must strike a balance between risk and reward based on their risk tolerance, investment goals, and time horizon. While higher-risk investments may offer the potential for greater returns, they also carry a higher probability of losses. Conversely, lower-risk investments typically offer lower returns but come with more stability and security. It is essential for investors to assess their risk appetite, conduct thorough research, and diversify their portfolios to optimize the risk-reward trade-off in stock trading.

Types of Risks in Stock Trading

When engaging in stock trading, investors are exposed to various types of risks that can impact their investment decisions. It is essential to understand these risks and implement strategies to mitigate them effectively.

Market Risk

Market risk, also known as systematic risk, refers to the risk of losses due to factors affecting the overall market, such as economic conditions, political events, or natural disasters. For example, a sudden economic downturn can lead to a decline in stock prices across the board. To mitigate market risk, diversification of investments across different asset classes and industries can help spread the risk.

Company-Specific Risk

Company-specific risk, also known as unsystematic risk, is associated with individual companies and can arise from factors like poor management decisions, lawsuits, or product recalls. For instance, investing heavily in a single company’s stock exposes investors to the risk of significant losses if the company underperforms. To reduce company-specific risk, investors can diversify their portfolios by investing in multiple companies across various sectors.

Liquidity Risk, Balancing risk and reward in stock trading

Liquidity risk refers to the risk of not being able to buy or sell an asset quickly at a fair price. This risk is more prevalent in thinly traded stocks or during market volatility. To manage liquidity risk, investors can stick to more liquid assets or set limit orders to ensure trades are executed at desired prices.

Interest Rate Risk

Interest rate risk pertains to the impact of changing interest rates on investments, particularly fixed-income securities like bonds. When interest rates rise, bond prices tend to fall, leading to potential losses for bondholders. Investors can mitigate interest rate risk by diversifying their bond holdings across different maturities or considering floating-rate bonds that adjust to interest rate changes.

Currency Risk

Currency risk arises from fluctuations in exchange rates, affecting the value of investments denominated in foreign currencies. For example, if an investor holds stocks in a foreign company and the domestic currency strengthens against the foreign currency, the value of the investment may decrease. To hedge against currency risk, investors can use currency derivatives or invest in hedged funds.

Risk of Ruin

Risk of ruin refers to the possibility of losing a significant portion of one’s capital, leading to financial devastation. This risk can occur when investors take overly aggressive positions or fail to implement risk management strategies. To avoid the risk of ruin, investors should adhere to proper position sizing, set stop-loss orders, and maintain a disciplined approach to trading.

Strategies for Balancing Risk and Reward

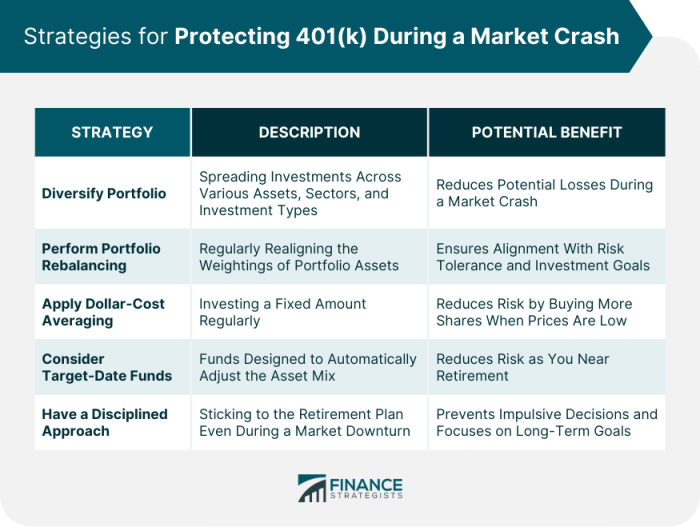

When it comes to stock trading, finding the right balance between risk and reward is crucial for long-term success. There are several common strategies that traders use to achieve this balance, including diversification and managing risk tolerance.

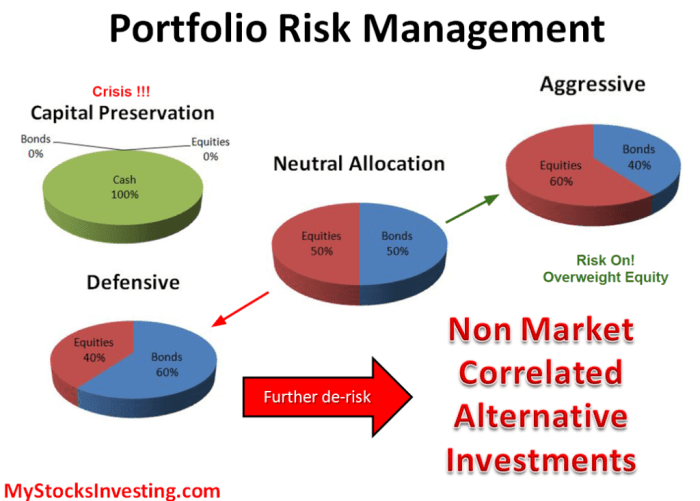

Diversification for Risk Management and Returns Maximization

Diversification is a strategy where investors spread their investments across different asset classes, industries, and securities to reduce the impact of any single investment on their overall portfolio. By diversifying, traders can manage risk while maximizing potential returns. For example, if one stock in a diversified portfolio underperforms, the impact on the overall portfolio is minimized because the losses are offset by the gains in other investments.

Risk Tolerance and Balancing Risk and Reward

Risk tolerance refers to an investor’s ability and willingness to withstand fluctuations in the value of their investments. Understanding your risk tolerance is essential for balancing risk and reward in stock trading. Investors with a high risk tolerance may be more comfortable with volatile investments that have the potential for higher returns, while those with a low risk tolerance may prefer safer, more stable investments. By aligning your investment choices with your risk tolerance, you can ensure that you are comfortable with the level of risk in your portfolio and better position yourself to achieve your financial goals.

Impact of Market Conditions

When it comes to stock trading, market conditions play a crucial role in determining the balance between risk and reward. Understanding how different market conditions can affect trading strategies is essential for successful trading. Traders need to adapt to changing market conditions in order to optimize their risk-reward ratio and make informed decisions.

Volatility in Market Conditions

- High volatility in the market can increase both the potential risk and reward of a trade. Traders may experience larger price swings, leading to higher profit opportunities but also higher potential losses.

- During periods of low volatility, the risk may be lower, but so are the potential rewards. Traders may need to adjust their strategies to capitalize on smaller price movements.

- Adapting to changing volatility levels is crucial for maintaining a balanced risk-reward ratio. Traders may need to implement different trading techniques depending on the market conditions.

Market Trends and Sentiment

- Identifying market trends and sentiment can help traders assess the risk and reward of potential trades. Following the trend can increase the likelihood of success, but traders should be cautious of sudden reversals.

- Market sentiment can also impact trading decisions. Positive sentiment may lead to inflated stock prices, increasing the risk of a market correction. Negative sentiment, on the other hand, can create buying opportunities but also comes with higher risks.

- Staying informed about market trends and sentiment is essential for adapting trading strategies to changing market conditions and maintaining a balanced risk-reward profile.

Concluding Remarks

As we conclude our exploration of balancing risk and reward in stock trading, it becomes evident that mastering this dynamic interplay is the key to success in the financial markets. By implementing sound strategies and adapting to changing market conditions, investors can achieve their desired outcomes while minimizing potential setbacks.

When it comes to investing, knowing how to analyze earnings reports is crucial for making informed decisions. By understanding the key components of these reports, such as revenue, expenses, and profit margins, investors can gain valuable insights into a company’s financial health.

Additionally, learning how to interpret trends and compare results to industry benchmarks can help investors identify opportunities and risks. To learn more about how to analyze earnings reports , check out this comprehensive guide.

When it comes to understanding the financial health of a company, analyzing earnings reports is crucial. These reports provide valuable insights into a company’s revenue, expenses, and overall performance. By learning how to analyze earnings reports effectively, investors can make more informed decisions about where to put their money.

To learn more about how to analyze earnings reports, check out this insightful guide: How to analyze earnings reports.